Canada Grocery Rebate July 2025 is the hot ticket this summer—and for good reason. With grocery bills going up like a balloon in a windstorm, this one-time government rebate is a welcome break for millions of households across Canada. Whether you’re a busy parent in Ontario or a senior in the Prairies, we’re unpacking exactly who qualifies, how much you’ll get, and what you need to do (hint: not much if your taxes are done).

Let’s walk through the real deal—expertly explained, beginner-friendly, and sharp enough for tax pros too.

What Exactly IS the Grocery Rebate?

Think of the Grocery Rebate as a top-up to the regular Goods and Services Tax (GST) Credit. The federal government introduced it as a one-time payment in 2023 to help Canadians cope with the rising cost of food. It wasn’t a separate application; if you were eligible for the GST Credit and filed your taxes, you automatically received the extra funds to help with your grocery bills.

From 2023 Rebate to 2025 Possibility

Back in July 2023, the federal government issued a one-time Grocery Rebate that provided a tangible, albeit temporary, boost to millions. A single person could receive up to $234, while a family with four children might have received up to $628. This was a direct response to a period of sharp food inflation. Should a similar rebate be approved for June or July 2025, we could expect the payment amounts and income thresholds to be adjusted to reflect the current cost of living and inflation data, but the core principle of using the GST/HST credit system as the delivery mechanism would likely remain the same.

Canada Grocery Rebate June 2025

| Feature | Details |

|---|---|

| Payment Date | July 4, 2025 (with GST/HST credit) |

| Max Rebate | Up to $978 (couple + 2 kids); $234 (single) |

| Eligibility | Must qualify for GST/HST credit based on 2024 tax return |

| Application Needed? | No – CRA calculates automatically |

| How Paid | Direct deposit or cheque from CRA |

| Taxable? | No – 100% tax-free |

| Where to Check Status | CRA My Account |

| Official Info | Canada.ca Grocery Rebate |

The Canada Grocery Rebate July 2025 offers up to $978 in tax-free help, and you don’t even need to apply. All you gotta do is file your 2024 tax return, keep your CRA info current, and the money will find you. With inflation stretching every dollar, this is a rare moment when you get something back—no strings, no stress.

What Is the Grocery Rebate?

The Canada Grocery Rebate is a one-time payment from the federal government, designed to help low- and modest-income Canadians deal with rising food prices. It’s tied to the GST/HST credit, meaning if you’re eligible for that—you’re likely good to go.

This 2025 version follows the 2023 rebate, where 11 million Canadians received help. This year’s rebate will be automatically added to your GST/HST credit payment on July 4, 2025.

Real-Life Example

“As a single mom with two boys, I didn’t even know I was getting this. Then—bam—$978 in my account. It covered our groceries, and I stocked up on school supplies for the fall. CRA actually made something easy for once.”

— Nicole S., Calgary, AB

Grocery Rebate Amounts by Family Type

| Family Type | Rebate Amount |

|---|---|

| Single (no kids) | $234 |

| Couple (no kids) | $306 |

| Single parent + 1 child | $387 |

| Couple + 2 children | $978 |

| Senior individual (no kids) | $255 |

Your exact amount will depend on your family net income and number of children under 19.

Who Is Eligible?

You qualify if:

- You filed your 2024 taxes before the May 1, 2025 deadline

- You’re eligible for the GST/HST credit

- You’re 19 or older, or have a spouse, partner, or child

- You live in Canada during the payment period

Pro Tip:

Use TurboTax or Wealthsimple Tax with auto-fill to avoid mistakes when filing.

Payment Date: July 4, 2025

Yup—it’s dropping like hotcakes on July 4th. If you’ve set up direct deposit with CRA, you’ll likely see the funds same day.

If you’re still on paper cheques, expect it 5–10 business days later.

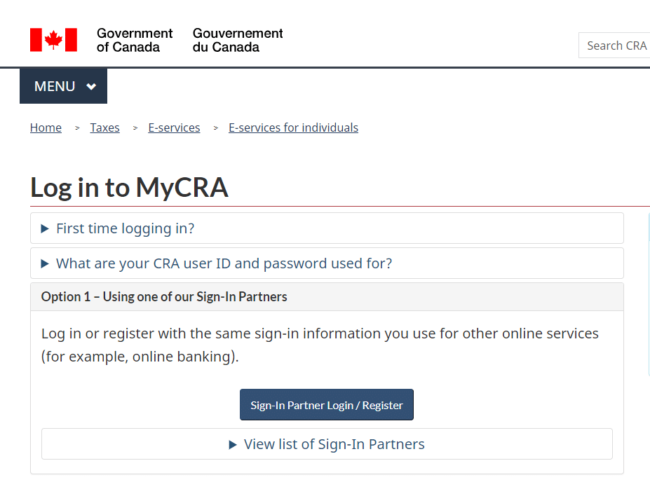

How to Check CRA Status (Even from Your Phone)

- Visit CRA My Account

- Sign in with your bank login or CRA credentials

- Click “Benefits & Credits”

- Look for “Grocery Rebate” under July 2025

Mobile App Users:

Download the CRA mobile app from the App Store or Google Play for real-time alerts.

Interactive Checklist: Are You Set?

Filed your 2024 taxes

Set up direct deposit

Updated marital/kid status with CRA

Know your CRA login info

Watched for notices or letters

If you said “yep” to all five—you’re golden.

Will I Pay Tax on This?

Nope. The grocery rebate is tax-free and doesn’t reduce:

- GST/HST credits

- Canada Child Benefit (CCB)

- Disability Tax Credit

- Employment Insurance (EI)

- Income-tested housing/utility benefits

It’s a one-and-done boost, no strings.

Budgeting Tip: What Can $978 Buy?

Here’s what $978 could stretch toward:

- 3–4 weeks of groceries for a family of four

- Back-to-school gear (lunch boxes, shoes, supplies)

- Energy-efficient appliances (e.g., new fridge or stove)

- Emergency fund pad for rent or medical bills

2023 vs. 2025 Grocery Rebate – Quick Comparison

| Feature | 2023 Rebate | 2025 Rebate |

|---|---|---|

| Based on Year | 2021 tax return | 2024 tax return |

| Max Payment | $628 (family of 4) | $978 (family of 4) |

| Issued With | July GST Credit | July GST Credit |

| CRA Contact Needed? | No | No |

Provincial Add-Ons (Where Available)

While the grocery rebate is federal, some provinces offer extra programs:

- BC: Climate Action Tax Credit

- Ontario: Ontario Trillium Benefit

- Alberta: Affordability Action Plan Payments

Check your provincial government website for possible stackable credits.

Grocery Rebate vs. Regular GST/HST Credit

It’s easy to mix these two up! Here’s a simple breakdown of how the one-time 2023 Grocery Rebate compared to the ongoing GST/HST Credit. A potential 2025 rebate would likely follow a similar structure.

| Feature | 2023 Grocery Rebate | Ongoing GST/HST Credit |

| Payment Frequency | One-time payment | Quarterly (July, October, January, April) |

| Purpose | To provide targeted, temporary relief from food inflation. | To offset the goods and services tax paid by lower-income families. |

| How to Get It | Paid automatically if you qualified for the GST Credit. | Paid automatically if you qualify based on your tax return. |

| Example Amount | Up to $467 for a couple with two children in 2023. | Varies by income, family size, and province. |

Big Picture: National Cost & Impact

According to government forecasts, the rebate is expected to cost $2.7 billion, reaching over 11.5 million Canadians. It also supports local economies, as most of the cash goes straight to small retailers, grocers, and service providers.

What You Should Do Next (CTA)

- Haven’t filed? File your 2024 taxes ASAP.

- Using a paper return? Expect delays—switch to NETFILE-compatible software.

- Help someone? Share this guide with elders, new parents, or newcomers in your community.

FAQs

Is it automatic?

Yes, as long as you qualify for the GST/HST credit.

Can I split it between accounts?

No—you’ll receive it into your primary CRA-linked account.

I moved recently. Will I still get it?

Only if you updated your address in CRA My Account.

My partner got it, but I didn’t?

The CRA may divide payments based on household structure or past filings. Check both accounts.