Social Security benefits are a vital source of income for millions of Americans, helping seniors, people with disabilities, and their families stay financially stable. But recently, some significant changes have been made to the way the Social Security Administration (SSA) handles overpayments, and it’s not all good news. These changes can potentially lead to massive cuts in your monthly benefits, but you don’t have to feel powerless. Let’s break down the situation, understand how overpayments happen, and provide practical advice on what you can do to avoid or manage these reductions.

Massive Benefit Cuts Are Starting

| Key Topic | Key Information |

|---|---|

| Overpayment Policy Changes | SSA is reducing the rate of withholding benefits for overpayment recovery, but changes are still significant. |

| Percentages of Withholding | As of April 2025, SSA will withhold 50% of your benefits for overpayment recovery in many cases. |

| Supplemental Security Income (SSI) | SSI recipients face lower withholding rates of 10%, but overpayment recovery is still a concern. |

| Causes of Overpayments | Overpayments can happen due to errors, delayed reporting, or SSA’s administrative mistakes. |

| Rights and Options for Recipients | You can appeal, request a waiver, or negotiate a lower repayment plan if you face overpayment issues. |

| Official Resources | Learn more and stay informed through SSA’s official website: SSA.gov |

The recent changes in Social Security overpayment recovery rates are significant and could have a major impact on your monthly income. But understanding how overpayments happen, knowing your rights, and taking proactive steps to keep your records up-to-date can help you avoid financial hardship. Whether you’re facing an overpayment or want to avoid one in the future, staying informed is the key.

What’s Going on with Social Security Overpayments?

The Changing Landscape of Overpayment Recovery

Overpayments in Social Security benefits can happen for a variety of reasons. Sometimes it’s a clerical error, or you might not have reported a change in your circumstances, like returning to work or moving to a new address. Historically, the SSA has had the power to deduct 100% of your benefits to recover overpayments, which created financial hardship for many. But after significant public feedback, they’ve started to make changes.

Overpayment Recovery Rates: What to Expect

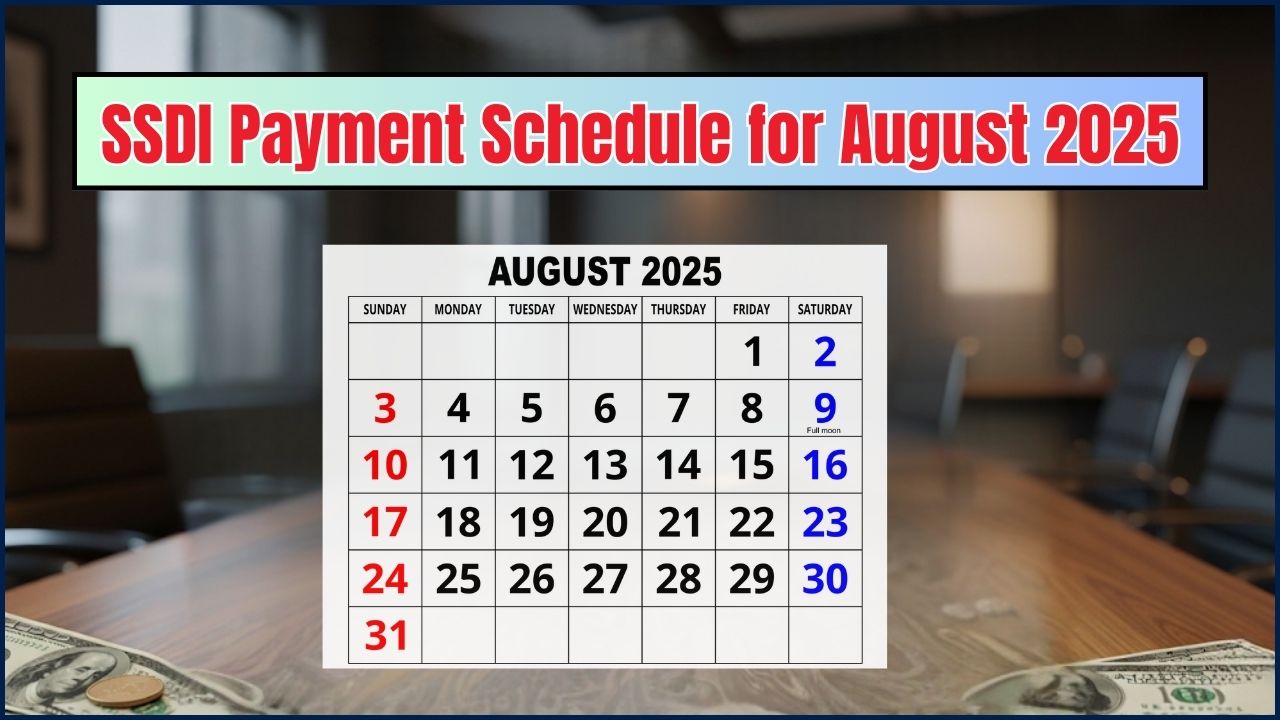

Starting in April 2025, the SSA will reduce the amount withheld from benefits for most individuals, cutting the rate down to 50% for retirement, family, survivor benefits, and Social Security Disability Insurance (SSDI). For those receiving Supplemental Security Income (SSI), this reduction will be lower, at 10%.

Though these new withholding rates might seem more manageable, they can still create a major financial strain if you’re already living paycheck to paycheck. With the cost of living rising, these cuts could leave you scrambling to make ends meet.

Why Should You Care?

Imagine this: you’ve been receiving your Social Security check every month, and suddenly, it’s halved because of an overpayment from years ago. Now, you have to adjust your lifestyle, plan around this reduced income, and find ways to make up for the loss. This isn’t just theoretical—many Americans are facing this reality right now. Let’s explore what’s causing these overpayments and how you can protect yourself.

How Do Overpayments Happen?

Understanding why overpayments occur can help you avoid future issues. Here are a few scenarios where overpayments are likely to occur:

1. Beneficiary Errors

Overpayments often happen when you fail to report significant life changes. For instance, if you go back to work but don’t tell the SSA about your new income, you could be overpaid, resulting in the need to repay those benefits later. The same applies to changes in your marital status, death of a spouse, or even if you relocate to a new state.

2. Administrative Mistakes

Sometimes the SSA itself makes mistakes. For example, if they fail to process a change in your income or family situation, you might continue to receive benefits at a higher rate than you’re eligible for. These errors can also occur if SSA’s systems fail to update your records promptly.

3. Systemic Issues

On occasion, the SSA’s systems may have outdated or incorrect information about your situation, leading to overpayment. This could include not updating your earnings record in their system or failing to account for certain factors that affect your eligibility.

Real-Life Example: The Smith Family

Take the case of John Smith, a 67-year-old retiree from Florida. He was receiving Social Security benefits when he was told by the SSA that he owed $7,000 due to an overpayment that occurred because of an error when reporting his retirement income. John was shocked, as he had not realized that his retirement income change had gone unreported. With 50% of his monthly benefits withheld, John now has to adjust his budget drastically. This is a real example of how overpayments can disrupt lives and make financial planning challenging.

Old vs. New Overpayment Withholding Rates

Understanding how much of your benefit might be withheld is crucial. Here’s a comparison of the recent changes:

| Feature | Prior to 2023 (General Standard) | 2023-Early 2025 (Temporary Change) | July 2025 Onward (New Policy) |

| Standard Withholding | Variable, often higher | Up to 10% of monthly benefit | Up to 50% of monthly benefit |

| Impact on Beneficiaries | Could be significant | Less severe, aimed at hardship | Potentially severe |

| SSA Goal | Recover overpayments | Reduce hardship, media scrutiny | Recover substantial backlog |

Your Rights and Options

Can You Do Anything About Overpayment Notices?

If you receive a notice that you owe money due to an overpayment, don’t panic. You have several options to protect yourself:

- Appeal: You have 90 days from the date you receive the overpayment notice to appeal. If you believe the overpayment was due to an error, you can request a formal review and even request a hearing if needed.

- Request a Waiver: If the overpayment wasn’t your fault and repaying it would create a financial burden, you may be eligible for a waiver. The SSA may waive the repayment entirely.

- Set Up a Repayment Plan: If paying the full amount at once would cause hardship, you can negotiate a repayment plan. This allows you to pay back the amount over time, making it easier to manage.

Financial Experts Weigh In

Financial advisors often suggest that you regularly monitor your Social Security records to ensure that the information is up-to-date. They also recommend keeping detailed records of your work history and any changes to your personal or financial situation, which can help avoid confusion later on.

“The key to avoiding overpayments is communication with the SSA. Don’t assume that they automatically know about changes in your life. Take charge of your own records and stay proactive.” — Sarah Jenkins, Certified Financial Planner

Practical Tips for Managing Overpayments

1. Review Your Social Security Statements Regularly

You can view your earnings record by creating a My Social Security account. Regularly check this account to ensure that all your reported earnings match up with SSA records. If something looks wrong, report it immediately.

2. Stay Informed About Policy Changes

Keep an eye on changes to Social Security policies and overpayment recovery guidelines. The SSA provides updates on their website, and being aware of these changes can help you prepare for any future impacts on your benefits.

3. Report Any Changes Promptly

As soon as you experience a change in your income or living situation, let the SSA know. By staying ahead of these updates, you can prevent potential overpayments down the line.

FAQs

1. What happens if I don’t pay back the overpayment?

If you fail to repay an overpayment, the SSA may take further actions such as withholding more of your future benefits, garnishing wages, or offsetting your tax refund. In severe cases, they could even pursue legal action.

2. Can I dispute the amount of overpayment?

Yes, if you believe the overpayment amount is incorrect, you can appeal. The SSA will review your case and determine if the overpayment amount was accurate.

3. How long does the SSA have to recover overpayments?

The SSA can attempt to recover overpayments for up to five years, but after that, they may lose the ability to collect the funds.