When it comes to safe, tax-free, long-term investments, nothing hits home quite like the Public Provident Fund (PPF). Whether you’re a college kid just learning about saving or a working pro mapping out your retirement, the PPF Withdrawal Rules 2025 offer both flexibility and strong returns—without any rollercoaster risk.

This year, updates have been made to how withdrawals, closures, and extensions work. We’re breaking it all down—real simple—with friendly examples, pro tips, and links to official sites. Buckle up, this is the real-deal guide.

What Exactly is a PPF Account?

Think of a Public Provident Fund (PPF) as a long-term savings plan backed by the Government of India. It’s designed to help you build a solid retirement corpus while offering tax benefits. You contribute a certain amount regularly, and your money grows with a guaranteed, tax-free interest rate, making it a super safe and popular investment choice for millions of Indians.

How PPF Closure Has Changed

Just a few years ago, getting your money out of a PPF account before the 15-year lock-in was quite restrictive. It was primarily allowed only for treating life-threatening diseases for your immediate family or for your children’s higher education. Fast forward to 2025, the rules are more considerate. Now, you can also prematurely close the account for your own higher education expenses or if you are moving abroad and your residential status changes. This is a significant shift, offering more flexibility to account holders facing major life changes.

PPF Withdrawal Rules 2025 Updated

| Feature | Details | Why It Matters | Reference Link |

|---|---|---|---|

| Interest Rate (2025) | 7.1% p.a., unchanged for Q2 FY 2025–26 | Solid, government-backed return | |

| Partial Withdrawal | After 6 years; max 50% of eligible balance | Gives access for planned/life needs | |

| Premature Closure | After 5 years; allowed for illness/education with 1% interest penalty | Emergency exit with small cost | NSI India |

| Maturity Period | 15 years; entire amount withdrawable tax-free | Great for retirement, large goals | Income Tax India |

| Extension Options | 5-year blocks; with/without deposits | Lets you keep compounding—flexible plans | |

| NRI Rules | No new accounts; existing must close at 15 years | Important update for overseas investors |

The PPF Withdrawal Rules 2025 offer one of the safest, smartest investment strategies in India. With a 7.1% interest rate, partial access after 6 years, emergency exits after 5, and tax-free maturity at 15 years, this scheme works across all stages of life. Whether you’re building a nest egg or saving for college, it’s a solid move.

If you understand the timelines and play it smart, PPF can be your go-to financial anchor.

What is PPF and Why Should You Care?

The Public Provident Fund (PPF) is a government-run savings scheme that:

- Guarantees returns (not tied to the market)

- Offers EEE tax benefits

- Has a 15-year lock-in (unless withdrawn early for specific reasons)

Think of PPF as your “steady-eddy” investment—perfect for long-term goals like your kid’s college, a new home, or retirement.

2025 PPF Interest Rate: What’s the Latest?

The current rate is 7.1% per annum, unchanged since April 2020. It’s reviewed quarterly but hasn’t changed in over 4 years due to economic stability.

“If you invest ₹1.5 lakh every year, after 15 years you’ll get around ₹40 lakh—completely tax-free.”

Tip: Deposit before the 5th of every month to earn full interest for that month.

Visual Example: Real-Life Story

Meet Priya, a school teacher. She started a PPF account in 2015. In 2025, she needs funds for her daughter’s college fees. Since she’s completed 10 years, she makes a partial withdrawal of ₹1.5 lakh. It doesn’t hurt her long-term corpus, and it’s tax-free. Win-win.

PPF vs Other Investment Options

| Feature | PPF | EPF | NSC | Fixed Deposit | Mutual Funds |

|---|---|---|---|---|---|

| Risk | Very Low | Low | Low | Low | Moderate–High |

| Tax-Free Returns | Yes (EEE) | Yes (EEE) | No | No | Depends |

| Return (2025) | 7.1% | 8.15% | 7.5% | 6.5–7.5% | Varies |

| Lock-In | 15 Years | Until retirement | 5 Years | 5+ Years | Flexible |

PPF Withdrawal Rules in 2025

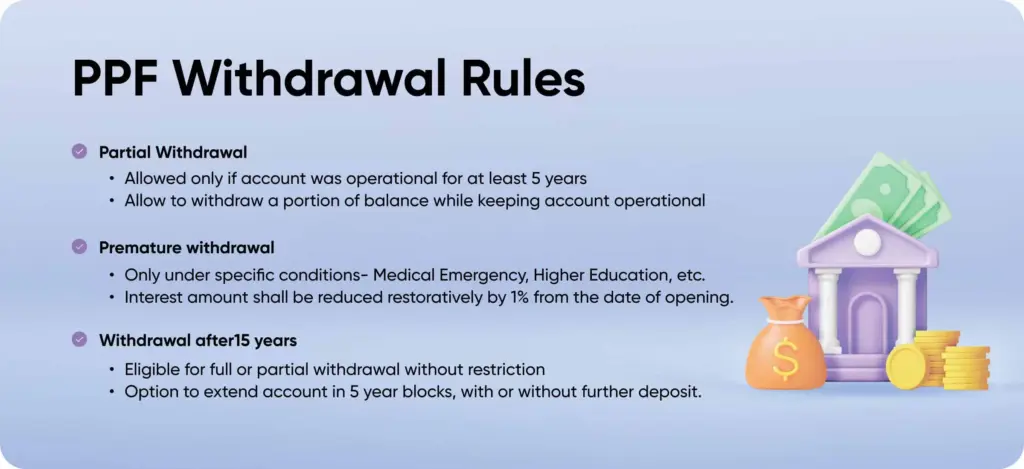

1. Partial Withdrawal

- Allowed after 6 full financial years

- Limit: 50% of the lower balance between 4th year prior and previous year

- Only one withdrawal per year

Example: If balance in Year 4 = ₹2,00,000 and in Year 6 = ₹2,50,000 → max withdrawal = ₹1,00,000

2. Premature Closure

- Allowed after 5 years only for:

- Medical treatment of self/family

- Higher education (proof needed)

- 1% interest penalty on total interest earned

3. Maturity Withdrawal (After 15 Years)

- You get to withdraw the full amount—principal + interest

- Absolutely tax-free

- Option to extend for more growth (see below)

PPF Extension Rules

Option 1 – Without Contributions

- No new deposits

- Earn interest

- Withdraw once a year

Option 2 – With Contributions

- Submit Form H within 1 year after maturity

- Continue investing up to ₹1.5 lakh/year

- Withdraw up to 60% of balance during the 5-year block

Old Rules vs. Updated 2025 Rules

Understanding the changes is easier when you see them side-by-side. Here’s a simple comparison of how premature withdrawals work now.

| Feature | Old Rule (Pre-2024) | Updated Rule (Effective 2025) |

| Account Maturity | 15 years from the end of the financial year of opening. | No change. Still 15 years. |

| Premature Closure | Allowed after 5 years only for specific reasons like critical illness or higher education of children. | Rules are more streamlined. You can now also close the account for your own higher education or if your residential status changes to NRI. |

| Partial Withdrawal | Allowed from the 7th financial year onwards. | No change. You can still withdraw partially from the 7th year. |

| Interest Penalty | A 1% penalty on the interest rate was applied for premature closure. | The 1% interest penalty for premature closure remains in place. This means if the rate is 7.1%, you’ll get 6.1%. |

Tax Benefits: The EEE Advantage

PPF qualifies for Exempt-Exempt-Exempt (EEE) status under Indian Tax law:

| Tax Stage | PPF Benefit |

|---|---|

| Contribution | Deduction under Section 80C |

| Interest Earned | Tax-free |

| Maturity Withdrawal | Tax-free |

Pro Tip: Use it to reduce your taxable income and grow a long-term safety net.

PPF Rules for NRIs in 2025

What’s Allowed:

- Continue existing account until maturity

- Withdraw at maturity into NRO account

What’s Not Allowed:

- Open a new PPF account

- Extend beyond 15 years

Don’t forget to inform your bank if your residency status changes—your interest rate might get downgraded to 4% if you don’t notify!

Use a PPF Calculator

Want to see how much you’ll make over 15 years?

Try this PPF Calculator by Groww or the NSI India Tool to simulate maturity and withdrawals.

Quick Checklist

Invest before the 5th of the month

Track 6-year and 15-year marks

Use partial withdrawal wisely

Submit Form H for extension

Inform bank if you become an NRI

Keep medical/education proof handy

Use official calculators

Bookmark India Post PPF Portal

Expert Tips & Mistakes to Avoid

Don’t ignore lock-in: PPF is long-term. Avoid if you might need liquidity soon.

Do partial withdrawals before loans: Better than paying 10–12% interest elsewhere.

Don’t miss Form H deadline: You’ll lose contribution benefits if you don’t extend on time.

Plan around 80C limit: Combine PPF with ELSS and LIC to optimize your tax-saving bucket.

FAQs

Q1. Can I close PPF before 15 years?

Yes, after 5 years, only for medical or education with 1% penalty.

Q2. Can I withdraw every year?

Partial withdrawals once a year after 6 years; full only at maturity.

Q3. Can I have two PPF accounts?

No, one account per individual allowed.

Q4. Is PPF better than FD?

In most cases, yes. Higher interest and tax-free returns.

Q5. Can NRIs invest in PPF in 2025?

No new accounts. Old ones can continue till 15-year maturity.