In August 2025, Social Security recipients might notice something a little different. Two payments in one month! While this sounds exciting, you might be wondering why this is happening and if you’re eligible. In this article, we’ll break down everything you need to know about the second Social Security check in August, why it’s happening, and how you can check if you’re eligible.

Whether you rely on Social Security benefits for your daily needs or you work in a field like accounting, social services, or financial planning, understanding payment schedules is crucial. By the end of this article, you’ll be equipped with the knowledge you need to navigate this situation with confidence.

Social Security Sends a Second Check in August

| Key Point | Details |

|---|---|

| Why a second check? | SSI payments are adjusted due to weekends or holidays. |

| Payment Schedule in August 2025 | August 1st payment shifts to July 31st; second payment on August 31st. |

| Who gets the second check? | Primarily SSI recipients; others based on birthdate schedule. |

| How to check eligibility | Use the SSA website or call to confirm payment dates. |

| Official Website for Reference | SSA Website |

| Contact SSA | Call 1-800-772-1213 for more info or to confirm payment dates. |

In August 2025, you may find yourself receiving two Social Security payments if you’re an SSI recipient. The first will be moved to July 31st to accommodate the weekend, and the second will come as usual on August 31st. This adjustment helps to keep everything running smoothly and ensures that people get their benefits without unnecessary delays.

Social Security and SSI are vital programs that help millions of people across the U.S. make ends meet. Understanding how the payment system works and staying informed about any changes is key to making sure you don’t miss out on the support you deserve. Whether you’re receiving Social Security or working with clients who rely on these programs, knowing the details of payment schedules and adjustments can make all the difference.

What’s the Deal With Social Security Sending a Second Check?

Social Security benefits are designed to help individuals with disabilities, those over 65, and others who may need additional financial support. For many people, these checks are an essential part of their monthly budget. But what happens when the payment schedule gets shifted?

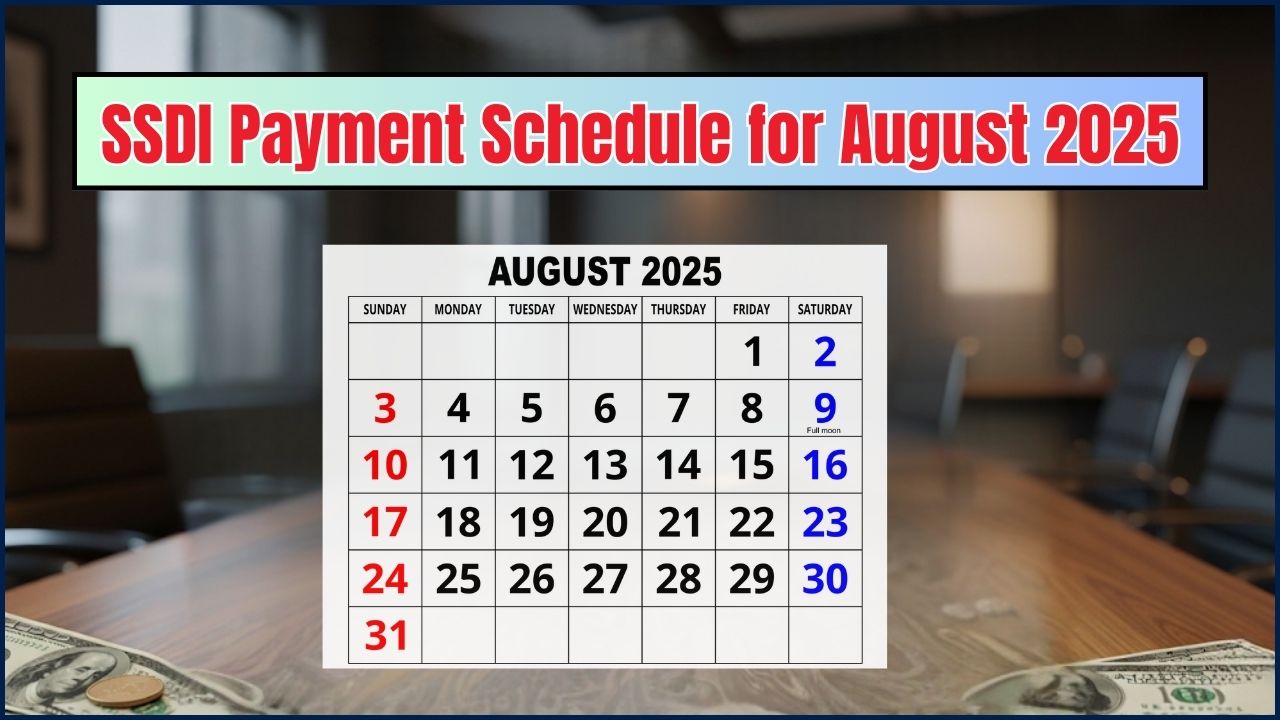

In August 2025, the Social Security Administration (SSA) is adjusting payments for certain recipients, especially those receiving Supplemental Security Income (SSI). Normally, SSI checks are sent out on the 1st of the month, but when that date falls on a weekend or holiday, the payment is moved to an earlier date. For August, because August 1st is a Friday, the first payment will arrive on July 31st. This ensures that people aren’t left waiting for their payment.

But the surprises don’t end there. A second check will be sent out on August 31st to make sure recipients get their full benefits for the month.

Who Will Get the Second Social Security Payment in August?

This adjustment primarily impacts those who are receiving SSI. If you are an SSI recipient, you should be seeing two payments in August 2025:

- First Payment (July 31st): The regular payment that would usually come on August 1st will be sent a day early—on July 31st—to account for the weekend.

- Second Payment (August 31st): The second payment for the month will arrive as usual, at the end of the month.

For those receiving regular Social Security (not SSI), the SSA doesn’t make the same adjustments, but you’ll still want to check the exact payment date based on your birthdate.

A Closer Look at Social Security and SSI

Before we dive further into the specifics of payments, let’s take a moment to understand what Social Security and SSI really are and how they work. This context will help you better appreciate why these payment adjustments are happening.

Social Security is a federal program designed to provide financial assistance to retired, disabled, or survivors of deceased workers. It’s funded through payroll taxes collected from workers and employers. As of 2023, the average monthly Social Security benefit for retired workers was around $1,650. This amount varies depending on your work history and earnings.

Supplemental Security Income (SSI), on the other hand, is a program that provides financial support to people with low income and limited resources who are disabled, blind, or age 65 and older. Unlike Social Security, SSI isn’t based on work history but is instead aimed at helping those who need it most.

Real-Life Impact: How a Second Payment Can Help

Imagine Sarah, a 72-year-old woman living on a fixed income. Sarah receives SSI benefits to help cover her living expenses. Normally, she would get her check on the 1st of the month, but this month, her payment is moved to July 31st because August 1st is a Friday.

This early payment helps Sarah make sure she doesn’t run out of money before her next check. Then, she gets another payment on August 31st. For Sarah, this gives her some breathing room, especially with any upcoming bills or unexpected expenses.

Understanding Different Social Security Benefits

Social Security isn’t just one type of payment! Here’s a quick look at the main types of benefits and who they’re for:

| Benefit Type | Who It’s For | Key Eligibility Factors |

| Retirement Benefits | Retired workers, spouses, and dependents. | Requires a minimum number of work credits (usually 40) and reaching a specific age (Full Retirement Age varies by birth year, earliest at 62). |

| Disability Benefits | Workers who can no longer work due to a severe medical condition. | Requires sufficient work credits and a medical condition meeting SSA’s definition of disability. |

| Survivors Benefits | Spouses, children, or parents of a deceased worker. | Based on the deceased worker’s earnings record. |

| Supplemental Security Income (SSI) | Low-income individuals who are aged, blind, or disabled. | Need-based program; doesn’t require work history, but has strict income and resource limits. |

Tips for Managing Social Security Payments

Receiving your Social Security or SSI check is one thing, but managing those funds is another. Here are a few tips to help you stay organized and avoid problems with your payments:

- Set Up Direct Deposit: This is the most reliable way to receive your Social Security payments on time. You won’t have to worry about your check getting delayed or lost in the mail.

- Track Your Payments: Keep a payment calendar to make sure you know exactly when your benefits are coming. This can be especially helpful if you get a second check.

- Budget for Delays: Even though the SSA makes every effort to get payments out on time, sometimes things happen. If you rely on these payments to cover essentials, try to build a small buffer in your monthly budget.

- Be Ready for Adjustments: Sometimes the SSA will adjust payments due to changes in the economy, inflation, or legal rulings. Stay informed by checking your SSA account or calling them for updates.

Busting Common Social Security Myths

There are many misconceptions about Social Security, and it’s important to set the record straight. Here are a few common myths:

Myth #1: “Social Security is only for retirees.”

- Truth: Social Security isn’t just for people who’ve retired. It also supports disabled individuals, surviving family members, and those with limited income through programs like SSI.

Myth #2: “I can’t change my payment date.”

- Truth: While you can’t directly choose your payment date, the SSA does make adjustments if your regular payment falls on a weekend or holiday.

Myth #3: “Social Security checks are always the same amount.”

- Truth: Social Security benefits can change yearly due to Cost-of-Living Adjustments (COLA). This is done to keep up with inflation and ensure that your benefits don’t lose purchasing power over time.