As Canadians navigate the financial challenges of 2025, government assistance programs like the $300 CRA Federal Payment provide crucial relief to individuals and families facing financial difficulties. In this article, we’ll take a deep dive into this one-time payment, explaining eligibility, key dates, and how you can ensure you get your payment smoothly. With rising living costs, this financial assistance could be a lifeline for many families.

Financial assistance is a tool to alleviate immediate economic stress, but it also has the potential to have a lasting impact on long-term financial stability. Whether you’re a young professional trying to build a stable financial future, a senior looking to supplement your income, or a parent managing household costs, this guide will help you navigate the process.

$300 CRA Federal Payment 2025

| Key Information | Details |

|---|---|

| Payment Amount | $300 (one-time federal payment) |

| Eligible Recipients | Low- and moderate-income Canadians who file taxes for 2024 |

| Key Dates | Payments start April 22, 2025. Tax returns must be filed by April 2, 2025 |

| Filing Method | File electronically through CRA’s online portal |

| Direct Deposit | Fastest method for receiving payments |

| Source | Canada Revenue Agency (CRA) |

The $300 CRA Federal Payment for 2025 is a valuable lifeline for many Canadians. Understanding the eligibility requirements and key dates is essential to receiving this financial support. By filing your taxes on time, opting for direct deposit, and keeping your information up-to-date, you can ensure a smooth process. Remember, this small financial relief can make a big difference when times are tough, so take action now to secure your payment.

Understanding the CRA Federal Payment

In 2025, the CRA Federal Payment program is aimed at providing immediate financial relief to Canadians who need it most. This payment is part of a broader federal strategy to reduce the impact of rising living costs, particularly on low- to moderate-income households.

Why This Payment Matters

With the rise of inflation, everyday expenses like groceries, transportation, and housing are taking a bigger chunk of family budgets. The $300 payment serves as a financial buffer, allowing eligible Canadians to cope with these pressures. Though it may not make up for all financial shortfalls, this payment is a welcome relief for those living paycheck to paycheck.

For example, let’s take Lena and Michael, a couple with two children living in Ontario. Lena works as a teacher while Michael runs a small construction business. Between rising energy costs and daycare bills, their family budget is stretched thin. The $300 federal payment allows them to cover additional expenses like groceries or to set aside a little money for an unexpected repair. For many Canadians, this small yet impactful payment helps families feel a little more secure.

Who Is Eligible for the $300 CRA Federal Payment?

Eligibility for the $300 CRA Federal Payment is determined by a few key factors:

- Income Level:

The payment is targeted at low to moderate-income Canadians, making it a great option for those who need it most. The income thresholds vary based on family size and other factors, so be sure to check the current CRA guidelines to confirm if you qualify. - Tax Filing:

In order to receive the payment, you must file your 2024 tax return. If you haven’t filed taxes yet or need to amend a previous return, don’t delay! Ensure you file electronically by the April 2, 2025 deadline to ensure you’re included in the payment cycle. - Canada Resident:

The payment is reserved for Canadian residents for tax purposes. So, if you’re temporarily abroad or live outside of Canada for extended periods, you may not qualify for the program.

Key Dates You Can’t Miss

To ensure everything goes smoothly, here are the key dates you must remember:

- April 2, 2025 – Deadline to file your 2024 income tax return. If you file after this date, you may experience delays or miss out on receiving the payment.

- April 22, 2025 – Payments begin. Eligible individuals will receive their payment through either direct deposit or by cheque, depending on your CRA settings.

Filing early ensures that there are no delays in your payment, and you’ll have peace of mind knowing you’re set to receive the support when you need it most.

How to Make Sure You Get the Payment

Now that you know the key details, here’s a step-by-step guide to ensuring you receive the $300 payment.

1. File Your 2024 Tax Return on Time

The most critical step in receiving the $300 payment is filing your taxes. It’s essential to file your 2024 tax return electronically by the April 2, 2025 deadline. If you’re unsure about how to file, or need assistance, consider working with a tax professional to ensure your submission is complete.

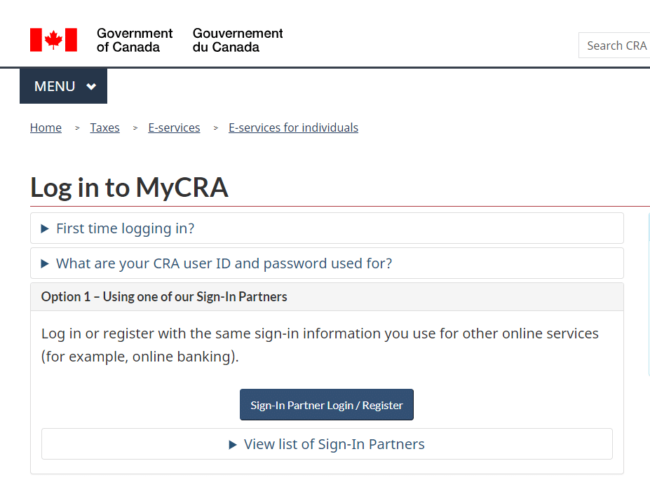

2. Opt for Direct Deposit

Direct deposit is by far the fastest way to receive your payment. It ensures that the money is deposited directly into your bank account, bypassing the waiting time for physical cheques. To set it up, simply visit the CRA My Account portal and provide your banking details.

3. Update Your Information

Have you moved recently? Changed your phone number or email address? Keeping your information up-to-date is crucial. Log in to your CRA account to make sure that your personal information is accurate, especially if you’ve had any changes since your last tax filing.

Understanding CRA Payments – Then & Now

While the $300 payment for 2025 is a specific focus, it’s helpful to see how it fits into the broader picture of CRA benefits. Here’s a simplified comparison:

| Feature | General CRA Benefits (e.g., GST/HST Credit, CCB) | $300 CRA Federal Payment 2025 |

| Purpose | Broad support for specific demographics (low-income, families, etc.) | Specific, often one-time or targeted relief |

| Frequency | Monthly or Quarterly | Likely a one-time payment for 2025 |

| Eligibility Determination | Based on annual income, family status, etc. | Specific criteria tied to program goals |

| Payment Method | Direct deposit (preferred) or cheque | Direct deposit (recommended) or cheque |

| Taxable? | Varies by benefit (check official CRA info) | Likely non-taxable, but always confirm official details |

Financial Tips to Maximize Your $300 Payment

While the $300 payment might not feel like a lot of money in the grand scheme of things, it can still be used strategically. Here are a few tips on how to make the most out of the CRA Federal Payment:

- Set it aside for emergencies: It’s always smart to put unexpected windfalls like this into a savings account or emergency fund. This way, you can use it for future needs.

- Use it for everyday expenses: For families like Lena and Michael, the $300 could cover monthly essentials like groceries, transportation, or even utilities. The payment can ease the pressure on your family budget.

- Invest in your future: If you’re in a stable position and don’t immediately need the $300, consider investing it in a RRSP or TFSA for longer-term financial benefits.

FAQs

Q1: How do I apply for the $300 CRA Federal Payment?

You don’t need to apply for this payment. If you file your 2024 income tax return, and meet the eligibility requirements, you’ll receive the payment automatically.

Q2: How will I receive my payment?

Payments are made via direct deposit or cheque. If you haven’t already, setting up direct deposit through your CRA My Account is the quickest way to get your payment.

Q3: Will receiving this payment affect other benefits I receive?

No, the $300 federal payment won’t affect your eligibility for other benefits such as the Canada Child Benefit or GST/HST Credit. It is a separate one-time payment designed to provide immediate relief.

Q4: I missed the April 2 deadline. Can I still receive the payment?

If you miss the filing deadline, you can still receive the payment, but there may be a delay until your tax return is processed.