If you’re one of the millions of Americans receiving Social Security Disability Insurance (SSDI) benefits, you’re probably wondering when your next check is coming. More specifically, you’re probably curious about the August 2025 SSDI payment schedule and how it might affect your financial planning.

Understanding when and how your SSDI payments arrive is essential for managing your budget and ensuring you don’t miss important deadlines or payments. Luckily, we’ve broken down everything you need to know in this comprehensive guide. From the exact dates to practical tips and frequently asked questions (FAQs), we’ve got you covered.

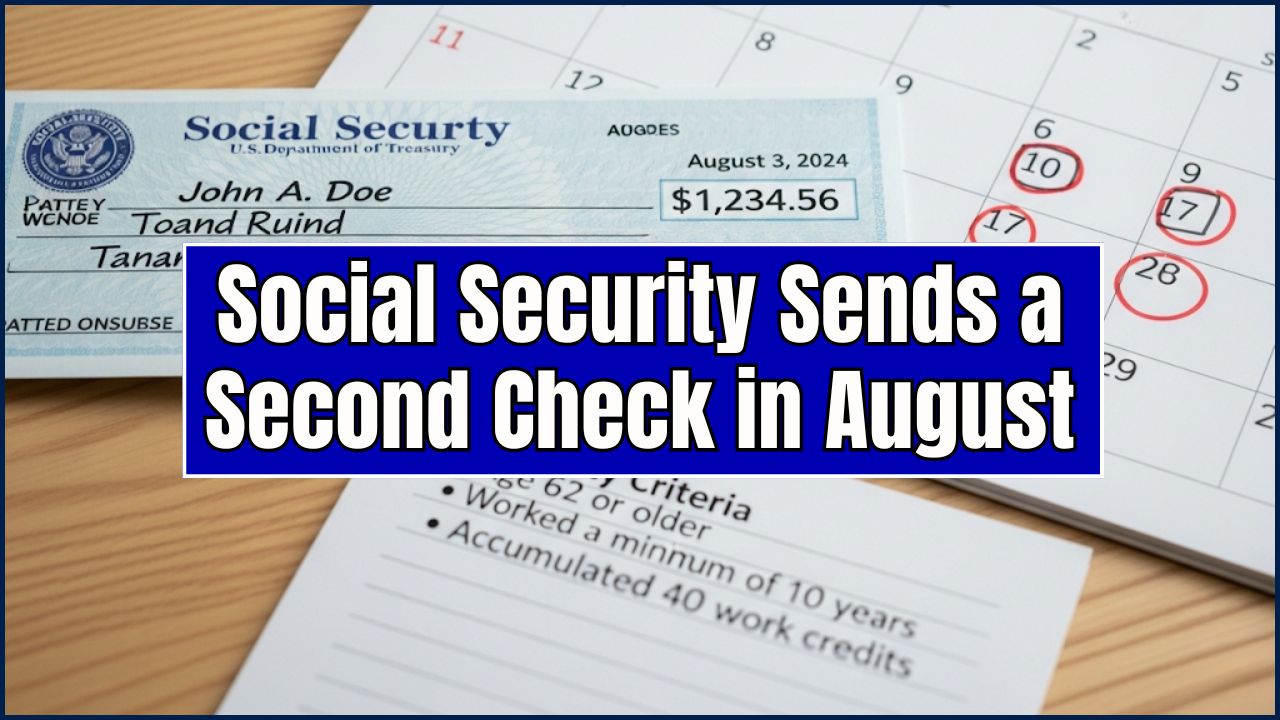

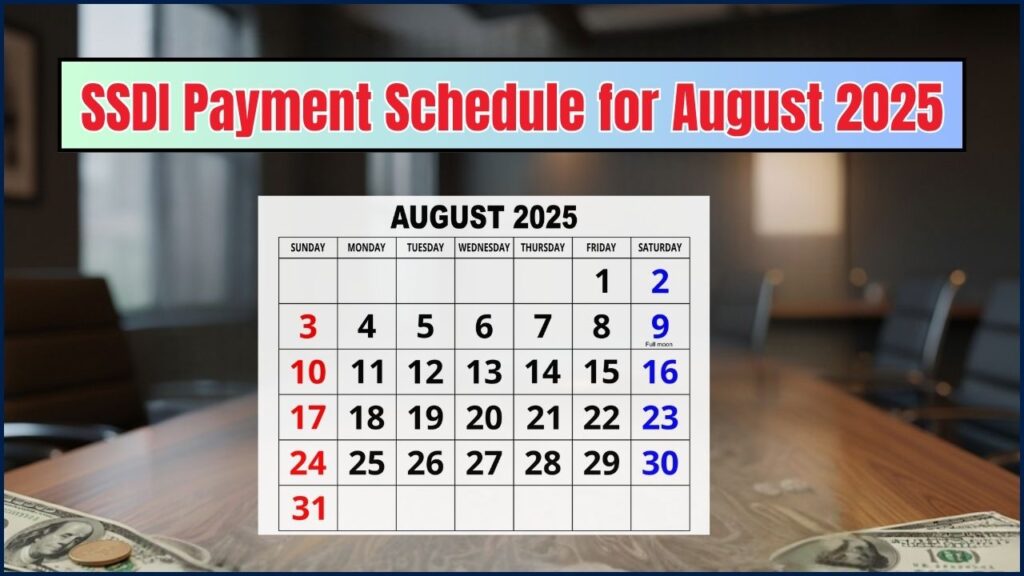

SSDI Payment Schedule for August 2025

| Key Information | Details |

|---|---|

| Payment Dates | Second Wednesday: August 13, 2025 Third Wednesday: August 20, 2025 Fourth Wednesday: August 27, 2025 |

| Recipient Types | People born between 1st-10th: Second Wednesday Born between 11th-20th: Third Wednesday Born between 21st-31st: Fourth Wednesday |

| Important Notes | SSI recipients may get payments earlier Possible overpayment recovery affecting benefits |

| Official Reference | SSA Payment Schedule |

The August 2025 SSDI payment schedule is straightforward, but understanding the exact dates for your specific situation can help you stay on top of your finances. Whether your payment arrives on the second, third, or fourth Wednesday of the month, it’s crucial to know when to expect it. If you’re an SSI recipient, you’ll likely receive your payment earlier in the month.

It’s also worth noting that recent increases in SSDI benefits and new policies like overpayment recovery could affect your financial planning. By staying informed and proactive, you can avoid surprises and ensure that your benefits arrive on time.

Understanding the SSDI Payment Schedule

The Social Security Disability Insurance (SSDI) program provides monthly payments to individuals who are unable to work due to disability. These payments can be a lifeline, so understanding the schedule and the factors that influence it is crucial.

For August 2025, the payment schedule follows the same guidelines as always, but it’s worth revisiting how the SSA determines your specific payment date. Generally, payments are issued on a staggered schedule, depending on your birth date. This helps spread the payment load across the month, ensuring the Social Security Administration (SSA) doesn’t get overwhelmed.

Let’s break it down:

How Does the SSDI Payment Schedule Work?

The payment schedule is divided into different groups based on the month of birth. Here’s how it works:

If Your Birthday Falls Between the 1st and 10th of the Month

- Payment Date: Second Wednesday of the month

- For August 2025: August 13, 2025

If your birthday falls in this range, you’ll get your payment on the second Wednesday of the month. So, for August 2025, be ready for a deposit on August 13.

If Your Birthday Falls Between the 11th and 20th of the Month

- Payment Date: Third Wednesday of the month

- For August 2025: August 20, 2025

For those with birthdays from the 11th to the 20th of the month, the SSA will send your payment on the third Wednesday. For August, that means you’ll receive your payment on August 20, 2025.

If Your Birthday Falls Between the 21st and 31st of the Month

- Payment Date: Fourth Wednesday of the month

- For August 2025: August 27, 2025

Lastly, if your birthday is from the 21st to the 31st, your payment will be on the fourth Wednesday. This year, it falls on August 27, 2025.

Special Considerations for SSI Recipients

If you also receive Supplemental Security Income (SSI), the rules are a little different. SSI recipients typically receive their payments on the 1st of each month or the 3rd day if the 1st falls on a weekend or holiday. For August 2025, that would mean your payment would arrive on August 3, 2025.

Note that SSI recipients also typically get their payments earlier in the month compared to SSDI beneficiaries, which can be handy for budgeting.

How SSDI Payments Are Calculated

The amount you receive from SSDI is based on your average lifetime earnings. The SSA uses a formula that takes into account how much you earned during your working years. Generally, the higher your earnings before you became disabled, the higher your SSDI benefit.

For example, if you worked for many years and paid into Social Security at a higher income level, you could expect higher monthly SSDI payments. Conversely, if your earnings were lower, your SSDI benefits might be on the smaller side. Understanding this can help you better plan your finances and manage your SSDI benefits.

Common Challenges and How to Overcome Them

Navigating SSDI benefits can sometimes feel like walking through a maze. Here are a few common hurdles SSDI recipients face and how to overcome them:

- Delayed Payments: Sometimes, your SSDI payment might be delayed. This could be due to a bank error, issues with your account, or SSA processing delays. The first thing you should do is check your SSA online account for any notifications or updates. If that doesn’t help, don’t hesitate to call 1-800-772-1213 to get a direct update from the SSA.

- Eligibility Issues: Some people face confusion regarding their eligibility for SSDI. It’s essential to keep accurate records of your medical condition and work history, as SSDI eligibility is based on both. If you’re uncertain about your eligibility, consult with a Social Security attorney or a professional to avoid delays or denials in your claim.

- Overpayment Recovery: As mentioned, the SSA may withhold payments to recover overpayments. This often occurs due to a miscalculation, and if it happens to you, filing for a waiver is your best option if the recovery is putting undue strain on your finances. Always keep your SSA information updated and report any changes as soon as possible to avoid future overpayment issues.

Financial Tips for SSDI Recipients

Living on SSDI benefits can be challenging, but with the right financial strategies, you can make it work. Here are some practical tips:

- Create a Budget: Track your expenses carefully, and try to stick to a strict budget. Prioritize essentials like food, utilities, and medical care. Apps like Mint or YNAB (You Need A Budget) can help you manage your finances effectively.

- Look for Ways to Supplement Your Income: While it’s tough to work full-time while receiving SSDI, you may be eligible for work incentives that allow you to earn some extra income without losing your benefits. Check out programs like Ticket to Work for opportunities.

- Cut Non-Essential Spending: Review your monthly expenses and identify areas where you can cut back, like subscriptions or entertainment expenses. Even small savings can add up over time.

SSDI vs. SSI: Which One Are You Receiving?

It’s easy to confuse these two important Social Security programs, but they have key differences. Knowing which one applies to you is crucial for understanding your payment schedule and eligibility!

| Feature | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

| Funding Source | Payroll taxes (FICA) | General tax revenues |

| Eligibility Basis | Work history and paid Social Security taxes; “insured” status | Financial need (limited income and resources) |

| Disability | Must meet SSA’s strict disability definition | Must meet SSA’s strict disability definition (or be 65+, blind) |

| Work Credits | Required (based on age at disability onset) | Not required |

| Payment Schedule | Usually based on birth date (2nd, 3rd, or 4th Wednesday) | Generally on the 1st of the month |

| Medical Coverage | Eligible for Medicare after 24 months of benefits (with exceptions) | Often eligible for Medicaid immediately (varies by state) |

What Happens if the Payment Doesn’t Arrive on Time?

Sometimes payments can be delayed, or you might not see your deposit right away. Here are some steps you can take:

- Check Your Bank Account: Before anything else, make sure your bank account or direct deposit service hasn’t been delayed for other reasons.

- SSA Online Account: Log into your Social Security online account to verify the date and details of your payment.

- Call the SSA: If your payment still hasn’t arrived, you can contact the Social Security Administration. Call 1-800-772-1213 (TTY: 1-800-325-0778) or visit your local SSA office to inquire about the delay.