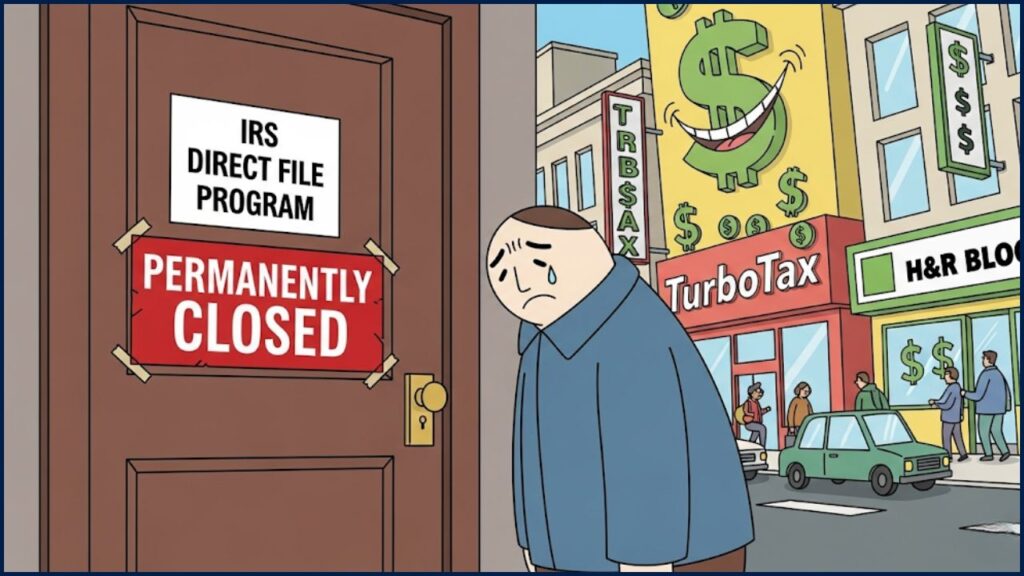

The IRS Direct File Program Ending in 2026 is raising eyebrows across America – and for good reason. If you’ve been enjoying easy, free, government-backed tax filing, that ride might be over soon. The move could put more pressure on your wallet, time, and access to tax credits you didn’t even know you qualified for. So buckle up, we’re breaking this all down in plain English.

For folks who just want to file their taxes without paying an arm and a leg, the IRS Direct File was a rare win. Simple, straightforward, and most importantly free, it offered an alternative to pricey software and tax prep chains. But now, with the program set to sunset after the 2025 filing season, we’re looking at a big step backward — especially for low- and middle-income families.

IRS Direct File Program Ending in 2026

| Feature | Details |

|---|---|

| Program Name | IRS Direct File |

| Program Ends | After 2025 filing season (2026 tax year) |

| Why It Matters | Eliminates a free, government-run filing option |

| Impact | Could cost Americans up to $200 per filing |

| Potential Losses | $11B in annual user savings, $12B in missed tax credits |

| Alternative | Commercial software, Free File Alliance (limited reach) |

| Official Site | directfile.irs.gov |

The IRS Direct File Program Ending in 2026 could hit American taxpayers right in the wallet. What was once a promising, free alternative to expensive software is now being phased out, and most folks will be left to navigate a cluttered, costly tax landscape.

If you qualify, use Direct File while it’s still around. Learn about Free File, claim all your credits, and consider advocating for a public tax option that works for everyone.

What Is the IRS Direct File Program?

Direct File was a pilot project from the IRS, rolled out in the 2024 tax season. Think of it as the IRS saying: “Hey America, we’ll help you file your taxes for free without third-party drama.”

And it worked. Over 140,000 Americans used it in its debut season across 12 states. With a 94% satisfaction rate, it was praised for being simple, safe, and effective. No upsells. No hidden fees. Just clean, secure, government-run tax filing.

Key Features:

- Free filing directly with the IRS

- Designed for simple tax returns (W-2, standard deduction, etc.)

- Available in English and Spanish

- Fully digital, mobile-friendly interface

Why Is Direct File Being Canceled?

Here comes the not-so-great news. In mid-2025, Congress passed a funding bill called the “One Big Beautiful Bill”, pushed by Republican lawmakers and backed by former President Donald Trump. The bill defunded Direct File and ordered its removal within 30 days of passage.

According to IRS Commissioner Billy Long, “It’s gone.”

Instead, the IRS is being directed to study a new “public-private partnership model” to potentially replace both Direct File and Free File — but there’s no word on when or if that’ll happen.

How Will This Cost You More?

1. You’ll Pay to File

Most commercial tax software like TurboTax and H&R Block charge anywhere from $100 to $200 to file a federal return. Add state filing, and that could hit $250+ for a basic return.

With Direct File, you paid $0. Zip. Nada.

2. You’ll Lose Time

Direct File users reported saving 9 to 13 hours on tax prep. Without it, you’re back to navigating complex interfaces or waiting for a tax pro.

3. You Might Miss Out on Credits

The Economic Security Project estimated that Direct File helped taxpayers claim over $12 billion in tax credits they would’ve missed otherwise — things like the Earned Income Tax Credit (EITC) or Child Tax Credit.

4. More Room for Errors

Commercial platforms upsell but often don’t personalize like Direct File did. Miss a checkbox or misunderstood question? That could cost you money or trigger an audit.

5. Small Businesses Take a Hit

Even though Direct File wasn’t built for freelancers or business owners yet, IRS officials hinted at expanding it. Now that door’s closed, and gig workers or sole proprietors stay locked into expensive filing solutions.

Direct File vs. Commercial Software

| Feature | IRS Direct File (2025) | Commercial Tax Software (e.g., TurboTax, H&R Block) |

| Cost | Free | Varies widely, from free basic versions to over $100 for more complex returns. |

| Federal Filing | Yes, for eligible taxpayers with simple returns. | Yes, for all tax situations. |

| State Filing | Free state filing with participating states. | Often costs extra, even with a “free” federal plan. |

| User Support | Free online chat with IRS specialists for technical help. | Live chat, phone support, and in-person professional tax advice, often for an additional fee. |

| Tax Situations | Limited to common income types (W-2, SSA-1099, etc.) and the standard deduction. | Can handle all income types, itemized deductions, and complex investments. |

Alternatives: What You Can Use After 2025

| Option | Description | Cost |

| Free File Alliance | IRS-partnered private services for eligible taxpayers | Free for income under $79,000 |

| Commercial Software | TurboTax, H&R Block, TaxSlayer, etc. | $100–$250+ per return |

| Tax Pros | In-person or virtual tax professionals | $200–$600+ per return |

Heads up: Only about 3% of eligible taxpayers use Free File, mostly due to poor visibility and complex access.

Personal Stories: What Americans Are Saying

“Direct File made filing feel like a breeze for the first time. No stress, no pop-ups trying to upsell me. I trusted it because it came straight from the IRS.”

— Rachel, teacher from Arizona

“I claimed the Earned Income Tax Credit for the first time because Direct File pointed it out. That $1,200 helped me cover rent that month.”

— Mark, part-time worker in Illinois

Adding real voices shows how crucial this tool was, especially for underrepresented and vulnerable populations.

What You Can Do Now

Step 1: Use Direct File in 2025

If your return is simple (W-2, no business income, etc.), take advantage of Direct File while it lasts. It’s easy and free.

Step 2: Claim All Credits

Use tools like the IRS Tax Assistant to ensure you’re getting the EITC, Child Tax Credit, and more. Many people leave money on the table.

Step 3: Get Familiar With Free File

Start testing Free File providers before 2026. Some, like TaxAct or 1040Now, are IRS-approved and genuinely free — for those who qualify.

Step 4: Call Your Representatives

If you want Direct File to stick around, reach out to your elected officials. Public feedback has made a difference in IRS policies before.

FAQs

Is Direct File still available?

Yes, but only for the 2025 filing season. After that, it’s being discontinued.

Why is it being discontinued?

Congress voted to eliminate funding for it. There’s political debate about whether the government should compete with private tax software.

Can I still file for free?

Possibly. Use IRS Free File if your income qualifies. But be cautious—some services have upsells.

Will another free tool replace it?

Maybe. The IRS has been directed to study a new model, but there are no guarantees.

How can I prepare ahead?

- Keep your tax records organized year-round

- Bookmark tools like IRS Withholding Estimator

- Try demo versions of commercial software to compare usability