If you live in Georgia, there’s some exciting news: Georgia taxpayers get an unexpected bonus in 2025, thanks to the state’s whopping budget surplus. Governor Brian Kemp signed a law that approves a special tax rebate program, and that means money is headed straight into the pockets of hardworking Georgians.

This isn’t just pocket change. It’s a $1 billion rebate that will be distributed to millions of residents. Depending on your tax filing status, you could receive between $250 and $500. And unlike lottery winnings, you don’t need luck—just a filed tax return.

Georgia Taxpayers Get an Unexpected Bonus

| Category | Details |

|---|---|

| Program | Georgia Surplus Tax Refund (2025) |

| Eligibility | Must file both 2023 & 2024 state tax returns; must have 2023 tax liability |

| Refund Amounts | $250 (single filers), $375 (heads of household), $500 (married filing jointly) |

| Start Date | Refunds began June 2, 2025 |

| Delivery | Direct deposit or paper check |

| Deadline to File | May 1, 2025 (or Oct. 15 with extension) |

| Official Website | Georgia Department of Revenue |

The Georgia surplus tax refund is a welcome surprise for millions of residents. With payments of $250 to $500, it’s money that can make a real difference for households and businesses across the state. Whether you use it to pay bills, save, or invest, it’s a tangible reminder that Georgia’s economy is strong—and that taxpayers are reaping the benefits.

Keep an eye on your bank account or mailbox, and don’t forget you can track your status online with the Georgia Department of Revenue.

Why Georgia Taxpayers Are Getting This Bonus

Georgia is sitting on a surplus of more than $16 billion, one of the largest in the state’s history. Lawmakers decided to return some of that money to residents rather than letting it sit idle.

The rebate was made possible by House Bill 112, signed into law in April 2025. Alongside this rebate, House Bill 111 also lowered income tax rates for all Georgians. This isn’t the first time the state has done something like this—Governor Kemp approved similar rebates in 2022 and 2023, each returning hundreds of dollars to taxpayers.

It’s becoming a bit of a tradition in Georgia: when the state does well, the people see some of the reward.

How Much Money You’ll Get

Here’s how it breaks down:

- Single filers (or married filing separately): $250

- Heads of household: $375

- Married couples filing jointly: $500

But remember: the rebate amount is capped at your 2023 tax liability. If your 2023 liability was only $180, that’s all you’ll get.

When You’ll Get Your Refund

Payments began going out on June 2, 2025, and will continue in waves through mid-July 2025.

- If you used direct deposit when filing, expect your rebate that way. Look for “GASTTAXRFD” in your bank statement.

- If you got paper checks, you’ll get a “State Surplus Refund Check.”

Most residents who filed by May should see money in 6–8 weeks. Those filing extensions will see checks later in the year.

Who’s Eligible?

- You must have filed both 2023 and 2024 Georgia state tax returns.

- You must have had a 2023 tax liability.

- If you owe money (back taxes, child support, student loans), your rebate may be reduced.

How to Check Your Refund Status

- Visit the Georgia Tax Center Refund Checker.

- Enter your SSN or ITIN.

- Input your 2023 federal adjusted gross income (AGI).

- See if your refund is processing, issued, or delayed.

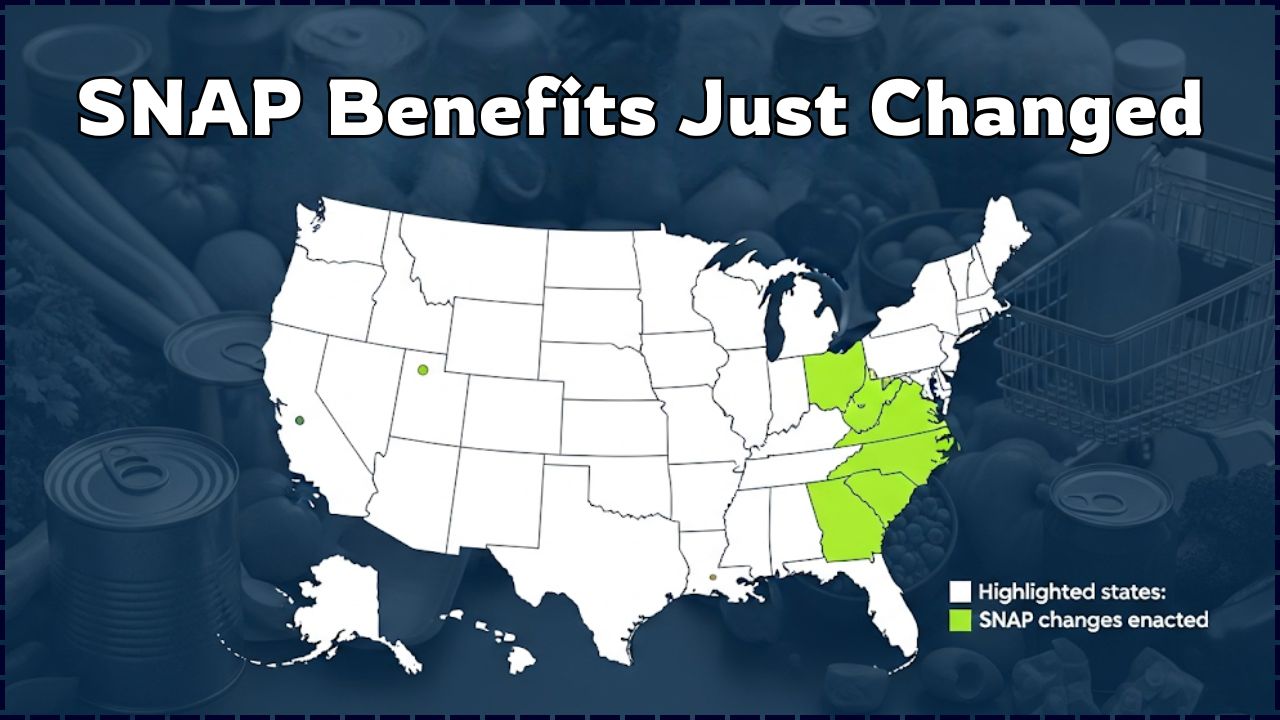

Comparing Georgia to Other States

Georgia isn’t the only state sending refunds. In recent years:

- California sent “inflation relief checks” up to $1,050 in 2022.

- Colorado gave residents $750 in 2022.

- Alaska consistently issues its Permanent Fund Dividend, averaging around $1,300 in 2023.

What makes Georgia unique is its conservative financial management. Rather than borrowing or overspending, the state has built up reserves and only issues rebates when it can truly afford them.

Economic Impact: Why This Matters

Putting $1 billion back into the hands of residents means more consumer spending. Small businesses—from your local BBQ joint to car repair shops—are likely to see a boost. Families might use the rebate for school supplies, groceries, or rent.

Economists call this a “mini stimulus”—it helps cushion households while also fueling the state’s economy.

Practical Ideas: What to Do with Your Rebate

Sure, you could splurge on new sneakers or a weekend getaway, but here are smarter ways to make that money work:

- Pay down debt – Credit card interest eats away at finances. Knock out some of that balance.

- Build an emergency fund – Aim for at least 3–6 months of expenses.

- Invest in yourself – Courses, certifications, or business tools can pay off long-term.

- Cover essentials – Gas, groceries, or utility bills.

Think of this rebate not as “free money,” but as a chance to improve your financial footing.

Top 3 Mistakes to Avoid with Your Georgia Tax Rebate

- Mistake #1: Not Filing on Time. To be eligible, you must have filed your 2023 and 2024 Georgia tax returns by the May 1st deadline (or a valid extension). Late filing could mean missing out.

- Mistake #2: Expecting a Check When You Owe Money. If you have outstanding debt to the state, such as past-due taxes or child support, your rebate may be reduced or used to offset that debt.

- Mistake #3: Calling the DOR Too Soon. The Department of Revenue’s phone lines are often busy. Their call center representatives have the same information as the online refund checker. Only call if the online tool tells you to, or if your refund hasn’t changed status in more than six weeks.

Real-Life Reactions from Georgians

- Amanda in Macon: “I’m putting my $375 toward back-to-school shopping for my two kids. Every little bit helps.”

- Carlos in Savannah: “My wife and I are using the $500 to pay down our car loan. That’s one less payment to stress over.”

- Derrick in Atlanta: “I’m saving mine. With the way rent keeps going up, you never know when you’ll need a cushion.”

These stories highlight how meaningful even a few hundred dollars can be for families.

Looking Ahead: Will Georgia Do This Again?

It’s possible. With the state continuing to grow economically, and conservative budgeting practices in place, Georgia may keep returning surplus funds in the future. But experts caution that it depends on tax revenues, spending, and the economy.

For now, Governor Kemp has signaled that tax relief will remain a priority—through both rebates and permanent income tax cuts.

FAQs

Do I need to apply?

No. If you’re eligible, the refund is automatic.

When will I get it?

Most payments will be sent June–July 2025. Later for extensions.

Is it taxable?

No, it’s a refund of your own state tax dollars.

What if I owe money?

The state can reduce or withhold your rebate to cover debts.

Where can I check status?

On the Georgia DOR website.