Millions of American retirees and other beneficiaries may see a 2.5% increase in their Social Security payments in 2026, according to a preliminary forecast. This potential cost-of-living adjustment, or COLA, would provide a modest boost to incomes but raises questions about whether it will fully shield seniors from the persistent pressures of inflation on household goods and services.

The projection, released by The Senior Citizens League (TSCL), a non-partisan advocacy group, is based on recent inflation data. If it holds, the 2026 COLA would mirror the 2.5% adjustment that took effect in January 2025, suggesting a period of more stable, moderate inflation compared to the dramatic spikes of recent years.

The official COLA for 2026 will be announced by the Social Security Administration (SSA) in October 2025. The final figure is contingent on third-quarter inflation data as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

What a 2.5% COLA Means for Your Check

For the average retired worker, who received approximately $1,924 per month in 2025, a 2.5% COLA would translate to an increase of about $48 per month, bringing their estimated monthly benefit to around $1,972 in 2026.

However, the actual dollar amount of the increase varies significantly based on an individual’s benefit amount, which is tied to their lifetime earnings and the age they started claiming benefits.

Projected 2026 Social Security Benefits with a 2.5% COLA

| Recipient Profile (2025 Pre-COLA Monthly Benefit) | Estimated Monthly Increase | Estimated 2026 Monthly Benefit |

|---|---|---|

| Average Retired Worker (~$1,924) | ~$48.10 | ~$1,972.10 |

| Average Retired Couple (~$3,382) | ~$84.55 | ~$3,466.55 |

| Maximum Benefit (Retired at Full Retirement Age – 67) ($3,911) | ~$97.78 | ~$4,008.78 |

| Maximum Benefit (Retired at age 62) ($2,710) | ~$67.75 | ~$2,777.75 |

| Maximum Benefit (Retired at age 70) ($4,873) | ~$121.83 | ~$4,994.83 |

Note: Figures are estimates based on a 2.5% projection and recent SSA data. Actual amounts will vary.

The Economic Drivers Behind the Forecast

The 2.5% projection reflects a broader trend of cooling inflation across the U.S. economy. After historic highs that led to a record 8.7% COLA in 2023 and a 5.9% increase in 2022, the economic landscape has shifted. The Congressional Budget Office (CBO), in its early 2025 economic outlook, projected that inflation would continue to moderate, aligning with the Federal Reserve’s targets. The CBO forecast for the Consumer Price Index is in the 2.3% to 2.4% range for 2026, which lends government-level support to the 2.5% COLA estimate.

“The forecast of a 2.5% COLA for 2026 indicates that the period of intense inflation is likely behind us,” said Alex Beene, a financial literacy instructor for the University of Tennessee at Martin. “While this is a sign of economic stability, it also means that the significant annual boosts to Social Security checks that retirees saw in the immediate post-pandemic years are also over.”

The Debate Over Inflation’s True Impact

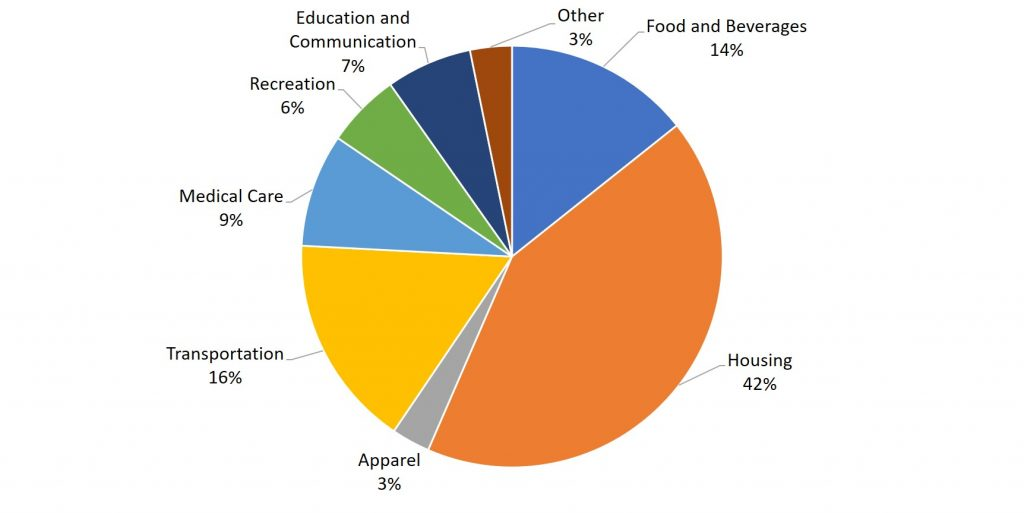

Despite the moderating trend, some advocates express concern that the official inflation metric, the CPI-W, does not accurately reflect the spending habits of seniors. Retirees often allocate a larger portion of their budgets to healthcare and housing, costs that have in some cases outpaced general inflation.

“A modest COLA is always a double-edged sword,” stated Shannon Benton, Executive Director of The Senior Citizens League. “It signals that overall inflation is less of a problem, but it can feel inadequate for seniors whose personal inflation rate is driven by rapidly rising medical and housing costs.”

TSCL has long advocated for using an experimental index, the Consumer Price Index for the Elderly (CPI-E), which gives more weight to these expenses. According to their research, using the CPI-E would likely result in a higher COLA.

Adding to the complexity are recent concerns about the data collection methods used by the Bureau of Labor Statistics (BLS), the agency that calculates the CPI-W. The BLS has acknowledged that staffing shortages have led to cutbacks in its price-surveying efforts. In a statement, the agency maintained these changes have “minimal impact on the overall all-items CPI” but could “increase the volatility” of more specific indexes. Benton worries that any erosion in data quality could lead to a COLA that “doesn’t match inflation,” potentially costing seniors thousands over their retirement.

How the COLA is Calculated

The annual Social Security COLA is not an arbitrary figure or a response to political pressure. It is determined by a specific formula established by law in 1973.

The process involves comparing the average CPI-W for the third quarter (July, August, and September) of the current year to the average for the same period in the last year a COLA was granted. The percentage increase, rounded to the nearest tenth of a percent, becomes the COLA for the following year. If there is no increase, or if the result is negative, benefits remain the same; they do not decrease.

This automatic adjustment is a critical feature of Social Security, designed to protect the purchasing power of benefits from eroding over time due to inflation.

The final determination of the 2026 COLA rests on the economic data that will unfold over the summer. Retirees and other beneficiaries will be watching closely in October when the Social Security Administration makes its official announcement, which will set the stage for their financial planning for the year ahead.