The $1,000 Credit One Bank Settlement in 2025 is stirring buzz across the U.S.—and for good reason. If you’ve ever held a Credit One Bank credit card, been hit with unexpected fees, or received automated debt collection calls without your say-so, this class-action settlement could mean up to $1,000 back in your wallet.

Whether you’re a savvy financial pro or just trying to make sense of what a “TCPA violation” even is, we’ve got you covered with a clear, trustworthy breakdown of the claim form, deadline, eligibility requirements, and how to file your claim easily today.

What’s a Class Action Lawsuit?

Ever wonder how a settlement like this happens? A “class action lawsuit” is a legal case where a group of people who have suffered similar harm from the same entity (like a company) collectively sue that entity. Instead of thousands of individual lawsuits, one case represents everyone, making it more efficient and powerful. In this Credit One Bank settlement, it means many consumers who experienced similar issues are getting compensation through a unified legal effort.

Consumer Protection Then and Now

In the past, individual consumers often faced an uphill battle when trying to resolve issues with large financial institutions. Legal recourse was expensive and daunting. However, over the last decade, the landscape of consumer protection has significantly evolved. Class action lawsuits, like this Credit One Bank settlement, have become a powerful tool, allowing a collective voice to demand accountability. Regulatory bodies like the CFPB have also played a crucial role in advocating for consumer rights and establishing clearer guidelines, making it easier for individuals to seek redress for unfair practices.

Credit One Bank Settlement in 2025

| Detail | Information |

|---|---|

| Settlement Amount | $14 million (payouts up to $1,000/person) |

| Filing Deadline | July 31, 2025 |

| Eligible Individuals | Credit One cardholders (2014–2024), robocall recipients |

| Claim Filing Website | creditonesettlement.com |

| Proof Required? | Yes—docs like card statements, call logs, or ID verification may be needed |

| Type of Settlement | Class Action (includes TCPA and consumer finance violations) |

| Regulating Body | Consumer Financial Protection Bureau (CFPB) |

| Similar Cases | Capital One (2023, $190M), Wells Fargo (2018, $575M) |

The $1,000 Credit One Bank Settlement in 2025 gives you a chance to recover money from unfair fees and robocalls—with little effort on your end. With a $14 million fund on the table, don’t miss your chance to file a claim before July 31, 2025.

It’s more than just a refund. It’s a signal to big banks: treat customers right or pay the price.

What’s the Settlement About?

This class action lawsuit claims that Credit One Bank:

- Charged excessive or hidden fees (e.g., monthly servicing charges, late fees with vague billing practices)

- Made unauthorized robocalls in violation of the Telephone Consumer Protection Act (TCPA)

- Inaccurately reported or mishandled consumer credit info, affecting scores and approvals

The defendant denies wrongdoing, but is agreeing to pay up to avoid a prolonged court fight. That’s typical in class-action settlements: nobody admits guilt, but everyone gets a shot at compensation.

Background: The Bigger Picture

What Is the TCPA?

The Telephone Consumer Protection Act protects Americans from automated calls and texts without consent. It applies to:

- Debt collection robocalls

- Spam marketing texts

- Auto-dialed voicemails

If Credit One made any of these calls to you between 2014 and 2019, you may qualify under that part of the suit.

In 2023 alone, the FCC received over 124,000 consumer complaints about unwanted calls.

How This Impacts Consumers and the Financial Industry

This isn’t just about Credit One—it’s about consumer protection on a national scale.

- The Consumer Financial Protection Bureau (CFPB) has ramped up enforcement against misleading banking practices, filing 68 enforcement actions in 2024, up from 47 in 2023.

- Class actions like this are now more common thanks to easier filing rules and better public awareness.

And yeah—when banks mess up, the public gets to push back.

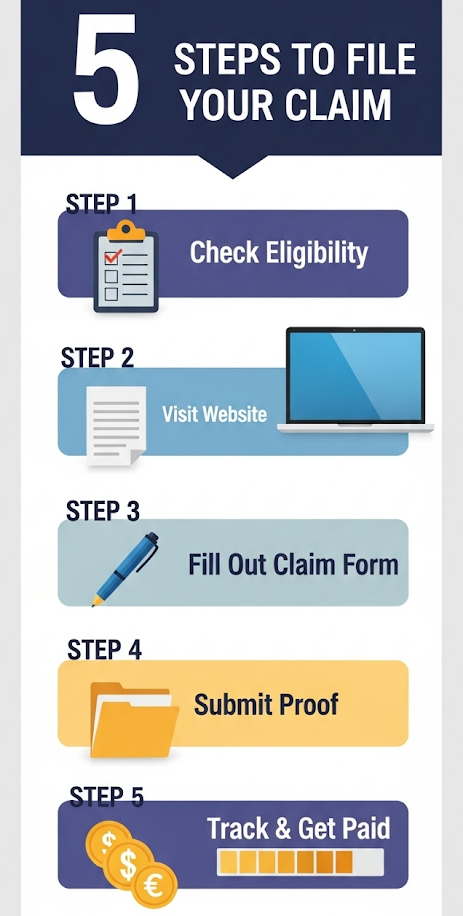

How to File Your Credit One Settlement Claim — Step-by-Step Guide

Here’s how to grab your piece of the settlement pie.

Step 1 – Confirm Your Eligibility

You’re likely eligible if:

- You had a Credit One Bank card between 2014 and 2024

- You received calls or were charged unclear fees

- You can provide evidence like statements, voicemails, or call logs

Step 2 – Go to the Official Website

Visit creditonesettlement.com — this is the ONLY official site. Don’t fall for scams or third-party services charging a fee.

Reminder: Filing a claim is 100% free. No lawyer needed unless you want one.

Step 3 – Fill Out the Claim Form

You’ll need:

- Your name, contact info, and last four digits of your Credit One card

- Any supporting documentation

- Your preferred payment method (mail or direct deposit)

Upload digital files (PDF, JPG) or opt for mail-in service.

Step 4 – Submit and Track Your Claim

- Keep a copy of your Claim ID

- Use the same website to check your status

- If mailing, use certified mail for peace of mind

Step 5 – Watch for Payment

Once all claims are processed and the court finalizes the payout pool:

- Checks or direct deposits will be sent (expected late 2025 or early 2026)

- Final amounts depend on how many people file and your level of documentation

Real-Life Examples

Joe from Texas

Joe got hit with late fees in 2018 even though he paid on time. He filed a claim and uploaded screenshots of his statements. His payout? $375.

Maria from California

Maria kept getting robocalls after closing her account in 2015. She submitted phone logs and received $800 in the last class action she participated in.

Legal Insight for Professionals

If you’re in compliance, legal, or finance, this case reflects:

- The rising scrutiny of mid-tier banks

- Consumer credit practices under heightened regulatory pressure

- A blueprint for future TCPA and FCRA litigation

LSI Keywords: Credit card fees lawsuit, consumer protection lawsuit 2025, Credit One robocall settlement, Credit One Bank class action

Who’s Managing the Settlement?

The case is managed by:

- United States District Court – Nevada

- Claims processed by: Credit One Settlement Administrator

- Legal representation: Class counsel appointed by the court

FAQs

Q: How do I know if Credit One called me?

A: Check your call log or voicemail from 2014–2019 for numbers associated with Credit One or collection agencies.

Q: Do I need to hire a lawyer to join the lawsuit?

A: Nope. This is a class-action settlement—just fill out the claim form.

Q: Will this affect my credit score?

A: Not at all. Filing has zero impact on your credit.

Q: Is there a minimum payout?

A: Final amounts vary based on claims volume. Expect $100–$1,000, depending on proof and eligibility.

Q: Can I claim if I don’t have documentation?

A: Yes, but stronger proof = higher payout. You can still file with estimated dates and details.