If you’ve seen YouTube, Facebook, or TikTok posts claiming a $1,764 CPP payment boost in June 2025, you’re not alone—it’s buzzing everywhere. But lean in close, because I’ve been in the retirement planning world for years, and here’s the real scoop: There is no one-off $1,764 payout coming. However, something real and important is happening: CPP enhancements are now fully rolling out, giving you steadily bigger monthly payments—if you’ve been paying into the system since 2019.

What is the Canada Pension Plan (CPP)? The Canada Pension Plan (CPP) is a cornerstone of Canada’s retirement income system. It’s a social insurance program funded by contributions from employees, employers, and self-employed individuals. When you retire, become disabled, or pass away, the CPP provides a monthly, taxable benefit to you or your eligible family members. Think of it as a shared savings plan for your future!

The Evolution of CPP Benefits – Before the recent enhancements, the Canada Pension Plan aimed to replace about 25% of an individual’s average work earnings. This was a solid foundation, but as the cost of living continued to rise and life expectancies increased, there was a recognized need for a more robust system. With the full implementation of the CPP enhancement by June 2025, the plan will now replace one-third (33.33%) of covered average work earnings. This significant shift means a more substantial safety net for future retirees, adapting the plan to today’s economic realities.

CPP Payment Boost Coming in June 2025

| Topic | What’s Real & Official |

|---|---|

| June 2025 Payment Date | June 26, 2025 – just your normal monthly CPP deposit |

| Max Monthly CPP (2025) | Up to $1,433.44/month at age 65 if full contributions made |

| The $1,764 “Boost” Explained | A projected max monthly amount, not a one-time bonus |

| CPP Enhancement Timeline | Began in 2019, fully implemented by 2025 |

| Who Benefits Most | Long-term contributors, especially those working past 2019 and delaying CPP until 70 |

| 2025 Contribution Thresholds | YMPE = $71,300; YAMPE ≈ $82,000; Enhanced contributions push replacement rate from 25% → 33.33% |

| Official Reference | Canada.ca – CPP Enhancement |

There’s no surprise $1,764 boost heading your way in June 2025. That’s a monthly projection, not a bonus. But hey—CPP enhancements are real, and they’ve been cranking up your pension since 2019. If you’ve stayed in the game, you’re already getting the benefits—steady, durable, inflation‑protected income for life.

Stay wise: track your contributions, think about delaying CPP if you can, and don’t fall for the clickbait. This is your retirement, built with your hard work and smart choices.

Demystifying the “$1,764 Boost”

So what’s up with that $1,764 figure? Clickbait creators are taking the maximum eligible monthly CPP amount, adding base plus enhancement, and calling it a “boost.” Trouble is—they’re slapping that label on like it’s free money, dropping without effort or explanation. But here’s the real deal:

- That $1,764 is simply what someone might get monthly, not at once.

- That monthly figure assumes perfect eligibility—40 years of contributions, delaying until age 65 or more, etc.

- There is no surprise payment in June 2025. Just your steady, deserved pension.

Think of it like this: If you fed the garden every year since 2019, you’re seeing it bloom now. But that bloom is monthly flowers, not a giant bouquet all at once.

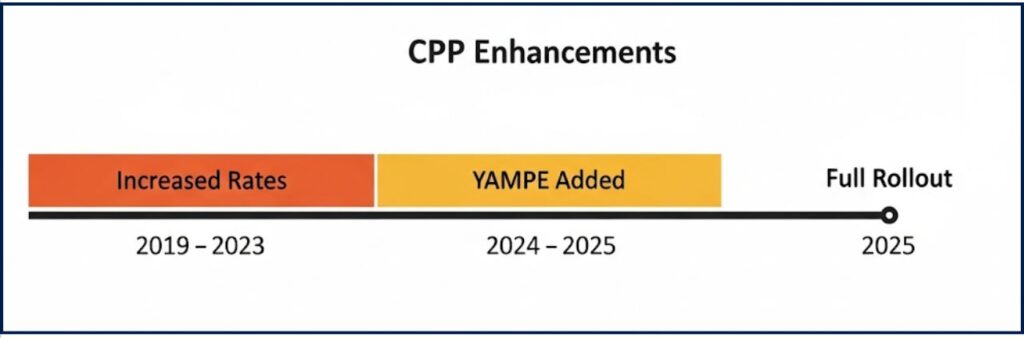

The CPP Enhancement – A Breakdown

What is CPP Enhancement?

Back in 2019, Canada decided it was time to boost retirement benefits for folks who’ve been working longer and earning more. So they raised the contribution rate—and not just a little:

- Phase 1 (2019–2023):

- Employee CPP rate went from 4.95% → 5.95% on income up to the YMPE.

- Self-employed bumped from 9.9% → 11.9%.

- Phase 2 (2024–2025):

- Introduced YAMPE—a higher earnings ceiling (approx. 7–14% above YMPE).

- Earnings between YMPE and YAMPE now taxed at 4% (plus employer in traditional employment).

- Self-employed pay 8% there.

Once fully in effect, the CPP replacement rate increases from 25% → 33.33% of lifetime average income.

YMPE vs YAMPE — What They Mean

- YMPE (Year’s Maximum Pensionable Earnings):

In 2025, YMPE = $71,300 - YAMPE (New Enhancement Ceiling):

Typically ~14% higher—so around $82,000 in 2025

If you earned more than YMPE, your post-2019 contributions on that extra income boost your final monthly CPP.

Contribution Examples for 2025

Let’s break down contributions, step by step:

- Base CPP contribution (up to YMPE):

(71,300 – 3,500) × 5.95% = approx. $4,034 - Enhanced CPP (between YMPE and YAMPE):

(~82,000 – 71,300) × 4% = approx. $348 - Total annual contribution (employee):

≈ $4,382 - Employer matches, and if you’re self-employed, you pay both halves ⇒ ≈ $8,764

All that contributes to a higher eventual monthly benefit—but spread across your lifetime, not dumped in one chunk.

CPP Benefits – Before vs. After Enhancement

Let’s break down how the CPP enhancement changes things for your retirement!

| Feature | CPP Before 2019 Enhancement | CPP After Full 2025 Enhancement |

| Earnings Replacement Rate | 25% of average work earnings | 33.33% of covered average work earnings |

| Maximum Earnings Covered | Original earnings limit | Original limit + New “Additional Maximum” |

| Contribution Rates | Lower | Gradually higher |

| Benefit Amounts | Lower | Potentially significantly higher |

Real-World Scenario: Meet Tony

- Age: 66 in 2025

- Contribution history: 40 years, full-time, max income

- Post-2019 earnings → fully contributed into enhancement

What does Tony get?

- Max CPP = ~$1,433.44/month base

- Enhanced portion = up to $46/month

- Total possible monthly = ~$1,479.44

He doesn’t get $1,764—but he sure does get a solid retirement income. And it keeps flowing monthly.

Other Cool CPP Facts

Beyond the core mechanics, here’s some deeper value you can use:

- Index‑adjusted: CPP benefits go up with inflation every January—so they don’t just sit at your pickup rate.

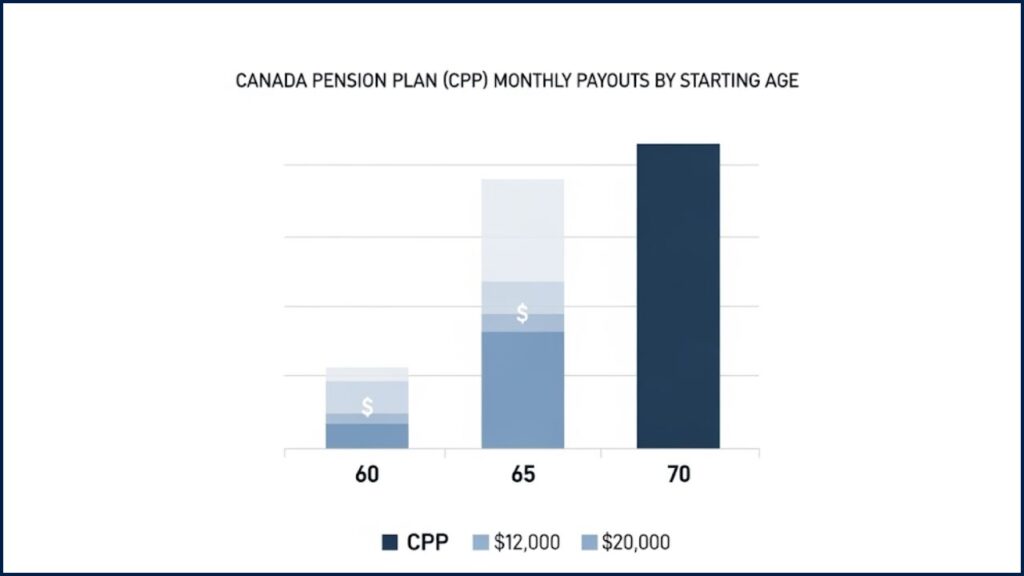

- Delay bonus: If you wait until age 70, your CPP increases by 42% above age 65 levels.

- Supplement programs: Low-income seniors may qualify for GIS/OAS—be sure to check your eligibility.

- Early draw penalty: Tapping CPP at age 60 results in a 36% permanent reduction.

- Spousal benefits: You may share CPP credits with a former spouse—embrace that planning perk.

What You Should Do Right Now

Step 1: Review Your CPP Contributions

Check your My Service Canada Account to confirm earnings and contribution history.

Step 2: Use the Retirement Income Calculator

Tools on Canada.ca let you plug in your age, contribution record, and retirement date to get personalized projections.

Step 3: Optimize Your Retirement Timing

Delaying CPP to 70 maximizes your monthly retirement income—especially useful if you’re in good health.

Step 4: Watch Inflation & Cost-of-Living Adjustments

CPP keeps pace with inflation—great news for your long-term purchasing power.

Step 5: Explain the Facts

Help others avoid the clickbait—share the facts about monthly enhancements, not fake middle-of-the-year boosts.

FAQs

Q1: Is there really a one-time $1,764 CPP check?

A: Nope—it’s a clickbait twist. It’s a projected max monthly amount, not a single lump-sum.

Q2: When will I get paid in June 2025?

A: Caveat clear: June 26, 2025. That’s your usual monthly deposit.

Q3: How much can I get max in 2025?

A: With full eligibility, about $1,433/month (base) + $46/month (enhancement) = ~$1,479/month.

Q4: Can I get extra if I delay to age 70?

A: You bet. CPP waited for = 42% more. Take it at 70, and you’ll breeze into retirement with a bigger steady check.