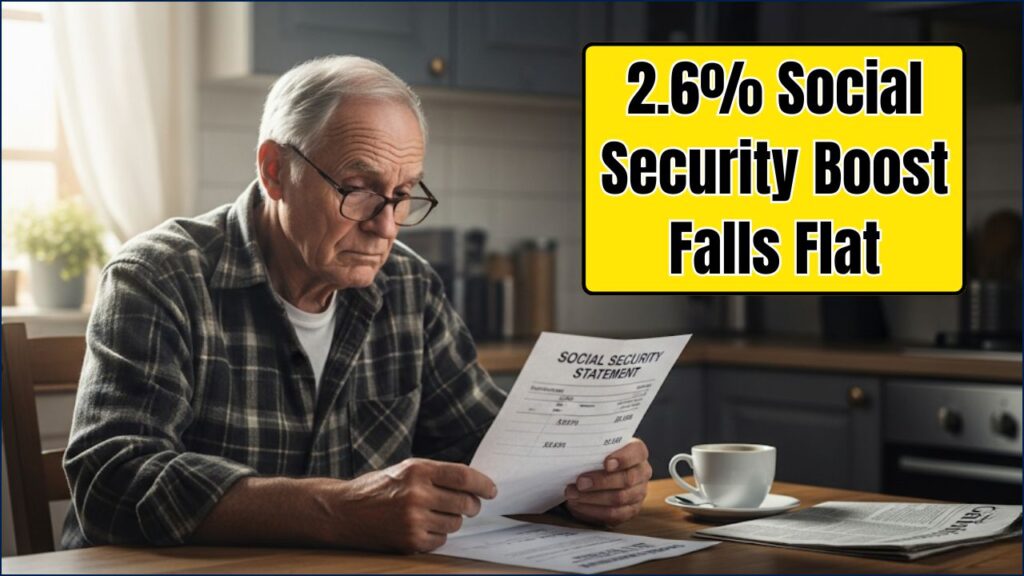

Social Security is one of the most important financial lifelines for retirees across the United States. Each year, the government adjusts Social Security benefits to account for inflation, offering a cost-of-living adjustment (COLA) to help retirees keep up with rising prices. For 2025, the Social Security Administration (SSA) announced a modest 2.6% COLA boost to monthly benefits. While it sounds like good news, many retirees feel that this increase doesn’t go far enough to address the rising costs of healthcare, housing, and daily living expenses. Many are calling for better solutions to make their retirement years more financially stable.

In this article, we’ll explore the details of the 2.6% COLA boost, explain why it’s leaving many retirees dissatisfied, and discuss what retirees are asking for instead. If you or a loved one relies on Social Security benefits, it’s essential to understand these changes and what might be done to improve the system for future retirees.

2.6% Social Security Boost Falls Flat

| Topic | Details |

|---|---|

| 2.6% COLA Boost | For 2025, Social Security benefits will increase by 2.6%, roughly $50 per month for the average retiree. |

| Retirees’ Concerns | Many retirees feel the 2.6% increase is insufficient to cover rising costs, especially healthcare and housing. |

| Consumer Price Index (CPI-E) | Retirees are advocating for the Consumer Price Index for the Elderly (CPI-E), which focuses on seniors’ unique spending needs. |

| Rising Medicare Costs | Rising Medicare premiums significantly erode retirees’ purchasing power, leaving less for other essential expenses. |

| Projected 2026 COLA | Experts predict the COLA increase for 2026 could be slightly higher than 2.6%, but still may not fully offset inflation for seniors. |

| Legislative Action | Lawmakers and advocacy groups are pushing for reforms to more accurately reflect the economic realities faced by retirees. |

The 2.6% Social Security boost for 2025 is a step in the right direction, but it’s not enough to help retirees keep up with rising costs, particularly in healthcare and housing. Retirees are advocating for major reforms, including adopting the CPI-E and addressing rising Medicare premiums. With the right action, we can make sure that Social Security continues to support retirees, especially as they face higher costs of living.

The 2.6% Social Security Boost: An Overview

Each year, Social Security beneficiaries receive a COLA (Cost-of-Living Adjustment) to their monthly payments to help offset inflation. For 2025, the COLA increase will be 2.6%, which means most retirees will see an average bump of around $50 in their Social Security checks.

However, 2.6% may not seem like enough when we look at the actual costs that retirees face. Healthcare and housing have become increasingly expensive, making it harder for seniors to live on a fixed income. Although the increase may help with day-to-day expenses, many retirees are feeling the squeeze as essential costs rise faster than their COLA.

Why the 2.6% Increase Isn’t Enough

The 2.6% increase sounds like a win, but when you break it down, it doesn’t go nearly far enough. Let’s take a closer look at the major issues retirees are dealing with:

- Healthcare costs: Seniors have higher healthcare costs, which are not fully accounted for in the standard COLA calculation. Medicare premiums, for example, are rising year after year. In 2024, Medicare Part B premiums jumped by over $10 per month, cutting directly into seniors’ Social Security checks. The high cost of prescription drugs also continues to be a concern for many.

- Housing costs: Whether it’s rent or home maintenance, seniors face the rising costs of housing. According to AARP, nearly one in three adults aged 65 and older live in a rental home, where rents are rising at a faster pace than the rate of inflation.

- Food and other essentials: Inflation in food prices has been particularly severe. Food costs have increased by 27% since 2020, which is a huge blow to retirees who are often living on a fixed income.

While a 2.6% COLA might seem like a small win, many retirees argue that it’s not enough to meet the increasing costs of essentials.

What Retirees Are Asking For Instead

Seniors are advocating for significant changes to the COLA adjustment process. The current system is outdated and doesn’t fully address the needs of retirees. Let’s dive into what retirees are asking for instead.

1. Adopting the Consumer Price Index for the Elderly (CPI-E)

The current CPI (Consumer Price Index) used for calculating the Social Security COLA is based on the CPI-U (Urban Consumer), which reflects the general population’s spending habits. But this doesn’t accurately represent the spending needs of seniors. Seniors spend more on healthcare and housing, and less on things like technology and entertainment. That’s why many retirees are pushing for the CPI-E, which is a measure of inflation specifically for older adults.

If CPI-E had been used over the last decade, retirees would have received thousands of dollars more in benefits. According to a report by the Senior Citizens League, seniors would have seen $1,400 more in benefits over the past 10 years if the CPI-E had been used instead of the CPI-U.

2. Addressing Rising Medicare Costs

In addition to advocating for a more accurate inflation measure, seniors are calling for Medicare premiums to be more fairly accounted for in Social Security adjustments. Every year, Medicare premiums increase, taking a big chunk of retirees’ Social Security checks. Many seniors are struggling to make ends meet, and rising healthcare costs are one of the biggest barriers.

Lawmakers should consider freezing Medicare Part B premiums or limiting their growth to ensure retirees have more disposable income.

3. Expanding Social Security Benefits

Some advocates argue that the COLA adjustment isn’t enough on its own. Social Security benefits should be increased overall to help seniors live more comfortably. Expanding benefits could involve:

- Raising the Social Security payroll tax cap, so high-income earners pay more into the system.

- Ensuring that benefit increases keep pace with the actual costs of living for seniors.

These changes would require Congressional approval, but there’s growing momentum behind the push for reform.

Real-Life Stories from Retirees

To help paint a clearer picture of how these issues affect real people, here are a few stories from retirees:

- Lena, 72, retired teacher from California: “I was hoping the 2.6% increase would help, but it’s just not enough. My Medicare premiums went up by $12, and food prices keep climbing. I find myself choosing between filling my prescriptions and buying groceries. It’s a constant struggle.”

- Tom, 68, retired mechanic from Texas: “My rent went up by 8% last year. That’s $200 more a month, and my Social Security check didn’t increase anywhere near that amount. It’s becoming harder to make ends meet, and I’m worried about what the future holds.”

Steps You Can Take to Prepare for Retirement

While the situation may feel frustrating, there are still things you can do to ensure financial stability in retirement. Here are a few tips:

1. Save Early and Often

The earlier you start saving for retirement, the more you can benefit from compound interest. If you haven’t already, consider setting up an IRA or 401(k) to help grow your savings.

2. Supplement Your Income

If you’re nearing retirement age and are concerned about the adequacy of your Social Security, consider finding supplemental income streams. This could involve part-time work, freelancing, or investing in real estate or stocks.

3. Cut Unnecessary Expenses

Review your spending habits. Reducing luxury expenses, like dining out or entertainment, can free up more funds for essentials. Downsizing your home or moving to an area with lower costs of living can also have a major impact.