The phrase “Bonus Tax Refunds Coming to This State” has sparked excitement and hope for millions—and it’s not just clickbait. Georgia is stepping up to return a portion of its revenue surplus to hardworking taxpayers in the form of one-time tax refund checks. That’s right, y’all—whether you’re a single filer, a head of household, or married filing jointly, you might see a few hundred bucks rolling into your account sooner than expected.

Here’s the scoop, explained in a friendly but professional tone with all the deets you need to understand, qualify, and benefit from this opportunity. Whether you’re a college student juggling a side hustle or a seasoned professional balancing a family budget, this guide will break it all down for you.

Bonus Tax Refunds Coming to This State

| Topic | Details |

|---|---|

| State | Georgia |

| Law Enacted | House Bill 112 (April 15, 2025) |

| Refund Issued By | Georgia Department of Revenue (dor.georgia.gov) |

| Refund Start Date | June 2, 2025 |

| Refund Amount | $250 (Single), $375 (Head of Household), $500 (Married Filing Jointly) |

| Filing Requirements | Must file 2023 and 2024 GA income taxes by May 1, 2025 |

| Eligibility | Must have 2023 tax liability; no outstanding debts to GA DOR |

| Estimated Recipients | Up to 8 million Georgia residents |

| Official Info | Georgia Department of Revenue – Surplus Refund |

Georgia’s Bonus Tax Refund is a win for residents across the Peach State. Whether you’re saving, spending, or paying off debt, it’s a nice little cushion at just the right time. With refunds going out sooner than expected, make sure your tax filings are up to date and your direct deposit info is correct.

What Are Georgia’s Bonus Tax Refunds?

Let’s break it down: thanks to a budget surplus, Georgia lawmakers decided to return part of that money directly to the people. Through House Bill 112, signed into law by Governor Brian Kemp on April 15, 2025, the state kicked off a one-time Surplus Tax Refund Program.

If you paid Georgia income taxes in 2023 and filed your 2024 return on time (by May 1), you could be eligible to receive up to $500, depending on your filing status.

This isn’t the first time Georgia has done this. But this year, checks are rolling out sooner than usual, giving Georgians a summer financial boost at just the right time.

Why Is Georgia Issuing Refunds Now?

Georgia finished the fiscal year with a multi-billion-dollar surplus. Rather than stash that cash away or spend it on new projects, the state government chose to put money back in taxpayers’ pockets. It’s a move that blends fiscal conservatism with a bit of good old-fashioned Southern generosity.

Governor Kemp said, “Georgians work hard and deserve to see the benefits of a healthy economy in their own lives.”

That sentiment led to House Bill 112—an initiative that mirrors previous surplus refund programs in 2022 and 2023, but with a faster implementation timeline.

How Much Money Can You Get?

Here’s what the Surplus Refund looks like:

- Single Filers: Up to $250

- Head of Household: Up to $375

- Married Filing Jointly: Up to $500

Example: Let’s say you’re a teacher filing jointly with your spouse and paid $3,000 in Georgia state income tax in 2023. If your 2024 return was filed by May 1, you’ll get the full $500, unless you owe back taxes or have other deductions applied.

Who Is Eligible for the Refund?

Not everyone will qualify, so make sure you fit the bill:

- You filed both 2023 and 2024 Georgia state income tax returns.

- You had tax liability in 2023.

- Your 2024 return was filed by May 1, 2025 (or by October 15 if you filed for an extension).

- You don’t owe back taxes or have unpaid debt with the Georgia Department of Revenue.

The refund is automatically calculated and issued, so you don’t need to apply.

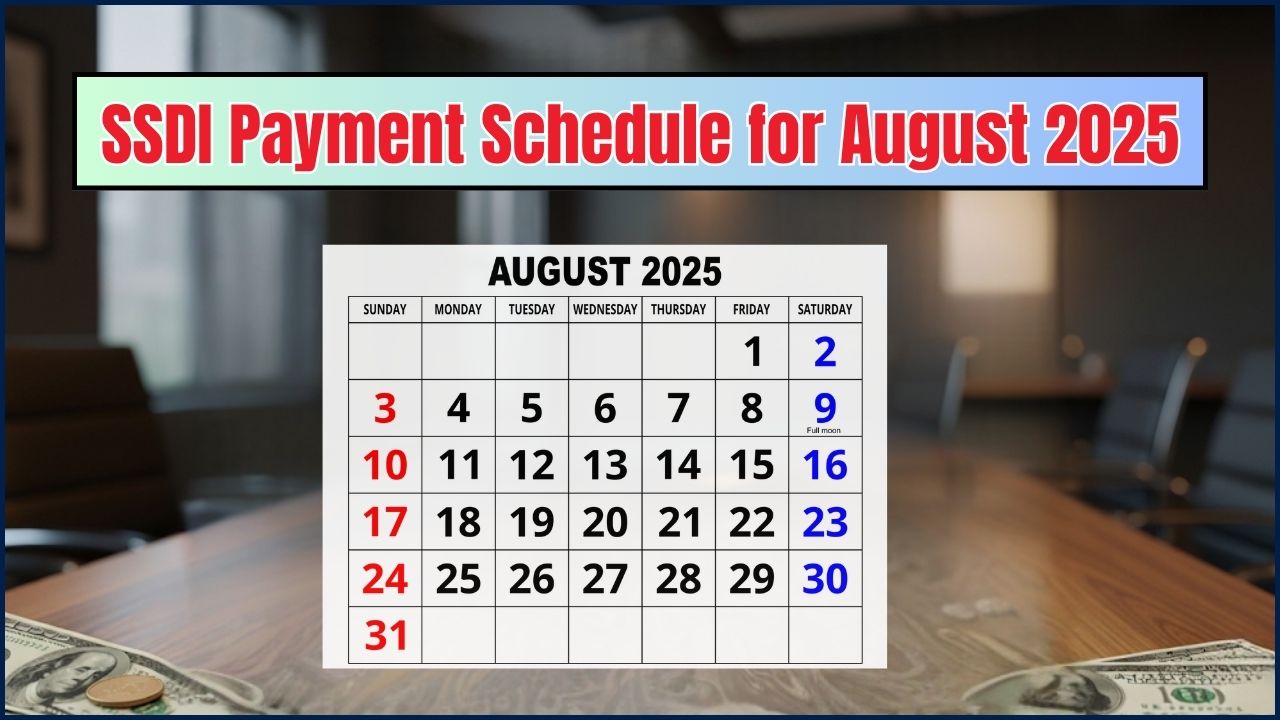

When and How Will You Get Paid?

Fast Timeline

- Refunds started going out on June 2, 2025.

- Most people should see the money within 6 to 8 weeks after filing.

Payment Methods

- Direct Deposit: If the state has your bank info from previous filings.

- Paper Check: If not, expect it by mail.

Heads up: If you filed late or have processing issues, your refund may take longer. Don’t panic—just keep an eye on your mailbox or bank account.

How to Check Your Refund Status

You can use the Georgia Tax Center’s Surplus Refund Eligibility Tool. Here’s what you’ll need:

- Social Security Number (SSN) or Taxpayer ID

- 2023 Adjusted Gross Income (AGI)

- 2023 Refund amount (if any)

Tips for Professionals and Families

- Budgeting Tip: Use the refund to pay off high-interest debt or pad your emergency fund.

- Parents: Use it for back-to-school supplies or savings bonds for your kids.

- Gig Workers & Freelancers: Double-check that you filed state taxes properly and didn’t miss the deadline.

- Elderly or Retirees: If you have limited income but still paid taxes in 2023, don’t assume you’re not eligible.

- Military Families: If you’re stationed out-of-state but still a GA resident, you may still qualify.

Historical Context: Georgia’s Surplus Refunds Over Time

Georgia isn’t new to this game. In both 2022 and 2023, the state issued similar refund checks based on prior year tax surpluses. Over the past three years, the Georgia DOR has refunded more than $2.1 billion to residents through surplus refund programs.

These moves are widely seen as a way to reward taxpayers, bolster public trust, and stimulate the local economy during summer months when spending typically spikes.

State vs. Federal Refund Timelines

It’s important to remember that state and federal tax refunds are handled by different entities and can have different processing times. Here’s a quick look at how they generally compare:

| Feature | Federal Tax Refund (IRS) | State Tax Refund (This State) |

| Typical Processing Time (E-file + Direct Deposit) | 21 days or less | Varies by state, often 1-4 weeks |

| “Where’s My Refund” Tool | IRS.gov/Refunds (or IRS2Go app) | Usually on your state’s Department of Revenue website |

| Why Delays Happen | Errors, claiming certain credits (EITC/ACTC), paper filing, identity verification | Errors, state-specific review processes, paper filing |

| Bonus Initiative | N/A (Federal is separate) | This is where the accelerated checks come in! |

What Experts Say

According to a recent analysis by the Georgia Public Policy Foundation, one-time tax refunds can increase consumer spending by 15-20% in the weeks following issuance. That’s a big deal for local businesses, especially small-town retailers.

Tax expert Linda Monroe, CPA, notes: “Georgia’s refunds are a great example of responsible governance. They’re simple, equitable, and come at a time when families really feel the pinch.”

FAQs

Q1: What if I missed the May 1 deadline?

A: If you filed an extension, you have until October 15 to file. Your refund will be issued after your return is processed.

Q2: Is this refund taxable?

A: Nope. State refunds are not considered taxable income on your federal return.

Q3: Do I need to apply for the refund?

A: No application needed. If you qualify, the Georgia DOR will handle it automatically.

Q4: What if I moved out of Georgia?

A: If you were a Georgia resident in 2023 and filed taxes, you’re still eligible.

Q5: I have student loans. Will my refund be garnished?

A: Possibly. If you owe debts to state or federal agencies, they might garnish your refund.