More than 72 million Americans will see a modest 2.5% increase in their Social Security and Supplemental Security Income (SSI) benefits in 2025, the Social Security Administration (SSA) announced. This cost-of-living adjustment, or COLA, comes as part of the new social security rules for 2025, which also include a significant shift in the full retirement age and a mandatory transition to electronic payments.

The changes arrive as the newly released 2025 Social Security Trustees Report underscores growing financial pressures on the program, projecting that the trust fund for retirement and survivor benefits will be unable to pay full benefits by 2033 without legislative action.

Social Security Announces 2.5% Benefit

| Key Change | Detail/Statistic |

|---|---|

| 2025 COLA | 2.5% increase for Social Security and SSI benefits. |

| Full Retirement Age | Increases to 67 for those born in 1960. |

| Earnings Limit (Under FRA) | Rises to $23,400/year ($1,950/month). |

| End of Paper Checks | All federal benefit payments must be electronic by Sept. 30, 2025. |

| WEP/GPO Repeal | “Social Security Fairness Act” ends benefit reduction for certain public-sector pensioners. |

Modest COLA Raises Concerns About Purchasing Power

The 2.5% COLA will boost the average retired worker’s monthly benefit by approximately $49, from $1,927 to an estimated $1,976, starting in January 2025. While intended to help benefits keep pace with inflation, some advocates for seniors argue the increase may not be sufficient.

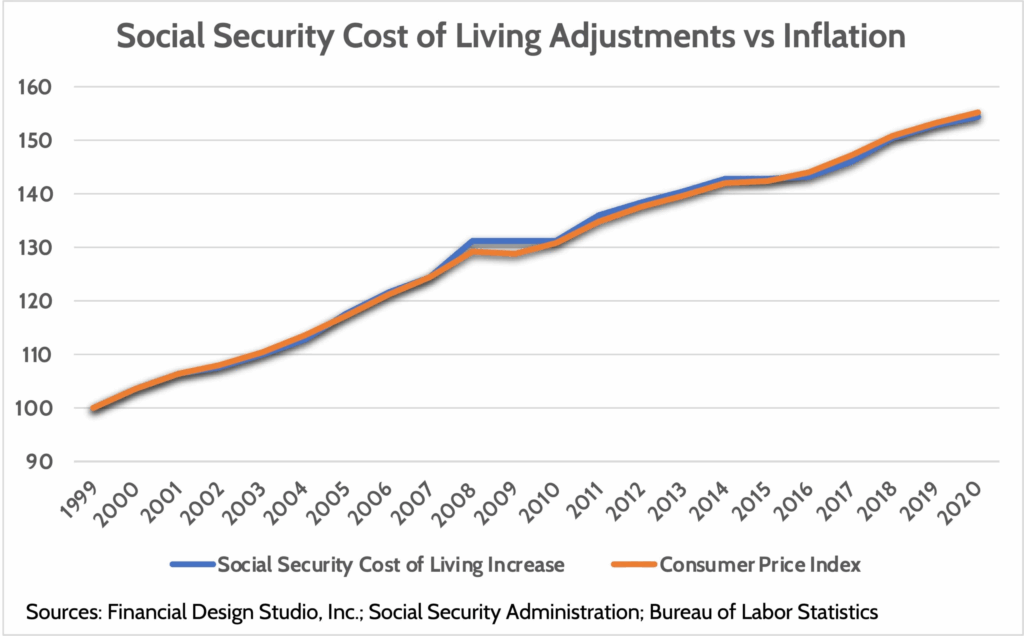

The adjustment is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). However, analysis from organizations like The Senior Citizens League, a non-partisan advocacy group, suggests that the expenses of older Americans, particularly in healthcare and housing, often outpace the inflation measured by the CPI-W.

“Any erosion in the CPI’s reliability presents big risks to seniors’ livelihoods,” said Shannon Benton, Executive Director of The Senior Citizens League, in a statement regarding inflation data collection. “Inaccurate or unreliable data…dramatically increases the likelihood that seniors receive a COLA that’s lower than actual inflation.”

New Social Security Rules 2025: Eligibility and Earnings

A significant structural change taking full effect in 2025 is the increase in the full retirement age (FRA). For individuals born in 1960, who will turn 65 in 2025, the FRA is now 67. This is the culmination of a gradual increase legislated in 1983.

Claiming benefits before age 67 will result in a permanently reduced monthly payment. An individual eligible for $1,000 per month at full retirement would only receive $700 if they start benefits at age 62, a 30% reduction, according to the SSA.

For those who work while receiving benefits, the rules have also been adjusted:

- For beneficiaries under full retirement age: The earnings limit will increase to $23,400 per year. For every $2 earned above this limit, the SSA will withhold $1 in benefits.

- For those reaching full retirement age in 2025: The limit rises to $62,160. In the months before reaching FRA, $1 in benefits will be deducted for every $3 earned over this threshold.

- Maximum Taxable Earnings: The maximum amount of earnings subject to the Social Security tax will also increase to $176,100.

Major Policy Shifts: Digital Payments and Fairness Act

The End of Paper Checks

In a move to enhance security and efficiency, the U.S. Department of the Treasury is mandating a complete transition to electronic payments for all federal benefits by September 30, 2025. This change, outlined in a presidential executive order, will affect the nearly 500,000 beneficiaries who still receive paper checks.

The government cites a significantly higher risk of fraud and theft with paper checks. Beneficiaries will need to enroll in direct deposit or the Direct Express® debit card program. While the Treasury has outlined exceptions for those without bank access or for whom electronic payment would cause undue hardship, the transition has raised concerns.

“This abrupt shift away from paper Social Security checks will disproportionately harm seniors who lack digital access or confidence navigating online banking,” Matt Watkins, a public affairs expert, told Newsweek.

The SSA has stated it will conduct a public awareness campaign to support beneficiaries through the transition.

Relief for Public Sector Workers

A major legislative change impacting benefits in 2025 is the implementation of the Social Security Fairness Act. Signed into law on January 5, 2025, the act repeals the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

These provisions previously reduced Social Security benefits for more than 3 million Americans, including many teachers, firefighters, and federal employees, who also earned a pension from work not covered by Social Security. The repeal means these individuals will see their benefit calculations adjusted, potentially leading to higher monthly payments and, for some, retroactive payments back to January 2024. The SSA began processing these adjustments in early 2025.

Looking Ahead: The Solvency Question

The 2025 changes are set against the backdrop of the Social Security system’s long-term financial challenges. The 2025 Social Security Trustees Report projects that, if Congress does not act, the combined trust funds will be depleted by 2034. At that point, ongoing tax revenues would still be able to pay about 81% of promised benefits.

“The Trustees’ Report is a stark reminder that policymakers must address Social Security’s long-term funding gap,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. She emphasized that waiting to implement reforms makes the necessary adjustments more difficult. The report highlights the need for a national conversation on potential solutions, which could include changes to the full retirement age, adjustments to the benefit formula, or increases in the Social Security tax rate.