If you’re a homeowner in New York, you’ve probably heard about the NY STAR Stimulus Program — and maybe even seen friends or neighbors cashing their checks already. This School Tax Relief (STAR) initiative isn’t just government talk; it’s real money in your pocket, with payouts this fall ranging from a few hundred bucks to well over a thousand.

The STAR program has been a fixture in New York since the late 1990s, designed to help residents shoulder the weight of some of the highest property taxes in the country. In 2025, the payouts are arriving in two waves: one in early summer and another this fall, timed to hit right before school tax bills land in mailboxes.

NY STAR Stimulus Program

| Category | Details |

|---|---|

| Program Name | NY STAR (School Tax Relief) Program |

| Who Qualifies | Homeowners in NY with income limits (Basic ≤ $500k, Enhanced ≤ $107,300 for 2025) |

| Average Payout | Basic: $350–$600 / Enhanced: $700–$1,500+ |

| Highest Reported Savings | Up to $5,015 in Suffolk County |

| Fall 2025 Rollout | Phase 2 payments Aug–Oct; nearly 3M homeowners benefiting |

| Total Statewide Relief | $2.2 Billion |

| Official Info | NYS Tax STAR Program Page |

The NY STAR Stimulus Program is a powerful tool to help keep homeownership affordable in New York, especially as property taxes climb. Whether you’re a young family buying your first home or a retiree looking to stretch your budget, making sure you’re signed up and up-to-date can mean hundreds — or even thousands — in your pocket this fall.

A Quick Look Back — How STAR Started

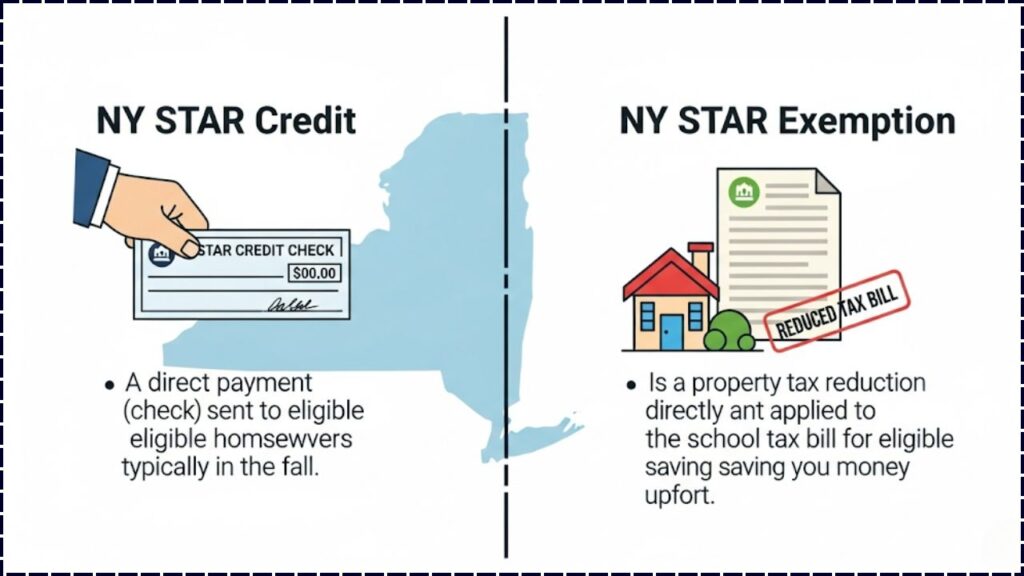

The STAR program was born in 1997 as a bipartisan effort to give New York homeowners some breathing room from skyrocketing school taxes. Originally, all benefits came as an exemption directly on the property tax bill. In 2016, new applicants switched to the STAR Credit system, where the state sends you the money directly — letting you decide how to use it.

Basic STAR vs. Enhanced STAR

Basic STAR

- Eligibility: Your primary residence is in NY and your household income is $500,000 or less. No age limit.

- Benefit: Usually $350–$600 depending on your school district.

- Example: A family in Albany might see $500 knocked off their school tax bill or get it as a check.

Enhanced STAR

- Eligibility: At least one homeowner is 65 or older and household income is $107,300 or less for 2025.

- Benefit: Around $700–$1,500, but in high-tax areas like Suffolk County, savings can exceed $5,000.

- Example: A retired couple in Long Island could see $3,000+ in relief this year.

Regional Differences Matter

The STAR benefit is tied to your local school tax rate, so where you live makes a big difference. According to state data:

- Suffolk County: Up to $5,015 in savings.

- Albany County: Around $1,733 for top-tier Enhanced STAR recipients.

- Upstate rural districts: Often in the $400–$800 range.

How Much You Could Get This Fall

| Program | Low Estimate | High Estimate |

|---|---|---|

| Basic STAR | $350 | $600 |

| Enhanced STAR | $700 | $1,500+ |

| Top Savings (select counties) | $1,733 (Albany) | $5,015 (Suffolk) |

Nearly 3 million homeowners are expected to share in over $2.2 billion in relief this year, according to the Governor’s Office.

Step-by-Step Guide to Check and Claim Your STAR Benefit

- Check Your Eligibility

Visit the NYS STAR Eligibility Page and enter your county, school district, and income information. - Know Your Benefit Type

- Bought your home after 2015? You’ll get the STAR Credit via direct deposit or check.

- Owned before 2015? You may still have the STAR Exemption.

- Apply or Update Your Info

- Basic STAR: One-time registration.

- Enhanced STAR: Annual income verification is required.

- Track Your Payment

Use the STAR Credit Delivery Schedule to see when your payment is coming.

Common Mistakes That Could Delay Your Payment

- Giving the wrong school district on your application.

- Forgetting to verify income for Enhanced STAR.

- Changing your mailing address without updating STAR records.

- Assuming you’re enrolled because you got it “last year.”

Pro Tips for Maximizing STAR

- Opt for direct deposit — it’s faster and avoids lost checks.

- Treat STAR as part of your annual budget — don’t spend it before it arrives.

- If you’re a senior turning 65 this year, apply early for Enhanced STAR to avoid missing the higher benefit.

Basic STAR vs. Enhanced STAR

| Feature | Basic STAR | Enhanced STAR |

| Who is it for? | All eligible homeowners, regardless of age. | Seniors aged 65 and older. |

| Primary Residence? | Yes, it must be your primary residence. | Yes, it must be your primary residence. |

| Income Limit (for 2025 benefits) | $500,000 or less | $107,300 or less |

| How to Apply (if new)? | Register for the STAR Credit with NYS. | Register for the STAR Credit with NYS. |

| Benefit Amount | Varies by school district, but generally a smaller reduction. | A larger reduction than the Basic STAR benefit. |

Top 3 STAR Program Mistakes to Avoid

- Myth: “You have to reapply for STAR every year.” Reality: If you receive the STAR Credit, you only need to register once. The state automatically checks your income eligibility each year. However, if you have the STAR Exemption and your income or other circumstances change, you might need to take action.

- Mistake: “My check is late, so I’m not getting it.” Reality: Payment dates vary significantly by region. Payments are staggered throughout the fall. Use the online tools to track your payment status before assuming there’s an issue.

- Tip: “Switch to the STAR Credit if you’re still on the Exemption!” Reality: The STAR Credit is the newer, more dynamic program. The value of the STAR Exemption is frozen, while the credit can increase by up to 2% each year, offering a potentially larger long-term benefit. It’s often a smart move to switch.

Myth-Busting the STAR Program

- Myth: STAR is a federal tax program.

Fact: It’s 100% state-funded. - Myth: Renters can qualify.

Fact: STAR is strictly for homeowners. - Myth: You can get both Basic and Enhanced STAR.

Fact: You only qualify for one.

Why This Matters in 2025

With property taxes averaging over $9,000 in some NY counties, STAR benefits are more important than ever. For seniors living on fixed incomes, this relief can mean keeping the heat on in winter or paying for necessary home repairs.

FAQs

Q: Do renters qualify for STAR?

No, STAR is for homeowners only.

Q: Can I get both Basic and Enhanced STAR?

No. You either qualify for one or the other.

Q: Does STAR count as taxable income?

No, STAR benefits are not taxable at the state or federal level.

Q: Is there a deadline to apply?

Yes — the deadline depends on your county’s property tax cycle. Check with your local assessor.