The IRS Confirms CAP 2026 Is Live, and if you’ve been waiting for your chance to get into the Compliance Assurance Process (CAP), the time has come. The application window opened September 3, 2025, and it’s closing tight on October 31, 2025. After that, it’s game over until the next cycle.

Think of CAP as a way to get on the IRS’s good side early. Instead of sweating through audits years after filing, you work directly with IRS examiners in real time to resolve issues up front. For big corporations with $10 million+ in assets, that’s like having instant replay in football—you know if the call is good before the play is over.

IRS Confirms CAP 2026

| Item | Details |

|---|---|

| Application Window | September 3 – October 31, 2025 |

| Notification of Acceptance | February 2026 |

| Eligibility | Public corporations (10-K filers) or privately held C-corps with ≥ $10M assets |

| Documentation Required | Audited financials (GAAP/IFRS), reconciled to Schedule M-3 |

| Exceptions | IRA & CHIPS Act-related open years allowed |

| Required Forms | 14234, 14234-A, 14234-B, 14234-C, 14234-D, 14234-E |

| Official Resource | IRS CAP Program Page |

The IRS Confirms CAP 2026 Is Live, and it’s one of the most powerful tools corporations have to reduce uncertainty and build trust with the IRS. The short window—from September 3 to October 31, 2025—means the time to act is now. If your company meets the eligibility requirements, applying could save you years of headaches, millions in audit costs, and give your investors confidence in your compliance strategy.

A Quick Look Back: How CAP Started

The IRS first launched CAP in 2005 as a pilot program. Back then, audits were dragging on for years, leaving both the IRS and corporations frustrated. CAP was the solution: a way for taxpayers and the IRS to collaborate in real time.

Over the years, the program has tightened eligibility and refined rules. By 2019, participation was capped at around 150–200 large taxpayers, according to IRS reports. Today, CAP remains one of the most sought-after compliance programs for U.S. corporations, especially those with complex, global tax structures.

Who Qualifies for CAP 2026?

Not every business can get in. Here are the non-negotiables:

- Assets: Must have at least $10 million in assets.

- Corporate Type: Must be a U.S. publicly traded corporation (filing 10-K, 10-Q, 8-K) or a privately held C-corporation (foreign-owned included).

- Financial Statements: Private companies must provide audited annual statements (GAAP/IFRS) with an unqualified opinion.

- Clean Legal Record: No ongoing investigations or litigation that restrict IRS access.

Why CAP 2026 Matters

This year, the IRS has introduced new wrinkles that make the program more appealing:

- Open Year Flexibility: Usually you can only have one filed and one unfiled open return. But IRA and CHIPS Act issues don’t count against you.

- New Applicant Perk: First-timers may be allowed in with up to three open years, provided IRS teams believe they can close them within 12 months.

That’s huge because it means more companies can get in, even if they’re still cleaning up past filings.

CAP Program vs. Traditional IRS Audit

| Feature | CAP Program | Traditional IRS Audit |

| When Issues are Resolved | Before the tax return is filed (proactive) | After the tax return is filed (reactive) |

| Process | Collaborative, transparent, and in real-time | Post-filing examination, can be lengthy and adversarial |

| Tax Certainty | Provides a high degree of certainty for tax positions | Can result in years of uncertainty and potential disputes |

| Resource Burden | Reduces future administrative burden and costs | Often resource-intensive for both the IRS and the taxpayer |

| Goal | To achieve compliance and certainty before filing | To verify compliance and identify discrepancies after filing |

Key Dates for the CAP 2026 Application Cycle

- September 3, 2025: The application window for the CAP 2026 program opens. This is your first chance to submit your application.

- October 31, 2025: The application period closes. Be sure to have all your documents submitted by this date.

- February 2026: The IRS will notify applicants whether they have been accepted into the program.

Benefits of Joining CAP

Pros:

- Audit Certainty: Resolve issues as they happen.

- Speed: Cut audit resolution time from 3–5 years to 12 months.

- Lower Costs: Less litigation and audit defense spending.

- Reputation Boost: Shareholders and investors love transparency.

Cons:

- High Bar for Entry: Not available to smaller companies.

- Resource Intensive: Requires strong internal controls and compliance staff.

- Ongoing Commitment: IRS expects full transparency—no hiding the ball.

Step-by-Step: How to Apply

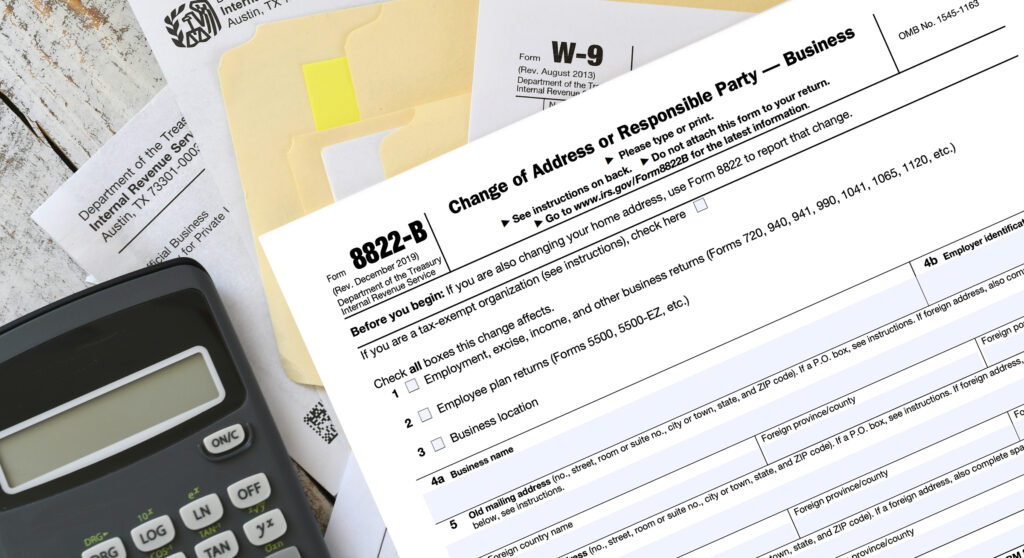

Step 1: Gather Your Forms

- Form 14234 – CAP Application

- Form 14234-A – Research Credit Questionnaire

- Form 14234-B – Intercompany Transactions Template

- Form 14234-C – Initial Issues List

- Form 14234-D – Tax Control Framework Questionnaire

- Form 14234-E – Cross-Border Activities Questionnaire

Download directly from the IRS CAP application page.

Step 2: Prep Your Financials

- Public companies: make sure your SEC filings are airtight.

- Private companies: confirm audited statements are reconciled to Schedule M-3.

Step 3: Submit Your Application

- Returning applicants: send to your IRS coordinator.

- New applicants: email package to the CAP mailbox. Use subject: “CAP Application – [Tax Year].”

Step 4: Get Your Answer

By February 2026, the IRS will notify you. If accepted, sign and return the Memorandum of Understanding (MOU).

Common Mistakes That Sink Applications

- Incomplete Forms: Forgetting Form 14234-E (cross-border activities) is a classic error.

- Parent-Company Financials: Submitting consolidated parent financials instead of applicant-only statements.

- Weak Internal Controls: IRS is wary if your Tax Control Framework looks flimsy.

- Late Submissions: CAP deadlines are non-negotiable.

Practical Tips for a Strong Application

- Start Early: Prep your package by August 2025.

- Get Audit-Ready: Have your internal controls documented.

- Cross-Border Disclosures: Be upfront about international operations.

- Consult a Pro: Tax advisors with CAP experience can boost acceptance odds.

Voices from the Field

Former IRS Commissioner Douglas Shulman once described CAP as “a model of cooperative compliance.” More recently, IRS executives have emphasized that CAP is meant to reduce disputes, not eliminate oversight. In other words: honesty and transparency are the price of admission.

Top 3 Mistakes to Avoid When Applying for CAP

- Mistake #1: Procrastinating on Your Application. The application window is short (Sept. 3 to Oct. 31, 2025). The application requires detailed financial statements and other documentation, so don’t wait until the last minute.

- Mistake #2: Not Meeting the Eligibility Criteria. The program is not for everyone. You must be a large corporation with at least $10 million in assets and have your audited financial statements in order. Double-check all criteria before you apply.

- Mistake #3: Lack of Transparency. The CAP program is built on a foundation of “open, cooperative, and transparent interaction.” Failure to fully disclose material issues or transactions can lead to your application being denied or even removed from the program.

Real-World Case Study or Mini Example

Sarah, the CFO of a growing tech company, was worried about the uncertainty of a future audit. Her company had recently completed a major international transaction and a complex merger, creating numerous tricky tax positions. Instead of waiting years for an audit, she applied for the CAP program. The IRS and her team worked together for several months, reviewing the transactions in real time. By the time her tax return was filed, all material issues had been resolved, giving her and her board peace of mind and allowing them to focus on the company’s growth, not on a looming tax dispute.

FAQs

Q1: What if I miss the October 31, 2025 deadline?

You’ll have to wait until the next cycle. No late entries allowed.

Q2: Can I back out after being accepted?

Yes, but it may hurt your chances of being accepted in future cycles.

Q3: Is CAP the same as Advance Pricing Agreements (APAs)?

No. CAP deals with overall compliance, while APAs focus specifically on transfer pricing.

Q4: Will joining CAP make me more likely to get audited in other areas?

Not necessarily—CAP actually lowers audit risk because issues are resolved in real time.