If you’ve ever asked yourself, “What are the steps to receive SSDI benefits?” you’re not alone. Every year, millions of Americans apply for Social Security Disability Insurance (SSDI), but most hit roadblocks along the way. From paperwork pile-ups to months-long wait times, it’s easy to feel lost in the system.

But here’s the truth: you can absolutely get approved if you know the rules of the game. In this guide, we’ll break down the five essential steps you need to follow, share insider tips, sprinkle in some real-life examples, and point you to official resources so you can take action right away.

5 Steps Every Applicant Must Clear to Receive SSDI Benefits

| Point | Details |

|---|---|

| Eligibility | Must have 40 work credits (20 in the last 10 years). Younger workers may need fewer. |

| Application | Apply online, by phone, or in person at SSA offices. |

| Evidence Needed | Medical records, work history, and RFC forms are vital. SSA uses a 5-step review process. |

| Approval Time | Decisions average 6–9 months. Payments start after a 5-month wait (ALS exempt). |

| Appeals | Only 40% approved initially; appeals go through reconsideration, hearing, Appeals Council, and court. |

| U.S. Impact | In 2023, over 8.5 million Americans received SSDI benefits SSA.gov. |

The path to SSDI benefits can feel like running an obstacle course blindfolded. But with preparation, persistence, and a clear game plan, you can win. Start with eligibility, file a complete application, back it up with solid evidence, wait patiently, and prepare for appeals if needed.

Remember: You’ve paid into this system your whole working life—it’s your right to claim what you’ve earned.

Step 1: Confirm You’re Eligible

Before you apply, you’ve got to make sure you meet the basic requirements. SSDI is like an insurance policy—you pay in through your FICA taxes, and you only get coverage if you’ve “paid your premiums.”

Work Credits Rule:

- Typically, you need 40 credits (10 years of work).

- At least 20 credits earned in the last 10 years.

- Younger workers? Fewer credits are required (e.g., under 31 may only need 2–6 years).

SSA’s Disability Definition:

- Your condition must stop you from earning above $1,550/month (2025 SGA limit).

- It must last at least 12 months or be terminal.

Example: Mike, a 45-year-old construction worker with a back injury, had 20 years of steady work. He meets both the credit and medical rules—so he’s eligible.

Step 2: Apply for SSDI Benefits

When it comes to the application, you’ve got options:

- Online: SSA.gov Disability Application

- Phone: 1-800-772-1213

- In Person: Local SSA office (schedule ahead).

Pro Tip: Use the SSA Starter Kit before applying. It’ll save you headaches later.

Common Mistakes to Avoid:

- Submitting incomplete medical history.

- Forgetting work details from the last 15 years.

- Missing deadlines (SSA loves deadlines).

Think of applying for SSDI like filing your taxes. If you leave blanks, the IRS delays your refund. Same here—missing info = slow approval.

Step 3: Build a Rock-Solid Case with Evidence

This is where people win—or lose—their claim. The SSA uses a 5-step sequential evaluation:

- Are you working above SGA? If yes, denied.

- Is your impairment severe? Must affect daily work.

- Is it in the Blue Book? Automatic win if listed.

- Can you do past work? If yes, denied.

- Can you do any other work? If not, approved.

Evidence Checklist:

- Medical records (doctor visits, lab results, hospital stays).

- Doctor’s opinion about your limitations.

- Residual Functional Capacity (RFC) form.

- Statements about daily living struggles (like fatigue, pain, mobility).

Example: Sarah, a teacher with MS, included MRI scans, neurologist reports, and a daily journal showing she couldn’t stand all day. That documentation made her case bulletproof.

Step 4: Understand the Waiting Game

Here’s the not-so-fun part: waiting.

- Decision Time: 6–9 months average.

- Fast Track: Conditions on SSA’s Compassionate Allowances List (ALS, certain cancers).

- Payment Delay: 5-month waiting period after disability onset (ALS exempt).

During this phase, your case is reviewed by your state’s Disability Determination Services (DDS) office. They might even call you in for a consultative exam with one of their doctors.

Fun comparison: Waiting for SSDI is like waiting for your favorite Netflix show’s next season—slow, but worth it if you hang in there.

Step 5: Prepare for the Appeal (Most People Need It)

Here’s the hard truth: 60% of first-time applications are denied. But that’s not the end.

Levels of Appeal:

- Reconsideration – A different examiner reviews your case.

- Hearing – You present your case to a judge (often the game-changer).

- Appeals Council – Reviews judge’s decision.

- Federal Court – Last chance.

Data Check: Applicants with representation win three times more often than those who go it alone (SSA data).

Good news: Lawyers work on contingency—no win, no fee.

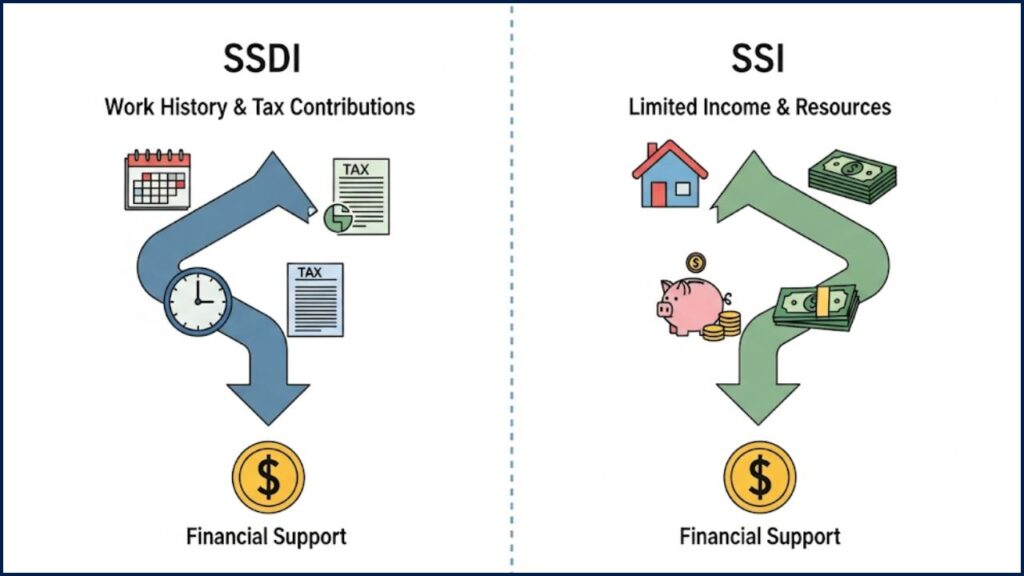

SSDI vs. SSI: A Quick Comparison

| Feature | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

| Who is it for? | Individuals who have worked and paid Social Security taxes. | Individuals with limited income and resources, regardless of work history. |

| Eligibility | Based on your work history and credits. | Based on financial need. |

| Funding | Payroll taxes paid by you and your employer. | General tax revenues. |

| Benefit Amount | Varies based on your lifetime average earnings. | A set federal rate, which may be supplemented by the state. |

| Medical Requirements | Must meet the SSA’s definition of “disabled.” | Must meet the SSA’s definition of “disabled” (or be 65+ or blind). |

Tips & Mistakes to Avoid

- Don’t ignore your doctor’s advice: Make sure you are following all prescribed treatments. If you’re not, it can be interpreted as a lack of effort to get better, which can hurt your claim.

- Don’t exaggerate your symptoms: Be honest and specific about your limitations. DDS examiners are trained to spot inconsistencies.

- Don’t skip the details: The more information you provide, the better. List every doctor, every clinic, and every hospital stay. A missing record could cause significant delays.

Extra Tips for Success

- Stay Organized: Keep a binder with all your medical records.

- Check Status Often: You can track your claim online at SSA My Account.

- Be Honest: Exaggerating symptoms can backfire. SSA will cross-check.

- Seek Help: Nonprofits like NOSSCR and local legal aid groups often provide free or low-cost help.

FAQs About SSDI

Q1: Can I work while applying for SSDI?

Yes, but you must earn below the SGA limit ($1,550/month in 2025).

Q2: What’s the difference between SSDI and SSI?

SSDI is based on work credits. SSI is need-based.

Q3: How many people get SSDI in the U.S.?

As of 2023, about 8.5 million disabled workers received SSDI benefits.

Q4: Do SSDI benefits increase?

Yes. Benefits are adjusted annually with Cost-of-Living Adjustments (COLA).

Q5: Can family members qualify?

Yes—spouses, children, and even divorced spouses can get auxiliary benefits.