Lede Paragraph: As Americans plan for their financial futures, 2025 marks a significant milestone for retirement policy in the United States. While no new legislation has been passed this year to alter the retirement age, the nation is seeing the final implementation of a decades-old plan that sets the full Social Security retirement age at 67. The US law impact on retirement age is the result of long-term structural changes, and this year also brings other crucial updates to retirement savings plans that will affect millions.

Full Retirement Age Reaches 67

| Key Fact | Detail/Statistic |

|---|---|

| Full Retirement Age (FRA) | For individuals born in 1960 or later, the full retirement age is now 67. |

| Early Retirement Impact | Claiming Social Security at age 62 results in a permanent 30% benefit reduction for those with an FRA of 67. |

| New 401(k) Auto-Enrollment | New 401(k) and 403(b) plans must automatically enroll eligible employees starting in 2025. |

| Higher Catch-Up Contributions | Individuals aged 60-63 can contribute up to $10,000 (or more) in catch-up contributions to their workplace plans. |

The Culmination of a Decades-Long Shift

Washington D.C. – In 2025, Americans are not facing a sudden new law changing their retirement eligibility, but rather the final phase of a plan set in motion over 40 years ago. The Social Security Amendments of 1983, signed into law by President Ronald Reagan, mandated a gradual increase in the full retirement age (FRA), the age at which individuals can claim their full, unreduced Social Security benefits. The law was a bipartisan response to improving life expectancies and long-term funding concerns for the Social Security system.

For decades, the FRA was 65. The 1983 law implemented a phased increase. Now, in 2025, that transition is complete. For anyone born in 1960 or later, the full retirement age is officially 67.

“This isn’t a surprise adjustment but the final step in a long-term strategy to ensure the solvency of Social Security for generations to come,” said Dr. Anya Sharma, a senior fellow at the Brookings Institution specializing in economic policy. “For those turning 65 this year, it means they must wait another two years to receive their full promised benefit.”

Understanding Your Full Retirement Age

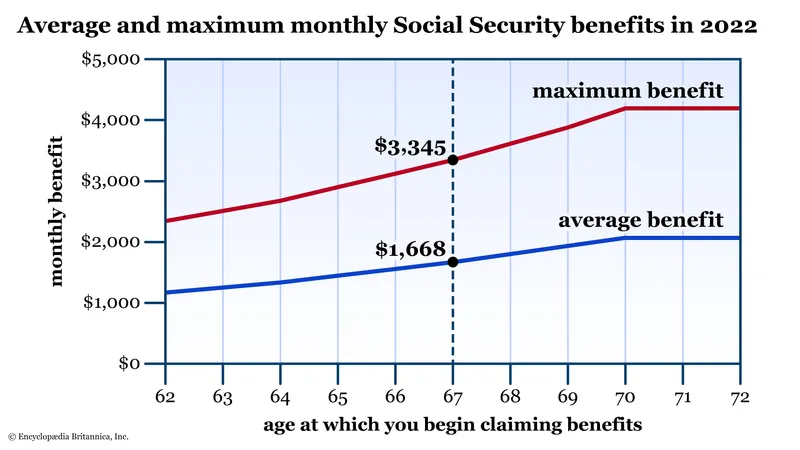

The Social Security Administration (SSA) provides clear guidelines based on an individual’s birth year. While Americans can still begin drawing Social Security benefits as early as age 62, doing so comes with a permanent reduction in monthly payments.

- Born 1959: Full retirement age is 66 years and 10 months.

- Born 1960 or later: Full retirement age is 67.

For a person with an FRA of 67, claiming benefits at age 62 results in receiving only 70% of their full benefit. If they were entitled to a monthly payment of $1,000 at full retirement age, they would receive just $700 by starting early. Conversely, delaying benefits past age 67 accrues delayed retirement credits, increasing the eventual monthly payment by approximately 8% for each year delayed, up to age 70.

SECURE 2.0: A New Layer of US Law Impact On Retirement Age and Savings

While the Social Security changes are the result of older legislation, a more recent law, the SECURE 2.0 Act of 2022, introduces several significant provisions that take effect in 2025. These changes are designed to expand retirement savings coverage and flexibility for the American workforce.

Mandatory Automatic Enrollment

Starting January 1, 2025, most new 401(k) and 403(b) retirement plans must automatically enroll eligible employees. The initial contribution must be between 3% and 10% of the employee’s pay and will automatically increase by 1% each year until it reaches at least 10% (but no more than 15%). Employees can opt out at any time.

“Automatic enrollment is one of the most effective tools we have to boost retirement savings,” stated a recent report from the U.S. Department of Labor. “It turns inertia from a barrier into a benefit, ensuring more workers start saving early in their careers.”

Enhanced Catch-Up Contributions

The law also gives older workers a better opportunity to bolster their savings before retirement. Beginning in 2025, individuals aged 60, 61, 62, and 63 will be able to make higher “catch-up” contributions. The limit is increased to the greater of $10,000 or 150% of the regular catch-up amount for that year. For 2025, the regular age 50+ catch-up is $7,500.

“This provision specifically helps those who may have had career interruptions or started saving later in life,” explained a financial advisor from Fidelity Investments. “It provides a critical, albeit brief, window to significantly increase their nest egg.”

Expanded Access for Part-Time Workers

Another key change taking effect in 2025 lowers the eligibility requirements for long-term, part-time workers to participate in their employer’s 401(k) plan. Previously, employees had to complete three consecutive years with at least 500 hours of service. SECURE 2.0 reduces this requirement to two years, opening retirement savings access to more of the workforce.

Navigating the Path Forward

The convergence of these long-planned and newer legislative changes makes 2025 a pivotal year for retirement planning. The US law impact on retirement age is now fully realized, cementing 67 as the new standard for the next generation of retirees. Simultaneously, new rules are actively reshaping how Americans save for their post-career years.

Financial experts urge individuals to review their retirement strategy in light of these changes. Understanding one’s specific full retirement age is crucial for maximizing Social Security benefits. Furthermore, the new provisions from SECURE 2.0 may offer new opportunities or require adjustments to existing savings plans.

The changes underscore a broader trend: the increasing responsibility placed on individuals to manage their own financial security in retirement. As a spokesperson for the AARP noted, “Informed planning has never been more essential. Knowing the rules of the road, from Social Security to 401(k)s, is the first step toward a secure and dignified retirement.”

Frequently Asked Questions

1. Did the US government pass a new law in 2025 to raise the retirement age? No. The change to a full retirement age of 67 is the final phase of a gradual increase scheduled by the Social Security Amendments of 1983.

2. Can I still retire and get Social Security at 62? Yes, you can still begin claiming Social Security benefits at age 62. However, your monthly benefit will be permanently reduced. If your full retirement age is 67, claiming at 62 will result in a 30% reduction.

3. What is the SECURE 2.0 Act? It is a comprehensive retirement reform law passed in 2022. Many of its key provisions, such as mandatory auto-enrollment in new 401(k)s and higher catch-up contribution limits, are scheduled to take effect in 2025.

4. Do the new auto-enrollment rules apply to my existing 401(k) plan? No, the mandatory auto-enrollment feature applies to 401(k) and 403(b) plans established after December 29, 2022. Plans that existed before that date are grandfathered and are not required to add this feature.