Taxpayers across the United States are buzzing again because the IRS sends another wave of refunds in August 2025. Whether you’re waiting for that extra cash to drop into your bank account or wondering if you missed out, this guide has your back. Let’s break it all down in plain English—no IRS jargon, just real talk with facts, examples, and steps anyone can follow.

The IRS may have kicked off the tax refund season months ago, but here we are in August, and Uncle Sam still has checks to cut. If you’re one of the millions still waiting on your money, don’t panic. You might be in the queue for this latest batch. Let’s unpack why these refunds are going out late and what you should do to stay in the loop.

IRS Sends Another Wave of Refunds in August 2025

| Topic | Details |

|---|---|

| Refund Wave | August 2025 (Late filers, amended returns, flagged cases) |

| Avg Refund | $2,945 (up 3.3% from 2024) |

| Affected Groups | EITC/ACTC recipients, amended filers, IP PIN holders, ID-verified individuals |

| Tools | Where’s My Refund, Amended Return Tracker |

| IRS Source | IRS Newsroom – Official Site |

If you’re still waiting on your tax refund, don’t sweat it—you’re not alone. The IRS sends another wave of refunds in August 2025, and millions of Americans are getting their long-awaited money. Whether you filed late, amended your return, or had credits that triggered a review, this could be your moment.

Stay sharp, use the official tools, and stay informed. You earned that refund—make sure it finds its way home. And once it does? Spend it smart, and set yourself up for the rest of the year.

Why Is the IRS Sending Refunds in August?

You might be thinking, “Didn’t tax season wrap up in April?” Yes—for most. But the IRS doesn’t stop working after Tax Day. Here’s why you’re seeing more refund action now:

1. Late Filers and Extensions

Some folks file late or request extensions. This year, over 19 million Americans filed after April 15, according to CNN. Their refunds are just now getting processed.

2. Amended Returns (Form 1040-X)

Filed your taxes and realized you made a mistake? Maybe forgot to claim a credit or income? You’re not alone. The IRS has seen a 42% increase in amended returns over the last two years. These take longer to review and often land in summer refund waves.

3. PATH Act Holds & Identity Checks

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), the PATH Act requires the IRS to hold your refund until at least mid-February. But some are still under review due to identity verification issues, leading to delays.

4. IRS Staffing Shortages

Budget constraints and early 2025 layoffs caused delays in manual processing. According to the Houston Chronicle, over 10,000 processing jobs were cut this year, straining the system.

5. AI-Assisted Audits and Error Checks

The IRS rolled out new AI tools in 2025 to flag suspicious returns. While this boosts fraud detection, it also increases the number of returns sent for manual review, adding to delays.

Who’s Getting a Refund This August?

Not everyone is in the refund party this month, but here’s who’s most likely to get one:

Late Filers

If you filed your taxes in June or July, and your return was clean, expect a refund within 21 days of acceptance.

Amended Return Filers

Got a 1040-X in before July? You might see a direct deposit soon. Amended returns can take 8-12 weeks to process.

EITC & ACTC Claimants

If your return had child-related credits, and you cleared ID checks or PATH holds, your refund may be dropping in this batch.

Manual Review Cases

If your return was flagged for identity theft, math errors, or income verification, but you’ve resolved the issue, you’re likely in this August batch.

Refunds from Retroactive Credits

New legislation passed in early summer included retroactive education and clean energy credits. If you filed an adjustment, those refunds may hit now.

How to Track Your Refund Like a Pro

You don’t need to sit around refreshing your bank app. Use these official tools:

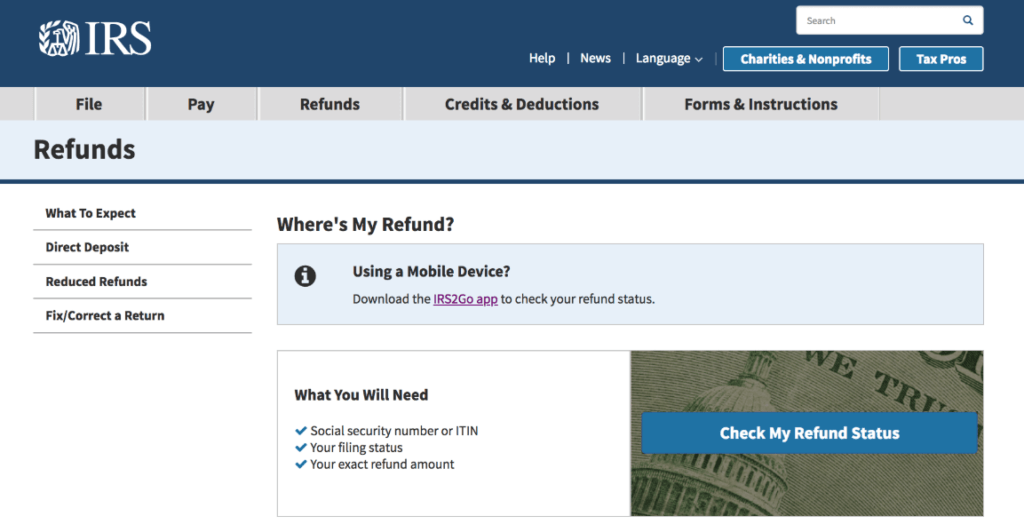

1. Where’s My Refund

Track your original return:

- Visit: irs.gov/refunds

- Info needed: SSN, filing status, refund amount

2. Where’s My Amended Return

Tracking an amended (1040-X) refund?

3. IRS2Go Mobile App

Get real-time alerts with the IRS’s official app. It’s free, secure, and surprisingly user-friendly.

Pro Tip: If your status hasn’t updated after 21 days, call the IRS at 1-800-829-1040 during off-peak hours (8-10 AM ET is best).

Real Talk: What to Do While You Wait

Let’s keep it real—waiting on money you’re owed is frustrating. Here’s what you can do:

Keep Records Handy

If the IRS sends you a letter (like CP75 or 5071C), respond quickly. Keep copies of W-2s, 1099s, and child care expenses.

Check for Offsets

Your refund may be used to pay off past debts (student loans, back taxes, child support).

Avoid Scams

The IRS will never call, email, or text you asking for bank info. All legit IRS contact starts with a paper letter.

Use Refund Wisely

Financial experts recommend using unexpected refunds to:

- Build an emergency fund

- Pay off high-interest credit card debt

- Invest in retirement (Roth IRA or 401(k))

- Cover essential expenses like rent or child care

2024 vs. 2025 Tax Refund Snapshot

Understanding how things change year-to-year can be helpful! Here’s a brief comparison of tax refund trends between 2024 and 2025.

| Feature | Tax Year 2024 (Filed in 2025) | Tax Year 2023 (Filed in 2024) |

| Average Refund | Around $2,942 (as of April 2025 data, subject to change) | Around $2,850 (final average for 2024 filing season) |

| Standard Deduction | Increased (e.g., $14,600 for single filers) | Slightly lower (e.g., $13,850 for single filers) |

| Processing Time | Most e-filed refunds within 21 days; paper returns 4+ weeks. | Most e-filed refunds within 21 days; paper returns 6-8+ weeks. |

| Key Influences | Inflation adjustments, changes in tax brackets and credits. | Inflation adjustments, economic conditions post-pandemic. |

Financial & Career Impacts

Whether you’re a freelancer, W-2 worker, or small business owner, a refund can impact your finances big-time:

- Emergency savings: Use refunds to build a cushion

- Debt payoff: Knock down credit card balances

- Education or career growth: Invest in certifications or tools

- Small business reinvestment: Upgrade software, launch a new ad campaign, or pay quarterly taxes early

Many professionals use August refunds to prep for Q4 business expenses, school season, or holiday planning. For working parents, this cash boost is right on time.

FAQs

Why is my refund still processing after 21 days?

If your return had EITC/ACTC credits or errors, it could be under manual review. Check the IRS tracker tools or call for updates.

Can I get interest if my refund is late?

Yes. The IRS may pay interest on refunds delayed beyond 45 days after filing. It’s taxable, though!

Will this be the last refund wave?

Not necessarily. The IRS may issue additional refunds into September, especially for amended and paper filers.

What if I changed banks since filing?

If your direct deposit fails, the IRS will mail a paper check to your last known address.

Is there any way to speed up my refund?

No guaranteed way, but e-filing with direct deposit and ensuring error-free returns help you avoid delays.