In June 2025, the Australian government made a crucial decision: the Centrelink Carer Payment has increased to $852 per fortnight for those who provide full-time care to a loved one. For many carers, this increase means more financial security, recognition of their hard work, and an opportunity to focus more on their care duties rather than financial stress.

This article explores everything you need to know about this increase – who qualifies, how to apply, and how the new rates can impact your life. Whether you’re a new carer or have been in the game for years, this guide is here to walk you through the changes in an easy-to-understand way.

Centrelink Carer Payments Jump to $852 in June 2025

| Key Points | Details |

|---|---|

| New Carer Payment Rate | $852 per fortnight for single carers, $1,281.60 for couples (combined). |

| Eligibility | Full-time care for someone with a disability, illness, or frailty. Must meet income and asset tests. |

| Payment Frequency | Fortnightly, every two weeks. |

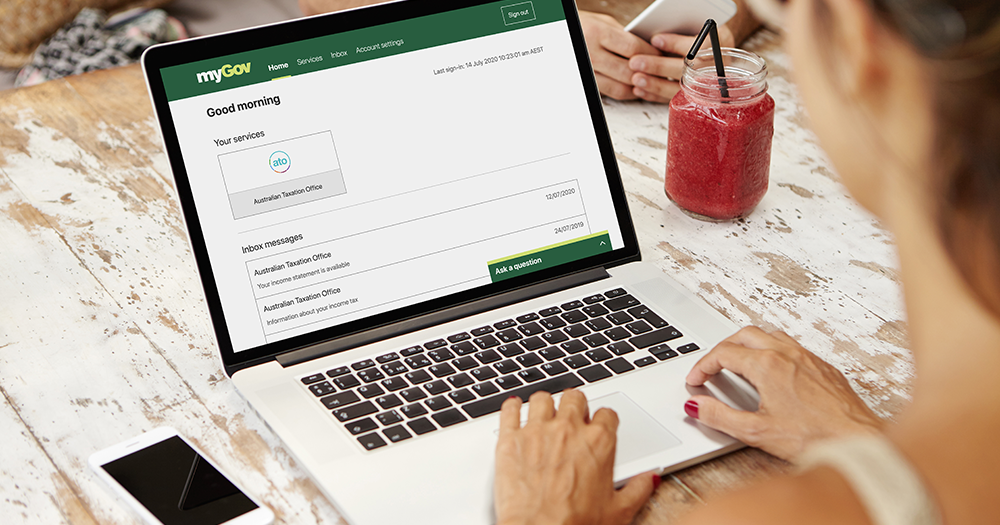

| Application Process | Apply online via myGov linked to Centrelink. |

| More Information | Visit Services Australia for complete details. |

The increase in the Centrelink Carer Payment to $852 per fortnight in June 2025 is a positive step forward in supporting the many Australians who devote their time to caregiving. By easing financial burdens, this payment allows carers to focus on what matters most: providing the best possible care for their loved ones. Whether you’re new to caregiving or have been doing it for years, the new payment rates and support services can help make your journey a little bit easier.

If you’re a carer, make sure to check your eligibility and apply today through myGov.

What is the Centrelink Carer Payment?

The Centrelink Carer Payment is a financial support payment provided to people who are responsible for providing full-time care for someone with a disability, medical condition, or who is frail due to age. This includes children, spouses, and elderly relatives who require constant assistance in daily activities.

The payment serves as a means of helping carers manage the financial burden of caregiving. Whether you’re providing care to a loved one with a physical disability, mental health condition, or old age frailty, this payment is designed to offer financial relief to those who forgo employment to provide care.

In June 2025, the government increased the fortnightly payment to $852 for single carers and $1,281.60 for couples. This is a significant change, aimed at better supporting carers who give up work to provide 24/7 care.

Who Qualifies for the Carer Payment?

Eligibility Requirements

To qualify for the Carer Payment, there are a few key criteria you need to meet:

- Full-time Care: You must be providing care that is considered full-time. This means you are looking after someone who needs assistance with daily living and care around the clock. For example, if you’re caring for a family member who cannot perform basic tasks like eating, bathing, or moving without assistance, you could qualify.

- Income and Assets: Your income and assets are assessed to determine eligibility. If you have other sources of income or substantial savings, you may not qualify. Both your income and the care recipient’s income are considered.

- Residency: To qualify, you need to be an Australian resident or hold a valid visa and meet the country’s residency rules.

- Care Requirements: The person you care for must have a disability, medical condition, or be frail due to age and need assistance with daily activities.

- Work/Study Limitations: As a carer, you are not allowed to work or study for more than 25 hours per week, but there are exceptions based on the level of care required.

Personal Testimonies of Carers

Many carers have shared how the payment increase has impacted their lives. Janet, a single mother, has been caring for her daughter who has a severe intellectual disability. Before the increase, she was barely managing on the previous payment rate, but with the new increase, she can afford extra medical treatments for her daughter and better childcare assistance for a few hours a week.

Case Study: The Impact of the Increase

Take Steve and Tom, a couple who care for Steve’s elderly mother, who suffers from dementia. Before the increase, the couple struggled to pay for additional in-home help, often leaving them with little time to rest. With the new $1,281.60 per fortnight, they are now able to hire a caregiver to come a few times a week, providing them with some much-needed relief.

How to Apply for the Centrelink Carer Payment

Step-by-Step Application Guide

- Set Up a myGov Account: If you don’t already have one, create a myGov account and link it to your Centrelink account. This is where you can apply for the payment online.

- Complete the Carer Payment Claim: Once logged in, you’ll be able to fill out the Carer Payment claim form. This will ask for details about you, your financial situation, and the person you care for.

- Submit Documentation: You’ll need to upload supporting documents, including medical assessments and identity verification for both yourself and the person you care for.

- Wait for the Decision: Once you’ve submitted your claim, Centrelink will review it and inform you whether you qualify. If approved, you will begin receiving the Carer Payment on a fortnightly basis.

Top 3 Mistakes to Avoid When Applying

Applying for Centrelink payments can feel complex, but avoiding these common pitfalls can make it smoother:

- Mistake #1: Not understanding the “constant care” requirement. Centrelink defines “constant care” quite specifically. It’s not just about household chores; it often means supervision or hands-on assistance for a significant portion of the day. Make sure you accurately describe the level of care you provide.

- Mistake #2: Overlooking income and assets tests for BOTH you and the care recipient. Many assume only their own financial situation matters. For Carer Payment, Centrelink assesses the income and assets of both the carer and the person being cared for.

- Mistake #3: Delaying your application. Even if the person you care for has a terminal illness or a condition that might improve, you don’t always need to wait six months to apply. Apply as soon as you meet the immediate eligibility criteria.

Carer Payment vs. Carer Allowance

It’s easy to get these two confused! While both support carers, they serve different purposes.

| Feature | Centrelink Carer Payment | Centrelink Carer Allowance |

| Purpose | Income replacement for those providing constant care. | Supplementary payment for those providing daily care. |

| Eligibility | Requires constant care preventing full-time work; strict income and assets tests for carer and care recipient. | Provides daily care; more generous income test for carer; no assets test. |

| Payment Amount | Higher payment, designed to be primary income. | Lower, supplementary payment. |

| Can I get both? | Yes, if eligible for both. | Yes, can be received in addition to other payments. |

| Health Care Card | Generally includes a Health Care Card for the carer. | Includes a Health Care Card for the care recipient (child under 16). |

Additional Resources for Carers

Carers often face unique challenges, both mentally and physically. The increased Carer Payment helps, but it is also important to tap into other support resources.

- Mental Health Support: Caregivers often experience mental health struggles, such as anxiety and depression. There are government programs and community services dedicated to providing mental health support for carers.

- Respite Care Services: These services give carers a break from their duties. By accessing respite care, carers can take some time off for themselves, which is crucial for mental and physical well-being.

- Carer Allowance and Health Care Cards: In addition to the Carer Payment, many carers may also qualify for the Carer Allowance or Health Care Cards. These additional supports can help reduce the cost of medications, medical services, and other health-related expenses.

FAQs

Can I still work and receive the Carer Payment?

Yes, but you must not work more than 25 hours per week. However, if you work or study fewer hours, there may be some flexibility in your eligibility.

Will the Carer Payment be taxed?

Yes, the Carer Payment is considered taxable income, so you will need to declare it on your annual tax return.

Can I receive the Carer Payment and other Centrelink payments?

In some cases, carers may be eligible for additional payments like the Carer Allowance, which is a separate, non-means-tested payment. Speak to Centrelink for advice specific to your situation.