You might’ve seen headlines about $1,500 Child Tax Credit (CTC) checks dropping this month. The reality? The IRS isn’t sending out monthly payouts in 2025—but that doesn’t mean families won’t get help. In this updated and practical guide, we’ll break down exactly what’s available, how much you can get, and what to do next.

Whether you’re a single parent, a tax pro, or just someone trying to keep up with the IRS, this article has you covered.

What is a “Direct CTC Payout”?

Ever wondered what “Direct CTC Payout” really means? CTC stands for “Cost to Company.” While your full CTC package includes everything your employer spends on you (like your basic salary, health insurance, provident fund contributions, and even allowances), a “Direct CTC Payout” refers specifically to the portion of your CTC that you receive directly in your bank account. This could be your monthly take-home salary, a bonus, or other direct benefits that are paid out to you in cash. In this article, we’re talking about a specific, additional $1,500 payout being distributed this month!

A Shift in Approach

Historically, direct payouts from employers might have been primarily limited to annual bonuses or specific performance incentives. The concept of a broader “direct CTC payout” for general financial support, outside of regular salary and traditional bonuses, is a more recent development in some sectors, often influenced by economic conditions or internal company policies aimed at employee well-being. This $1,500 payout signifies a modern approach to quickly inject funds directly to eligible employees, highlighting a shift towards more immediate and targeted financial support.

Direct CTC Payouts This Month

| Topic | Details |

|---|---|

| Monthly CTC in 2025 | Not active. Monthly payments ended in 2021. |

| 2024 CTC Credit | Up to $2,000 per child under 17. |

| Refundable Portion | Up to $1,700 per child through the Additional Child Tax Credit (ACTC). |

| Filing Requirement | Claim through Form 1040 and Schedule 8812 in 2025. |

| Eligibility | Must meet income thresholds, residency, SSN requirements. |

| Expected Refund Date | By March 3, 2025, if filed early with direct deposit. |

| State CTCs Available? | Yes — e.g., California, New York. |

| IRS Official Resource | Visit IRS Child Tax Credit page |

To wrap it up: the $1,500 monthly CTC payouts making the rounds online? They’re not happening in 2025. But that doesn’t mean you’re left out. If you qualify, you can claim up to $2,000 per child, with $1,700 potentially refunded, once you file your 2024 return in early 2025.

Filing early, keeping your records clean, and using direct deposit ensures that refund lands in your bank account as early as March.

CTC Timeline: A Brief History

- 1997 – Child Tax Credit introduced at $400.

- 2018 – Expanded to $2,000 under the Tax Cuts and Jobs Act.

- 2021 – Temporarily increased and paid monthly during the pandemic.

- 2022+ – Reverted to $2,000, claimed annually during tax season.

How Does the 2025 CTC Work?

1. Credit Value

- Up to $2,000 per qualifying child.

- If you owe little or no tax, you may receive up to $1,700 as a refund.

2. Eligibility Criteria

- Child under 17 on Dec 31, 2024.

- Valid SSN.

- Lived with you >6 months.

- Claimed as your dependent.

- Earned $2,500 or more to receive the refundable portion.

3. Income Phase-Out

- Single Filers: Credit phases out at $200,000.

- Married Filing Jointly: Begins to reduce at $400,000.

- Reduced by $50 per $1,000 over the threshold.

State-Specific CTC Benefits

Some states provide additional credits:

| State | Extra Benefit |

|---|---|

| California | Young Child Tax Credit (up to $1,083 extra) |

| New York | Empire State Child Credit (up to $330 per child) |

| Idaho | $205 per qualifying child (state-level) |

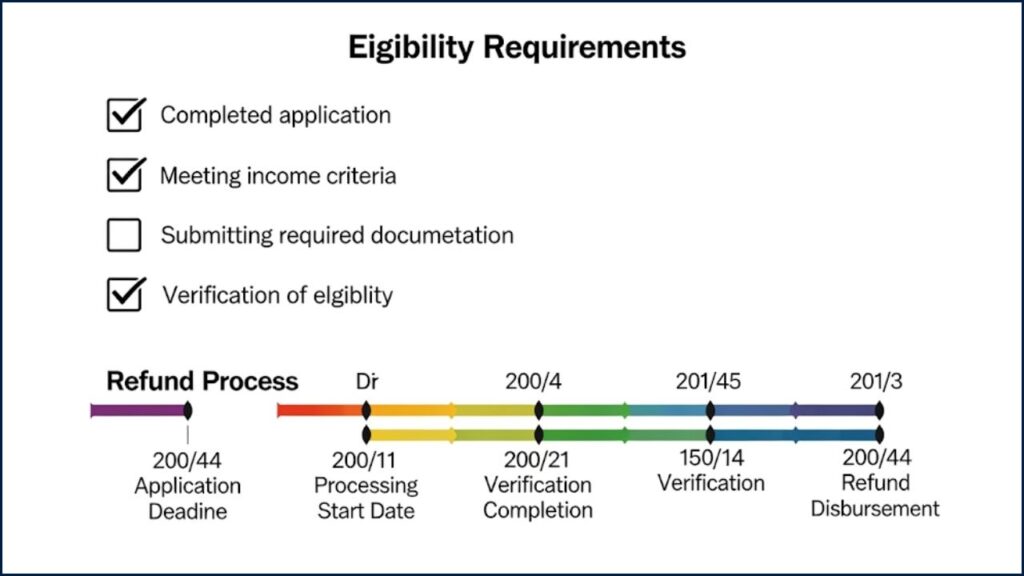

Step-by-Step: How to Claim the CTC in 2025

Step 1: Gather Docs

- W-2s, 1099s, SSNs

- Prior-year tax return

- Proof of residency for dependents

Step 2: File Early (after January 2025)

- File Form 1040 + Schedule 8812.

- Choose direct deposit for fastest refund.

Step 3: Check Refund Status

- Use IRS “Where’s My Refund?” tool.

- Updates daily.

Step 4: Adjust Withholdings (Optional)

- Use the IRS Tax Withholding Estimator.

“What If” Scenarios

| Scenario | What Happens |

|---|---|

| Child born on Dec 31, 2024 | Eligible for full CTC. |

| You share custody | Only one parent can claim the child each year. |

| Child has ITIN, not SSN | Not eligible for CTC, only for dependent exemption. |

| Filed taxes late last year | Still eligible — just make sure to file for 2024 before April 2028. |

CTC vs. Other Tax Credits

| Credit | Max Benefit | Refundable? | Best For |

|---|---|---|---|

| Child Tax Credit | $2,000/child | Partially ($1,700) | Families with children under 17 |

| Earned Income Tax Credit | $7,430 (3 kids) | Yes | Low-to-moderate income families |

| Child Care Credit | $3,000–$6,000 | (limited) | Working parents with child care expenses |

Real-Life Examples

“I filed in January and had two kids under 10. Got $3,400 back by Feb 28!”

— Vanessa T., Arizona

“We didn’t know about the refund part. Found out we qualified for $1,700 per kid—game changer!”

— Joe B., New York

Direct Payouts: Then vs. Now

Direct payouts have evolved! Here’s a look at how this $1,500 payout compares to past distributions:

| Feature | Past Direct Payouts (e.g., Early 2020s stimulus) | Current $1,500 Direct CTC Payout (July 2025) |

| Primary Purpose | Economic stimulus, pandemic relief | Specific benefit/refund for eligible individuals |

| Amount | Varied (e.g., $1,200, $600, $1,400) | Fixed at $1,500 |

| Eligibility | Broader income thresholds, dependent criteria | Specific criteria (details in article) |

| Payment Method | Mostly direct deposit, some checks | Primarily direct deposit, with checks as fallback |

| Frequency | Generally one-time or few-time initiatives | Potentially recurring based on policy |

Tips & Mistakes Section: Maximize Your Payout!

Getting your $1,500 payout smoothly is important. Here are some quick tips and common mistakes to avoid:

Do’s:

- Double-Check Your Bank Details: Ensure your direct deposit information is current with your employer or the relevant authority. An incorrect account number is a common cause of delays!

- Verify Your Eligibility: Don’t assume! Review all eligibility criteria carefully to avoid disappointment.

- Keep Records: Save any official communications regarding this payout.

- Check Your Status: Utilize any provided online tools to track your payment’s progress.

Don’ts:

- Fall for Scams: Be wary of emails or texts asking for personal information to “process your payout.” Official communications will rarely ask for sensitive data this way.

- Panic if Delayed: While frustrating, minor delays can happen. Give it a few business days before contacting support, and check official channels first.

- Miss Deadlines: If there are actions you need to take (like updating info), do so promptly.

FAQs

Q1: Is the $1,500/month payout real?

A: No. That was from the 2021 program. In 2025, you claim the credit once per year on your tax return.

Q2: Can I claim a newborn?

A: Yes, as long as the baby was born by December 31, 2024, and you meet other requirements.

Q3: Will I get the full $2,000?

A: Depends on your income and tax liability. If eligible for ACTC, you can get $1,700 refunded, even if you owe no tax.

Q4: Is there a deadline?

A: To claim 2024’s credit, file by April 15, 2025. You have up to 3 years to claim missed credits.