The $2000 Economic Relief Package 2025 has captured the attention of many Americans who are hoping to receive much-needed financial assistance. In these unpredictable times, such relief can make a huge difference. This article will dive into the details of the relief package—everything from payment dates to eligibility requirements and how to ensure you get your share. We’ll also break down how the IRS determines who qualifies and what you can do to maximize your benefits.

$2000 Economic Relief Package 2025

| Key Point | Details |

|---|---|

| Eligible Payment Amount | Up to $2,000 per eligible individual, based on certain criteria. |

| IRS Payment Date | Payments are expected to be distributed in late 2025. |

| Who Qualifies | Individuals with an Adjusted Gross Income (AGI) below specific thresholds and those who meet IRS criteria. |

| How to Check Eligibility | Review your IRS online account, or check your 2021 tax return. |

| Claim Deadline | File your 2021 tax return by April 15, 2025, to claim your payment if eligible. |

| IRS Official Website | IRS.gov |

The $2000 Economic Relief Package is a critical lifeline for many Americans in 2025. By following the steps outlined in this article, you can ensure that you qualify for the relief and get the financial support you deserve. From checking eligibility to understanding how payments are distributed, being informed and proactive will make all the difference. Stay updated through official IRS channels, file your taxes on time, and don’t miss out on this valuable financial relief.

What Is the $2000 Economic Relief Package 2025?

The $2000 Economic Relief Package 2025 is a financial assistance program designed to support U.S. citizens who are still recovering from the effects of the COVID-19 pandemic and other economic hardships. Similar programs have been rolled out in the past, but the 2025 package focuses on providing $2,000 to those who meet specific eligibility criteria.

This relief is important for people who may have been left behind in earlier rounds of relief payments. With inflation and economic uncertainty still affecting many, these funds offer a crucial lifeline to struggling households.

Historical Context of Economic Relief Packages

Before we dive into the specifics of the 2025 relief package, let’s take a look at its predecessors:

- 2020 Stimulus Checks: During the initial wave of COVID-19, Americans received direct payments ranging from $1,200 to $2,400 per person.

- 2021 Economic Impact Payments: This round extended relief payments, offering $1,400 per person, with eligibility based on AGI.

- 2023 Recovery Rebate: Aimed at taxpayers who missed earlier relief payments, it helped individuals claim missed credits from prior years.

Understanding the history of these relief packages allows us to appreciate the significance of the 2025 iteration, which seeks to close the gap for anyone who has missed out or is still struggling.

Who Is Eligible for the $2000 Economic Relief Package?

Eligibility for the $2000 economic relief package is based on several factors:

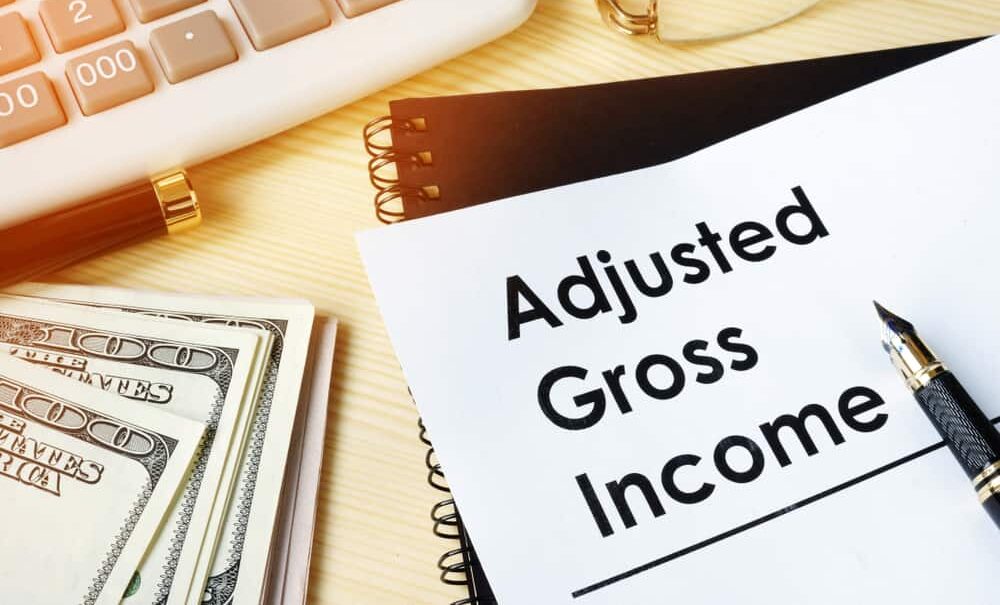

1. Income Limits

Your Adjusted Gross Income (AGI) must be below certain limits. For example:

- Single filers: Must have an AGI of $75,000 or less. Payments phase out for those making over $80,000.

- Married Filing Jointly: The combined AGI must be $150,000 or less. Payments phase out over $160,000.

- Dependents: $1,400 is available for each dependent, which makes this relief especially valuable for families.

2. Filing Your Taxes

You must have filed your 2021 tax return. If you haven’t done so yet, you can still claim your payment by filing before the April 15, 2025 deadline. If you don’t owe taxes, you can file simply to claim your relief.

3. Special Considerations for Families

Families with children, particularly those who meet the dependent criteria, will find this relief package quite beneficial. Each dependent can unlock an additional $1,400.

When Will You Get the $2000 Payment?

The IRS plans to distribute payments by late 2025. For those who are eligible, the payment will be directly deposited into the bank account linked to their 2021 tax return. If the IRS doesn’t have your banking information, a check will be sent to the address on file.

If your address or banking information has changed recently, be sure to update your details with the IRS to avoid delays. This can be done quickly through the IRS website.

How the IRS Calculates Your Relief Payment

The IRS uses your tax return to determine how much relief you’ll receive. This includes assessing your income, filing status, and dependents. The payment is calculated based on your Adjusted Gross Income (AGI), which can be found on the first page of your tax return.

- If your AGI falls below the threshold, you’ll receive the full payment.

- If it’s above the threshold, your payment will gradually reduce as your income increases.

- For those with dependents, each one counts for an additional $1,400.

How to Check if You Qualify

Wondering if you’re eligible for the $2000 relief payment? There are a few steps you can take to check:

1. Review Your 2021 Tax Return

Make sure that your AGI falls under the income limits and that you’ve properly listed any dependents.

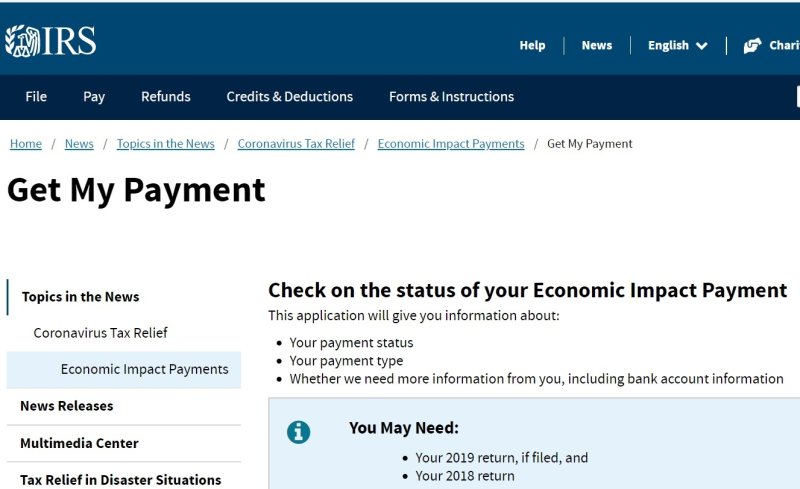

2. Check Your IRS Online Account

You can use the Get My Payment tool on the IRS website to check your payment status. Simply log into your account to view if you’re in line for a payment.

3. Update Your Information with the IRS

Make sure your banking information and mailing address are up to date with the IRS. If these details aren’t correct, you could miss your payment or experience delays.

Common Pitfalls to Avoid

When preparing for your payment, be sure to avoid these common mistakes:

- Not Updating Address or Banking Information: If your details have changed since you filed your tax return, update them promptly.

- Missing the Deadline: You have until April 15, 2025, to file your tax return and claim your payment. Don’t let the deadline slip by!

- Incorrectly Reporting Dependents: Make sure you’ve accurately reported all dependents. Mistakes here can cost you extra payments.

2020 vs. 2025 Economic Relief

Economic relief packages aren’t new! Here’s a quick look at how the proposed 2025 package might compare to past efforts, specifically the COVID-19 relief from 2020:

| Feature | 2020 CARES Act Stimulus (Example) | Proposed 2025 Economic Relief Package |

| Payment Amount | Up to $1,200 per adult, plus $500 per child | Potentially up to $2,000 per eligible individual |

| Eligibility Focus | Broad income thresholds, impact of pandemic | Could target specific income levels, economic conditions |

| Payment Method | Direct Deposit, Paper Check, Debit Card | Likely Direct Deposit, Paper Check, Debit Card |

| Primary Goal | Immediate financial aid during pandemic shutdown | Stimulate post-inflation recovery, support specific sectors |

| Claiming Missed Payment | Recovery Rebate Credit on 2020 or 2021 tax return | Likely Recovery Rebate Credit on 2025 tax return |

Tips on Maximizing Your Relief Benefits

To get the most out of the $2,000 relief, consider the following:

- File Jointly: If you’re married, filing jointly may give you a higher threshold for eligibility.

- Double-Check Your Dependents: Make sure all eligible dependents are claimed. Each one adds an additional $1,400.

- File on Time: To ensure you don’t miss out on the payment, file before the deadline.

State-Level Support

While the federal government provides this relief package, don’t forget that some states may have their own economic relief programs. States like California, Texas, and New York have provided additional relief payments. Be sure to check if your state has any supplemental relief available.

How the $2000 Relief Package Impacts the Economy

The $2000 payments are designed not only to provide financial assistance to individuals but also to stimulate the broader economy. By injecting cash into the hands of consumers, the relief package helps encourage spending on essential goods, services, and small businesses. This stimulates demand, creating a ripple effect that can help revitalize local economies and businesses.

FAQs

1. Will I Receive the Full $2,000?

If you meet the eligibility criteria, you will receive the full $2,000. However, payments phase out for higher earners.

2. How Do I Update My Bank Information with the IRS?

You can update your banking details by visiting the IRS website or using the Get My Payment tool.

3. What If I Miss the Deadline?

If you miss the April 15, 2025 deadline to file your tax return, you may not be eligible for the relief payment.