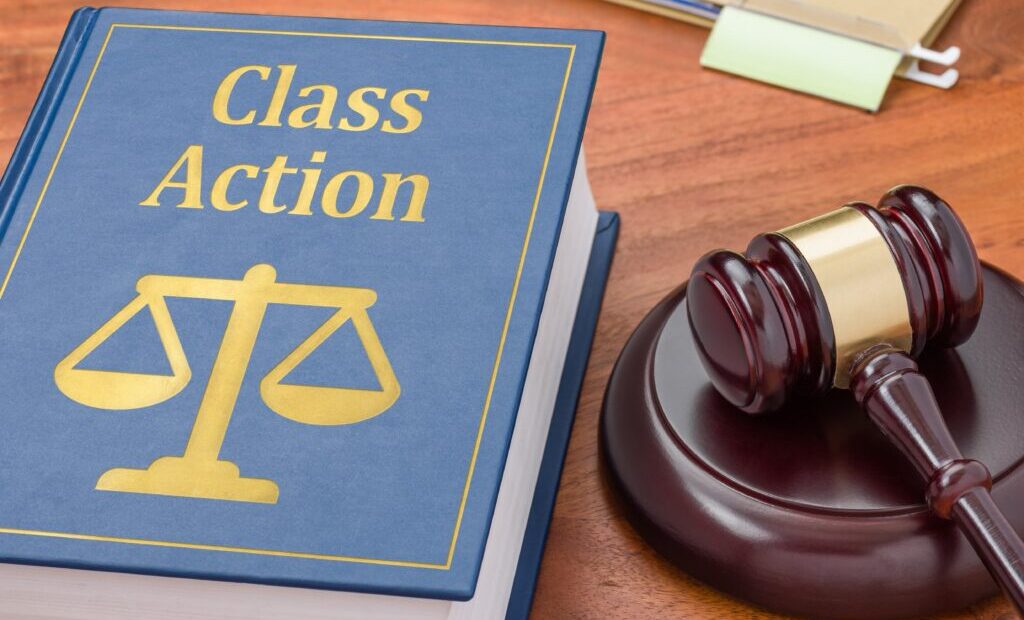

Robocalls—those annoying, automated phone calls—have long been a headache for consumers across the country. Recently, Credit One Bank found itself under fire for violating the Telephone Consumer Protection Act (TCPA) by placing unauthorized robocalls to individuals. The bank has been slapped with a massive $14 million penalty, and as a result, many individuals are now eligible for a cash payout. If you were one of the unfortunate people who received these robocalls, keep reading to learn how you can claim your share of the settlement.

Credit One Hit With $14M Penalty Over Robocalls

| Key Information | Details |

|---|---|

| Fine Amount | $14 Million |

| Affected Period | Between 2014 and 2019 |

| Eligibility | Anyone who received robocalls from Credit One during this period |

| Potential Payout | Up to $1,000 per eligible claim |

| Required Action | Submit a claim online once the official settlement website is live |

| Proof Required | Phone records, voicemail recordings, or complaints can strengthen your claim |

| Payment Methods | Check, PayPal, or bank deposit |

| Claim Deadline | Expected to open within 60 to 90 days from the approval of the settlement |

If you received unauthorized robocalls from Credit One Bank between 2014 and 2019, you may be eligible for a cash payout as part of a $14 million settlement. The process to file a claim is straightforward, and depending on the number of claims, you could receive up to $1,000. Keep an eye out for updates, and be sure to submit your claim before the deadline.

Don’t miss out on your rightful compensation—file your claim today and stay informed about your consumer rights.

What Led to the $14 Million Fine?

Credit One Bank came under scrutiny after it was revealed that they were making robocalls to individuals without their consent. According to the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC), these calls violated the Telephone Consumer Protection Act (TCPA), a federal law that protects consumers from unwanted telemarketing calls.

The TCPA, which was enacted in 1991, limits the use of robocalls and requires companies to obtain explicit written consent before contacting you with an automated message. The law was put in place to protect consumers from the increasing number of robocalls, many of which are related to scams and fraud.

Credit One’s violations took place between 2014 and 2019, a period in which they placed a significant number of unauthorized robocalls. As a result, the $14 million penalty was imposed, and a class action settlement was reached, offering cash payouts to those affected by the robocalls.

If you received one of these calls, it’s important to know that you may be eligible for compensation. Here’s how to determine if you qualify and how to file your claim.

How Do You Know if You’re Eligible for the Payout?

Eligibility for the class action settlement is based on a few simple factors:

1. You Received a Robocall Between 2014 and 2019

The primary requirement is that you received a robocall from Credit One Bank during the period of 2014 to 2019. Even if you were not a Credit One customer, you may still be eligible if the bank called you without your consent.

2. You Did Not Consent to Receive the Calls

The TCPA requires that businesses obtain your explicit consent before calling you with a robocall. If you didn’t give Credit One permission to contact you, your chances of being eligible are high.

3. The Calls Were Made to Your Phone Number

To be eligible, the robocalls must have been placed to your phone number during the affected time period. If you were on the receiving end of any of these calls, you might qualify, even if the number was later changed or reassigned.

4. You Don’t Have to Be a Credit One Customer

One of the most important aspects of this settlement is that you don’t need to be a Credit One customer to qualify. Even individuals who never had an account with Credit One can claim a payout if they received robocalls.

Robocalls: Before vs. After the National Do Not Call Registry

| Feature | Pre-2003 (Before Do Not Call Registry) | Post-2003 (With Do Not Call Registry) |

| Legitimate Telemarketers | Could call consumers at any time | Must check the registry and not call registered numbers |

| Enforcement | Primarily relied on individual state laws | Federal enforcement through the FTC |

| Consumer Control | Very limited; had to ask each company individually to stop calling | Consumers can register their number once to opt-out of most calls |

| Scam Robocalls | Still a problem, but fewer in number | Increased significantly as scammers ignore the registry |

How Much Could You Receive?

The amount of money you could receive depends on a few factors, such as the number of claims submitted and whether you can provide proof of the calls. While the exact payout amount isn’t yet finalized, eligible individuals could receive up to $1,000.

If you have proof of the robocalls—like phone records, voicemails, or call logs—your claim is likely to be processed faster, and your payout could be higher. Even without proof, you can still submit a claim, but the award may be smaller.

How to File Your Claim: Step-by-Step Guide

Once the official settlement website goes live, follow these steps to file your claim:

Step 1: Visit the Settlement Website

The first step is to visit the official settlement website. You’ll be asked to provide basic information, such as your name and phone number, to confirm that you were contacted by Credit One.

Step 2: Submit Proof (if Available)

If you have any documentation to support your claim, such as call records or voicemail recordings, upload them to the website. If not, a sworn statement detailing your experience will suffice.

Step 3: Choose Your Payment Method

Select your preferred payment method: check, PayPal, or bank deposit. Choose the one that’s most convenient for you.

Step 4: Submit Your Claim

Finally, submit your claim before the deadline. Be sure to stay on top of any communications regarding the settlement so you don’t miss any important updates.

When Will Payments Be Made?

Once the settlement is approved by the court, the review process typically takes 3 to 5 months. Payments will begin around 6 to 9 months after final approval.

FAQs

1. Do I need to be a Credit One customer to file a claim?

No, you don’t need to be a Credit One customer to file a claim. Anyone who received an unauthorized robocall from Credit One during the specified time period is eligible.

2. What kind of proof do I need?

Proof could include phone records, voicemail recordings, or call logs. If you don’t have proof, you can still submit a claim, but it may affect your payout.

3. How much money can I get?

Eligible individuals can receive up to $1,000. The exact amount will depend on the number of claims and available documentation.

4. How do I know if I’m eligible?

If you received robocalls from Credit One between 2014 and 2019 without giving prior consent, you are likely eligible. The official settlement website will allow you to confirm your eligibility.

5. How long will it take to get my payment?

The claims review process typically takes 3 to 5 months, and payments will begin around 6 to 9 months after final court approval.

Other Notable Robocall Violations

While Credit One is one of the most recent cases, it’s far from the only company facing scrutiny for robocall violations. Other large corporations have been penalized for similar offenses, including:

- Dish Network, which faced a $280 million fine for violating the TCPA.

- JPMorgan Chase, which agreed to a settlement over similar allegations, offering $15 million in payouts to affected consumers.

Why These Cases Matter

These cases are a part of a larger trend of robocall abuses that have plagued consumers, particularly with rising scam calls. By holding companies accountable, consumers are empowered to fight back and ensure that their rights are respected.