Amid a flurry of online speculation, U.S. officials have confirmed there is no new federal $725 Stimulus Check scheduled for nationwide distribution. Reports of such a payment appear to stem from a misunderstanding of a small, localized assistance program in California, creating widespread confusion as Americans continue to navigate post-pandemic economic pressures.

The Source of the $725 Figure

Recent online searches and social media discussions have centered on a “$725 payment,” but this amount is not part of any new federal relief package. The figure directly corresponds to the Family First Economic Support Pilot Program (FFESP), a guaranteed income initiative limited to a specific area within Sacramento County, California.

According to Sacramento County’s Department of Child, Family and Adult Services, this pilot program provides $725 per month for one year to just 200 specific families. The program is designed to assist low-income households with at least one child under the age of five in designated ZIP codes. Critically, the application period for this program closed in April 2025, and participants were selected via a lottery system.

“The FFESP is a targeted local pilot, not a statewide or federal stimulus,” said a spokesperson for Sacramento County in a public statement. “Its goal is to study the effects of direct financial support on child welfare and family stability within a very specific cohort.”

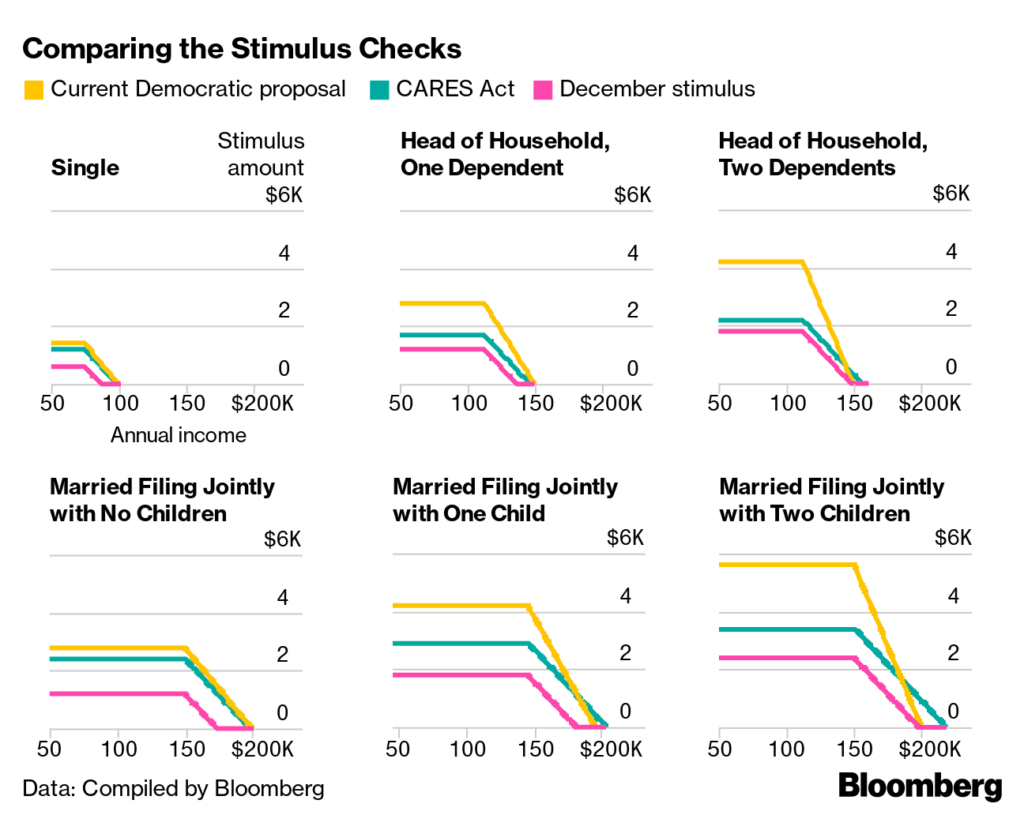

This distinction is central to understanding the current landscape of financial aid. Unlike the broad Economic Impact Payments issued by the Internal Revenue Service (IRS) during the COVID-19 pandemic, most current assistance programs are highly targeted and vary significantly by state or county.

State-Level Relief vs. Federal Stimulus

While no new federal stimulus checks have been approved by Congress for 2025, several states are independently offering their own financial relief to residents, typically in the form of tax rebates. These programs are funded by state budget surpluses, not the federal government, and have unique eligibility requirements, payment amounts, and schedules.

For example:

- Virginia announced one-time tax rebates of up to $200 for single filers and $400 for joint filers, contingent on an individual’s 2024 tax liability.

- Colorado has been issuing refunds to taxpayers as required by its Taxpayer’s Bill of Rights (TABOR), with amounts varying based on state revenue.

- Some reports have also associated a $725 figure with potential energy bill credits in California, separate from the Sacramento pilot program, adding to the confusion.

These state-specific initiatives are not “stimulus checks” in the same vein as the three federal rounds distributed between 2020 and 2021. Those payments were authorized by major federal legislation—the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan—to provide immediate, widespread economic relief across the nation.

“It’s essential for the public to differentiate between state tax rebates and a potential federal stimulus action,” stated Dr. Eleanor Vance, a senior fellow and economist at the Urban Institute. “Conflating them creates false hope and makes individuals more susceptible to scams. The legislative bar for another round of federal payments is exceedingly high and is not currently a focus in Congress.”

How to Verify Financial Information and Avoid Scams

The spread of misinformation about a $725 Stimulus Check highlights the need for public vigilance. Scammers often use rumors of government payments to trick individuals into providing personal information or paying bogus fees.

To protect against fraud and get accurate information, experts and government agencies recommend the following:

- Go to the Source: Always check official government websites for information. The primary sources for federal tax and payment information are IRS.gov and USA.gov. State-specific program details can be found on official state government or department of revenue websites.

- Be Skeptical of Unsolicited Contact: The IRS and other government agencies will not initiate contact via email, text message, or social media to request personal or financial information for stimulus payments. Any such communication is a red flag for a phishing attempt.

- Never Pay a Fee: There is no fee to receive a government tax rebate or relief payment. Scammers often invent processing fees or other charges to steal money.

As of June 2025, there is no pending legislation for a fourth round of federal stimulus checks. Any claims of a guaranteed, forthcoming payment—whether for $725 or another amount—should be treated with extreme caution. The most reliable information will always come directly from official government channels, not from social media posts or unverified online articles.

Frequently Asked Questions

1. So, is anyone getting a $725 check? Yes, but only a pre-selected group of 200 families in six specific Sacramento County, California ZIP codes as part of a closed pilot program. It is not a new state or federal payment available to the general public.

2. Where did the rumor about a federal $725 stimulus check come from? The rumor appears to be a misinterpretation of the Sacramento County FFESP pilot program. Misleading headlines and social media posts likely took the specific local payment amount out of context, presenting it as a widespread stimulus payment.

3. Are any other stimulus checks coming in 2025? There are no federal stimulus checks planned. However, some states are issuing their own tax rebates or relief payments. You must check your official state government website to see if you are eligible for any local programs.

4. Where can I find legitimate information about government financial assistance? For federal information, the official sources are IRS.gov and USA.gov. For state-level programs, visit your state’s official government website or its department of taxation/revenue.