As Canadians look ahead to 2025, there’s exciting news for low-income workers across the country. The Canada Revenue Agency (CRA) has officially confirmed that eligible workers will receive a substantial Canada Workers Benefit (CWB) payment in the form of quarterly deposits totaling up to $1,590. This payment, which is part of the Canadian government’s ongoing efforts to support working families, especially those in lower-income brackets, will be distributed in advance throughout the year.

In this article, we’ll break down everything you need to know about the 2025 CWB, including eligibility criteria, the deposit schedule, how to apply, and answers to the most frequently asked questions surrounding the benefit. Whether you’re looking for financial relief or just trying to navigate the eligibility maze, we’ve got you covered with clear, actionable advice.

CRA Confirms $1590 CWB Payment for 2025

| Key Information | Details |

|---|---|

| Maximum Payment for 2025 | $1,590 per quarter (up to $5,712 annually) |

| Quarterly Deposit Dates | January 15, 2025, April 15, 2025, July 15, 2025, October 15, 2025 |

| Eligibility Criteria | Canadian resident, at least 19 years old, working income, and not incarcerated |

| How to Apply | No separate application, file your 2024 taxes by November 1, 2025 |

| Official Website | CRA Canada Workers Benefit |

| Additional Conditions | Disability Supplement requires T2201 (Disability Tax Credit Certificate) |

The Canada Workers Benefit for 2025 is a powerful tool designed to help low-income workers thrive. With quarterly payments of $1,590 and the potential for an annual payout of $5,712, this benefit ensures that hard-working Canadians can make ends meet. By understanding the eligibility requirements, payment schedule, and application process, you can take full advantage of this valuable support. Ensure your information is updated, file your taxes on time, and look forward to a more financially stable year.

What Is the Canada Workers Benefit (CWB)?

The Canada Workers Benefit (CWB) is a refundable tax credit designed to provide support to low-income workers. The benefit is designed to encourage and assist Canadians in the workforce, ensuring that those in lower-paying jobs or part-time work can still make ends meet. With an annual benefit of up to $5,712, distributed quarterly, the CWB serves as a lifeline for many Canadians trying to get by in an often unpredictable economy.

The program was specifically designed to target working individuals who face financial struggles, giving them the boost they need to live a better life while still contributing to the economy. In fact, the government uses the CWB to help stimulate local economies by providing money that is typically spent immediately on necessities like groceries, rent, and utilities.

Real-Life Examples: How the CWB Can Help

Imagine a single mother named Sarah who works as a part-time cashier at a local grocery store. While Sarah works hard, her income often falls short when it comes to covering monthly expenses, especially after factoring in rent and utility bills. However, by qualifying for the Canada Workers Benefit, Sarah receives $1,590 every quarter, totaling $5,712 for the year. This makes a huge difference in her ability to provide for her child and reduce financial stress.

Similarly, John, a self-employed handyman, struggles with seasonal income fluctuations. The quarterly payments help John cover the lean months when his work is scarce, making it easier for him to plan and maintain his business operations throughout the year.

These are just two examples of how the CWB directly supports workers like Sarah and John, ensuring that they can focus on their jobs without constantly worrying about making ends meet.

Eligibility for the Canada Workers Benefit in 2025

To qualify for the Canada Workers Benefit (CWB) in 2025, you must meet specific eligibility requirements set by the CRA. These include:

1. Canadian Resident

You must be a resident of Canada throughout the entire year. If you’re living outside of the country for a significant period, you won’t qualify for the CWB.

2. Age and Family Criteria

You need to be at least 19 years old by December 31, 2024. If you live with a spouse, common-law partner, or dependent children, you can qualify regardless of age.

3. Working Income

The CWB is for people who are actively employed or self-employed. To qualify, you need to earn working income, such as wages from a job or income from a business.

4. Other Eligibility Factors

There are also restrictions for full-time students and individuals who have been incarcerated for more than 90 days.

If you have a disability, you may also qualify for a Disability Supplement by submitting the T2201 Disability Tax Credit Certificate.

Payment Schedule for 2025

The CRA has confirmed the quarterly payment schedule for 2025. These payments ensure that you’ll have regular, predictable financial support throughout the year:

- January 15, 2025

- April 15, 2025

- July 15, 2025

- October 15, 2025

These payments are part of the Advanced Canada Workers Benefit (ACWB), which disburses up to 50% of the total benefit amount in advance, with the remaining balance given after you file your 2025 tax return in 2026.

How to Apply for the Canada Workers Benefit

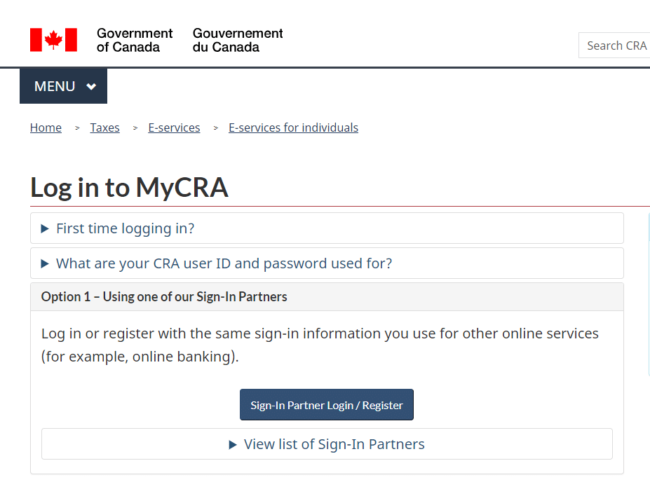

Good news: You don’t need to apply separately for the CWB! The benefit is automatic if you meet the eligibility requirements. However, you must file your taxes to receive the payment.

Step-by-Step Guide to Application

- File Your 2024 Taxes by November 1, 2025: Your taxes need to be filed before this date to qualify for the 2025 benefit. Complete Schedule 6 to claim the benefit on your tax return.

- Complete the Required Forms: Fill out the required sections, including Schedule 6 and Form T2201 (if claiming the Disability Supplement), and submit them as part of your tax filing.

- CRA My Account: Make sure your CRA My Account is up to date to ensure quick and accurate processing of your payments. This will also allow you to track the status of your benefit.

Comparison with Other Benefits

The CWB isn’t the only social safety net available to Canadians. For example, the Canada Child Benefit (CCB) provides direct monthly payments to families with children, while Employment Insurance (EI) provides temporary financial assistance to individuals who lose their jobs. The CWB is unique in that it specifically targets working individuals, rewarding them for their employment and supporting their ongoing efforts to maintain independence.

Maximizing the Canada Workers Benefit

While the CWB is a non-taxable benefit, there are still ways to make the most of it:

- Budget Wisely: Use the quarterly payments to cover essential needs, like rent, groceries, and utilities.

- Invest in Your Future: Consider putting a portion of the payments into savings or an RRSP to secure long-term financial stability.

- Track Expenses: Keeping a record of where the funds go can help you understand your spending habits and identify areas where you can cut costs.

FAQs

1. How much will I get from the CWB in 2025?

Eligible individuals will receive up to $1,590 per quarter, totalling $5,712 annually. The amount depends on your family situation and income.

2. How can I check if I’m eligible for the CWB?

Eligibility depends on factors like age, income, and whether you have dependents. You can use the CRA website or talk to a tax professional to determine your eligibility.

3. What if I miss the deadline for filing my tax return?

If you miss the deadline, you may still qualify, but filing as soon as possible is important to avoid delays in receiving your benefit.

4. Can I get the CWB if I’m a student?

Full-time students who are enrolled for more than 13 weeks in the year are generally not eligible unless they have dependents.