The GST/HST refund schedule for June 2025 is officially out, and if you’re a Canadian resident, this is your reminder to mark your calendars. Whether you’re a college student in Toronto, a working mom in Saskatoon, or a Cree elder in Alberta, this tax-free benefit helps millions of households cover daily costs like groceries, gas, and utilities.

This article breaks it all down: when you get paid, how much you could receive, and what you need to do to make sure the Canada Revenue Agency (CRA) doesn’t skip you over. No stress—just facts, advice, and a roadmap to your next payment.

GST/HST Refund Schedule for June 2025

| Topic | Details |

|---|---|

| Payment Date | July 4, 2025 (covers April–June 2025 quarter) |

| Next Scheduled Payment | October 3, 2025 |

| Eligibility | Based on 2023 tax return and income level |

| Maximum Annual Credit | $519 (single), $680 (couples), +$179 per child |

| CRA Contact | Official CRA Website |

| Direct Deposit Recommended | Yes – faster, safer, no lost checks |

The GST/HST refund schedule for June 2025 may seem like a minor government detail, but it has a real impact. Whether you’re a full-time worker, a retiree, or raising kids solo, that extra cash makes a difference. Just be sure to file your taxes, keep your info up to date, and watch for that July 4, 2025 payment. It’s your right, your benefit, and your boost—use it wisely.

What Is the GST/HST Credit Anyway?

In case you’re new to this: the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit is a quarterly tax-free payment issued by the Canada Revenue Agency (CRA). It’s designed to help lower- and modest-income Canadians offset the taxes they pay on everyday items.

Think of it like a government thank-you card — with cash inside. You don’t need to apply directly; the CRA figures out your eligibility based on your most recent tax return.

When Is the June 2025 GST/HST Payment?

Here’s the real kicker: there is no separate payment for June.

Instead, the CRA pays the GST/HST credit quarterly, and the July 4, 2025 payment is the one that covers the April to June 2025 period. So, yes, you get the money in July, but it’s for the last three months. (Yeah, it’s kinda like getting your allowance late, but better late than never, right?)

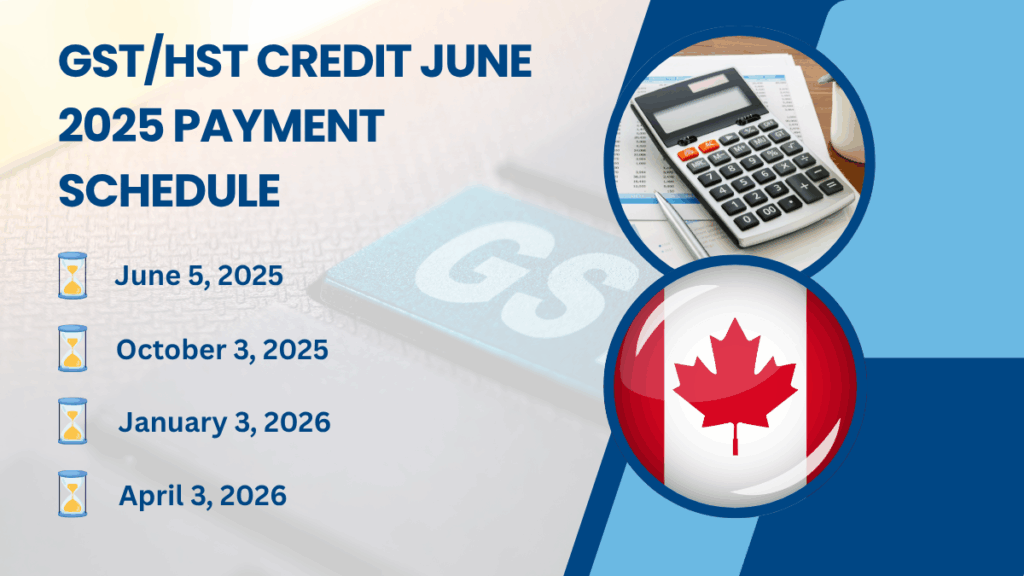

CRA GST/HST Credit Schedule 2025

- January 3, 2025

- April 4, 2025

- July 4, 2025 (covers June)

- October 3, 2025

So, set a reminder on your phone or old-school mark your calendar. That July 4th weekend might just get a little sweeter.

Who Is Eligible for the GST/HST Credit?

To qualify, you need to meet a few basic criteria:

- Be a Canadian resident for income tax purposes

- Be at least 19 years old, or have a spouse/common-law partner, or live with your child

- File your 2023 taxes

That last one is super important. No tax return = no money. Even if you made zero income, file that return.

How Much Will You Get in 2025?

Amounts vary based on your net income and family situation. Here are the maxs:

- $519 for a single person

- $680 for married/common-law couples

- $179 per child under 19

So, if you’re a single mom with two kids, you could receive:

$519 + $179 + $179 = $877/year, or about $219.25 every quarter.

The CRA uses your 2023 tax return to calculate your payments for July 2024 to June 2025.

How to Make Sure You Get Paid (Step-by-Step Guide)

Step 1: File Your Taxes

Even if you didn’t earn a penny, you must file your taxes. The CRA uses this info to figure out your credit.

Step 2: Sign Up for Direct Deposit

You can do this through your bank or CRA My Account. It’s faster and more reliable than waiting on snail mail.

Step 3: Monitor Your CRA Account

Check CRA My Account for payment status, changes in eligibility, or updates.

Step 4: Know the Dates

Mark your calendar for the quarterly payment schedule. Missed payments can take weeks to sort out.

Step 5: Keep Your Info Updated

Changed your bank or moved to a new place? Update your contact and banking info with CRA immediately.

Why Your Payment Might Be Delayed

If your payment doesn’t show up by July 15, don’t panic just yet. The CRA recommends waiting 10 business days after the official payment date before calling.

Common reasons for delay:

- Your banking info changed

- You moved and didn’t update your address

- You filed taxes late

Real-Life Examples From Indigenous Communities

Example 1: Sarah, a 21-year-old Cree student in Manitoba lives with her younger brother. She filed her taxes early and gets $519 + $179 = $698 annually. She uses it to cover groceries and internet bills.

Example 2: The Blackbird family from Treaty 6 Territory, with 3 children under 18, receives $680 (parents) + $537 (3 kids) = $1,217/year, helping cover fuel costs for school commutes and elder care.

These stories show the real value of this credit in Indigenous and remote communities where costs are often higher.

How Much Could You Get? 2025 vs. 2024 Benefit Year

The GST/HST credit amounts are adjusted annually based on inflation. Here’s a quick look at how the maximum annual credit amounts for the current benefit year (July 2025 – June 2026) compare to last year’s.

| Household Status | Max. Annual Credit (July 2025 – June 2026) | Max. Annual Credit (July 2024 – June 2025) |

| Single Individual | Up to $533 | Up to $519 |

| Married/Common-Law | Up to $698 | Up to $680 |

| Per Child Under 19 | Up to $184 | Up to $179 |

Top 3 Mistakes to Avoid for Your GST/HST Credit

Make sure you get your payments without a hitch by avoiding these common slip-ups:

- Forgetting to File Your Taxes: This is the biggest mistake! The CRA uses your annual tax return to determine your eligibility. No tax return means no GST/HST credit.

- Not Updating Your Personal Info: Did you get married, separated, or have a child? You need to tell the CRA right away. Changes in your family situation can affect your payment amount, and outdated info can cause delays.

- Using an Old Bank Account for Direct Deposit: If you’ve switched banks, update your direct deposit information in your CRA My Account immediately. Otherwise, your payment could be sent to the wrong account and get bounced back.

Tips for Professionals: How Advisors Can Help Clients

- Remind clients to file taxes, even if income is below the threshold

- Discuss GST/HST credits in financial literacy sessions

- Help set up CRA My Account or direct deposit

- Track missed or delayed payments to recover them later

Community leaders and financial advisors can become strong advocates by simplifying the system and showing how these credits bridge income gaps.

Bonus: How to Check Your Payment Status Online

- Visit CRA My Account

- Log in with your credentials (or register if you’re new)

- Under “Benefits and Credits,” look for “GST/HST Credit”

- View current status, upcoming payments, and any changes

It’s like checking your bank app—but for money the government owes you.

FAQs

Do I need to apply for the GST/HST credit?

Nope. Just file your tax return. CRA does the rest.

What if I didn’t get my July payment?

Wait 10 business days, then call CRA at 1-800-387-1193.

Can the CRA take my GST/HST credit to pay debt?

Yes, if you owe back taxes or certain government debts (like EI overpayments), they might offset your credit.

Is the GST/HST credit taxable?

Nope. It’s a tax-free benefit.

Can I get it if I’m Indigenous and live on a reserve?

Yes, Indigenous status doesn’t disqualify you. But you still need to file taxes.

How do I update my address or bank info?

Log into CRA My Account or call 1-800-387-1193. Keeping this updated avoids missed payments.