If you’re hunting for a smart, reliable, and low-risk retirement plan in India, Atal Pension Yojana 2025 (APY) might just be your golden ticket. Whether you’re a 20-something gig worker, a middle-aged street vendor, or someone advising clients on personal finance, this government-backed scheme brings peace of mind like a hot cup of chai on a cold Delhi morning.

Launched by the Indian Government in 2015, APY is all about making retirement stress-free for millions of Indians who don’t have access to formal pension systems. Fast forward to 2025, it’s more robust, flexible, and digitized than ever before. In this article, we’ll show you how to check your APY account status, use the official APY calculator, and explore the plan’s key benefits with real-world examples. Plus, we’ve added new sections on success stories, APY vs other pension schemes, and expert tips to make it even more engaging.

Atal Pension Yojana 2025

| Feature | Details |

|---|---|

| Subscribers (2025) | 7.65 crore (76.5 million); Corpus: ₹45,974.67 crore |

| Pension Amounts | ₹1,000 / ₹2,000 / ₹3,000 / ₹4,000 / ₹5,000 monthly |

| Eligibility Age | 18 to 40 years |

| Contribution Mode | Monthly, Quarterly, or Half-Yearly (via auto-debit) |

| Missed Payment Penalty | ₹1 to ₹10 per missed debit |

| Annual Pension Change | Yes, once a year (April) |

| Government Contribution | Up to 50% (only for early enrollees from 2015–16) |

| Official Website | jansuraksha.gov.in |

The Atal Pension Yojana 2025 is one of India’s most accessible, reliable, and affordable retirement tools. Whether you’re earning daily wages or building a freelance empire, locking in a guaranteed pension for a few hundred bucks a month is a no-brainer. Just remember to contribute consistently and review your plan every year.

With success stories and expert tips under your belt, you now have every reason to sign up or help someone else get secured for retirement. Peace of mind in your golden years? Now that’s priceless.

What Is Atal Pension Yojana (APY)?

Think of APY as a long-term buddy that has your back after age 60. Run by the Pension Fund Regulatory and Development Authority (PFRDA), APY guarantees a fixed monthly pension ranging from ₹1,000 to ₹5,000, depending on how much you put in during your working years.

It’s mainly aimed at workers in the unorganized sector — think delivery drivers, farmhands, shop helpers — but anyone without a formal pension plan can hop in.

Who Can Join?

- Indian citizens aged 18 to 40 years

- Have a valid savings bank account (in any public/private sector bank or post office)

- Commit to contributing till age 60

Note: Aadhaar and mobile numbers aren’t mandatory but they make your life easier during KYC.

Why You Should Care: Major Benefits

1. Guaranteed Lifetime Pension

Once you hit 60, you start getting a guaranteed monthly pension. That’s money you can count on, rain or shine.

2. Spouse Protection

If you pass away, your spouse continues to get the pension. After both pass, the corpus goes to the nominee.

3. Tax Savings

You can claim deductions under Section 80CCD(1) (part of Section 80C) and Section 80CCD(1B) of the Income Tax Act.

4. Flexible Contributions

Choose how often you want to pay: monthly, quarterly, or half-yearly.

5. Affordable for All

Contribution starts as low as ₹42/month. That’s less than a movie ticket!

How to Use the APY Calculator

Want to know how much to invest each month for your dream retirement? Here’s how to use the official APY Calculator:

Step-by-Step Guide

- Visit: NSDL APY Calculator

- Enter your age (e.g., 25)

- Choose your desired pension (e.g., ₹3,000/month)

- Click Calculate

- The tool will show your monthly contribution, total years of payment, and total corpus

Real-World Example

Name: Ravi, Age 25, Wants ₹3,000/month pension.

Contribution: ₹146/month

Total Outgo: ₹60,000 (over 35 years)

Returns: ₹3,000/month post 60 till death

How to Check APY Status

A. With PRAN (Permanent Retirement Account Number)

- Go to NSDL CRA Portal

- Click on “ePRAN/APY Statement”

- Enter your PRAN, Bank Account, and Captcha

- View contribution history, balance, and status

B. Without PRAN

- On same portal, select “Search PRAN”

- Provide Name, DOB, and Bank Account Number

- You’ll get access to your statement

C. Via UMANG App

- Download UMANG

- Register and select Atal Pension Yojana service

- Access your e-PRAN, transactions, and status

Adjusting Your Plan

Let’s say you started small with a ₹1,000 pension target and later decide you want ₹5,000. You can change your plan once every April:

- Visit your bank branch

- Fill out the APY Modification Form

- Choose a higher pension amount

- New contributions will auto-adjust

Penalties and Defaults

If you miss a payment:

| Monthly Contribution | Penalty per Month Missed |

| Up to ₹100 | ₹1 |

| ₹101 to ₹500 | ₹2 |

| ₹501 to ₹1000 | ₹5 |

| Above ₹1000 | ₹10 |

Miss 6 debits? Your account freezes. Miss 12? It’s deactivated. Miss 24? It gets closed.

APY vs Other Pension Schemes

| Scheme | Type | Guaranteed Pension | Age Limit | Tax Benefits |

| Atal Pension Yojana | Defined Benefit | Yes | 18–40 | Yes |

| NPS (Tier I) | Market-Linked | No | 18–70 | Yes |

| EPF/Pension | Employer-Based | Yes | 18–58 | Yes |

Conclusion: APY is ideal for those in the unorganized sector who want a predictable retirement income.

Success Stories

Shanta Devi, a 35-year-old vegetable vendor in Bihar, joined APY in 2016. With just ₹126/month, she’s set to receive ₹2,000 every month from age 60. “I never thought I’d get a pension like a government babu,” she says.

Mohammed Irfan, an Uber driver in Mumbai, upgraded his pension from ₹1,000 to ₹5,000 last year. “It feels like I’m investing in my future self.”

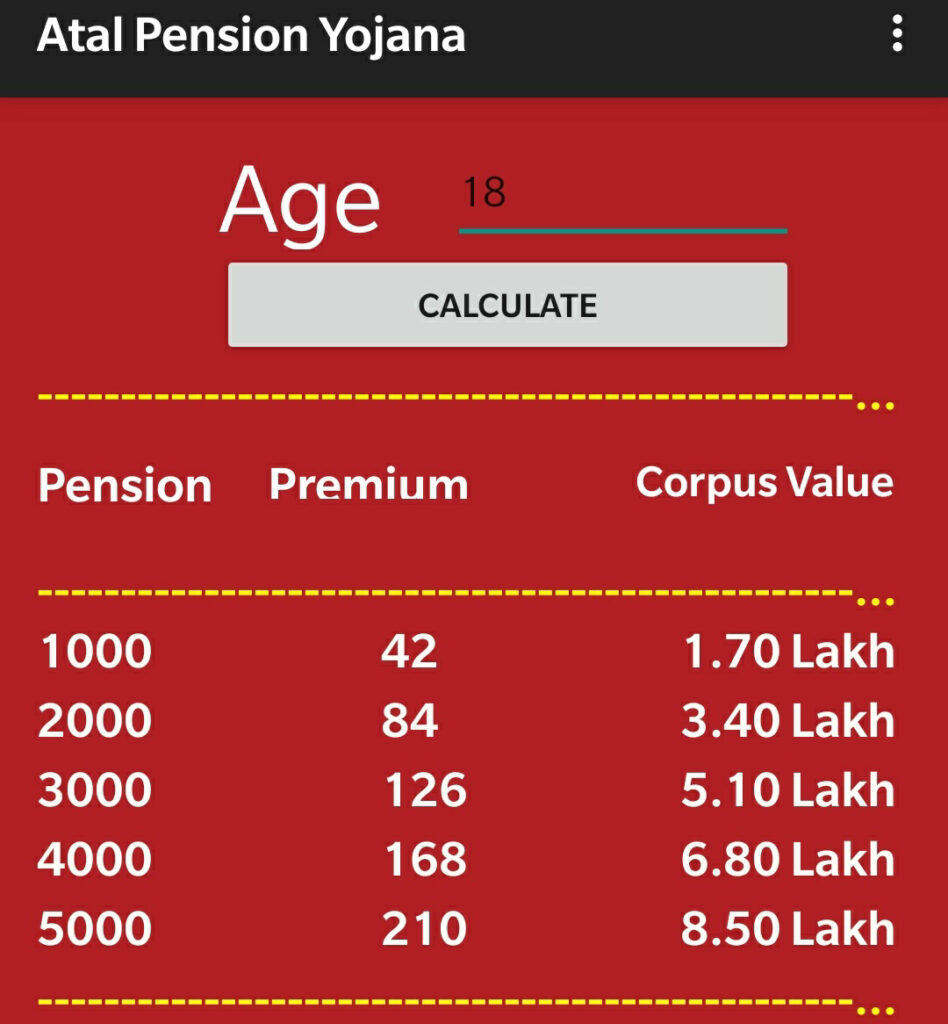

APY Pension Plans at a Glance (for an 18-year-old entrant)

Here’s a simple look at how your monthly contribution changes based on the pension you want. Starting early makes it super affordable!

| Guaranteed Monthly Pension | Monthly Contribution | Quarterly Contribution | Half-Yearly Contribution | Total Corpus Returned to Nominee |

| ₹1,000 | ₹42 | ₹125 | ₹248 | ₹1.7 Lakh |

| ₹2,000 | ₹84 | ₹250 | ₹496 | ₹3.4 Lakh |

| ₹3,000 | ₹126 | ₹376 | ₹744 | ₹5.1 Lakh |

| ₹4,000 | ₹168 | ₹501 | ₹992 | ₹6.8 Lakh |

| ₹5,000 | ₹210 | ₹626 | ₹1,239 | ₹8.5 Lakh |

Top 3 Mistakes to Avoid with Your APY Account

- Forgetting to Maintain Sufficient Balance: Your APY contribution is auto-debited from your savings account. If you don’t have enough funds, you’ll miss a contribution and may have to pay a small penalty. Set a reminder a few days before your contribution date!

- Not Updating Nominee Details: Life events like marriage happen. Ensure your nominee details are always up-to-date so that in case of an unforeseen event, your spouse or family can access the benefits without any hassle.

- Assuming You’re Not Eligible: While there is an income-tax payer restriction for new joiners (since October 2022), many people who work part-time or in the gig economy are eligible. Don’t rule yourself out without checking the latest criteria.

Expert Tips to Maximize APY Benefits

- Start Early: Lower contributions, higher returns.

- Set Auto-Debit Alerts: Avoid penalties.

- Link Mobile Number: For SMS updates on contributions.

- Review Annually: Adjust your pension amount as income grows.

FAQs

Q1: Can I exit APY before 60?

Yes, but only in cases of terminal illness or death. Otherwise, you must stick it out.

Q2: Can I increase or decrease my pension amount?

Absolutely. You can change it once every financial year (April) through your bank.

Q3: Is the pension taxable?

Yes. Pension received post-retirement is taxable under current income tax laws.

Q4: What if I die before 60?

Your spouse continues contributions and receives the pension after 60. If they choose to exit, the corpus is paid to nominee.

Q5: Is Aadhaar mandatory?

Nope, but it’s highly recommended for smoother processing and notifications.