The RBI cuts repo rate in 2025 by a bold 50 basis points, and it’s the talk of the financial town. If you’ve got a home loan, saving up in FDs, or just trying to make sense of the money maze, you’re in the right place. This move by the Reserve Bank of India (RBI) isn’t just a headline—it’s a shake-up with real consequences for your wallet.

Whether you’re a working professional, a young couple planning to buy a home, or a retiree keeping an eye on your nest egg, this change is going to impact you. But don’t sweat it—we’re going to break it all down in simple, plain English (with a little financial slang to keep things fun).

What is the Repo Rate, Anyway?

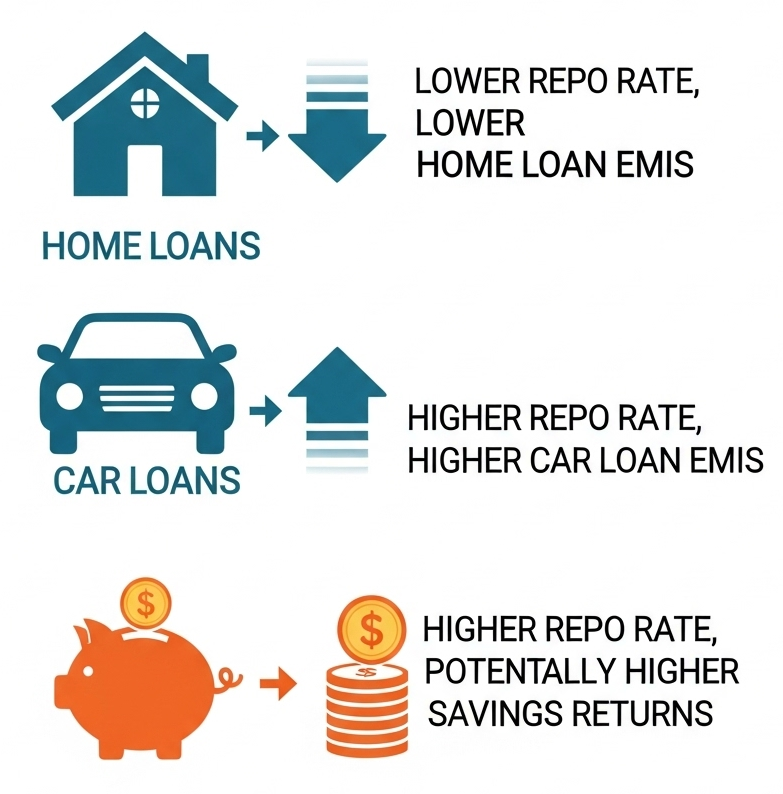

Think of the repo rate as the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks. When the repo rate drops, it becomes cheaper for banks to borrow funds. Often, banks pass on this benefit to us, their customers, in the form of lower interest rates on loans, including home loans.

From Highs to Relief: The Repo Rate Journey

Just a couple of years ago, in a bid to control rising inflation, the RBI had increased the repo rate multiple times, taking it to a high of 6.50%. This made borrowing more expensive. The current cut in 2025 to a lower rate signals a shift in focus towards boosting economic growth and providing relief to borrowers after a period of higher interest rates.

RBI Cuts Repo Rate in 2025

| Feature | Details |

|---|---|

| Repo Rate Cut | 50 basis points (bps) cut, from 6.00% to 5.50% |

| Date of Announcement | June 6, 2025 |

| Policy Stance | Shifted from “accommodative” to “neutral” |

| Impact on Home Loans | EMIs to drop significantly (up to Rs 6,000/month on Rs 50L loans) |

| Banks That Cut Rates | SBI, PNB, Union Bank, Canara Bank, BoB, BoI, IOB |

| Impact on Savings/FD Rates | Likely decline; act fast to lock in higher FD rates |

| Official Source | Reserve Bank of India |

The RBI’s 50 bps repo rate cut in 2025 is a big deal, and it directly affects your home loans, EMIs, savings, and investment choices. If you act smartly now—by checking your loan type, locking in FD rates, exploring refinancing, and diversifying your savings—you could save thousands a month or make your money work harder for you.

This is more than just a monetary tweak—it’s a signal. A chance to reassess your financial game plan and optimize for a potentially low-rate environment in the months ahead.

What is the Repo Rate, and Why Should You Care?

The repo rate is the interest rate at which RBI lends money to commercial banks. When the RBI cuts this rate, borrowing becomes cheaper for banks—and hopefully, they pass that benefit on to customers like you and me.

Imagine this like the Fed cutting rates in the U.S. When borrowing gets cheaper, people are more likely to take loans, buy homes, or start businesses. It fuels the economy, encourages spending, and helps cool inflation if used wisely.

In June 2025, the RBI slashed the repo rate by 50 basis points, the biggest single cut in over two years. That means big things for your monthly expenses, savings strategy, and financial planning.

How Does This Affect Home Loans and EMIs?

Repo-Linked Loans (RLLR)

Most new home loans these days are linked directly to the repo rate. So when the repo drops, your interest rate drops, and your EMI (Equated Monthly Installment) goes down.

Let’s break it down:

- ₹50L loan over 20 years? You could save ₹1,500 to ₹6,000 per month.

- ₹1Cr loan? Your EMI could fall to around ₹68,000/month.

Banks like SBI, BoB, and PNB have already cut their lending rates to reflect this change.

Pro Tip: Use an EMI calculator to get a clearer idea of your monthly savings.

MCLR and Base-Rate Loans

If your loan is tied to MCLR (Marginal Cost of Lending Rate) or base rate, the changes are slower. These are adjusted every few months, so you might not see immediate savings.

What Should You Do?

- Check your loan type. If it’s repo-linked, you’ll see savings fast.

- Consider refinancing. Switch from MCLR to repo-linked if possible.

- Negotiate with your bank. Especially if your interest rate is over 9%.

- Watch for processing fees. Factor those into your cost-benefit analysis.

Impact on Fixed Deposits and Savings Accounts

Here’s the catch: when lending rates fall, so do deposit rates. That means Fixed Deposits (FDs) and savings accounts might offer lower interest in the coming months.

If you’re relying on interest income, this could be a bummer. But there’s a silver lining:

- Lock in high FD rates now before banks adjust.

- Look into laddering your FDs so all your money isn’t stuck at low returns later.

- Consider debt mutual funds as an alternative with higher potential returns.

- Explore RBI bonds and Sovereign Gold Bonds (SGBs) for capital preservation.

The Bigger Picture: Why Did RBI Cut Rates?

The RBI cited a mix of slowing global growth, cooling inflation, and the need to support domestic consumption. Sound familiar? It’s a classic playbook move we’ve seen from the Federal Reserve in the U.S. too.

- Inflation is moderating.

- Growth is decent but needs a push.

- India’s core sectors are stabilizing, but exports and private investments need a jumpstart.

By cutting the repo rate, the RBI is basically stepping on the gas pedal.

Fun Fact: India’s repo rate is now at its lowest since 2022, aiming to replicate the post-COVID recovery strategies.

Sector-Wise Impact Snapshot

| Sector | Impact of Repo Cut |

| Real Estate | Boost in affordability; increase in housing demand |

| Banking | Lower lending income but possible volume growth |

| Auto Industry | Expected increase in auto loan demand |

| Stock Market | Positive sentiment in interest-sensitive sectors |

| Gold & Bonds | Could attract conservative investors seeking alternatives to FDs |

Actionable Tips for Borrowers and Savers

If You Have a Home Loan:

- Check your loan type (repo-linked or not).

- Calculate EMI savings using online calculators.

- Switch lenders or refinance if savings are big enough.

- Prepay if possible with the EMI savings.

- Keep EMI-to-income ratio < 40% for financial health.

If You Have FDs or Savings:

- Lock in current FD rates before they fall.

- Avoid very long-term deposits unless rates stabilize.

- Diversify: Look into bonds, mutual funds, and other safe alternatives.

- Plan liquidity so you’re not forced to break FDs during low-rate periods.

FAQs

Will my EMI reduce automatically?

Yes, if your loan is repo-linked. The change usually reflects during your next reset date (monthly, quarterly, or semi-annually).

Should I refinance my home loan?

If you’re paying over 9%, it’s worth exploring. Calculate the cost of switching and compare with potential savings.

Will FD rates drop?

Most likely, yes. Banks cut deposit rates to manage costs. Act fast to lock in.

Is it a good time to buy a house?

Yes. Lower rates mean lower EMIs, which improves affordability. Just make sure you buy within your budget.

Will this affect the stock market?

Rate cuts often boost equities, especially in interest-sensitive sectors like real estate, banking, and auto.

What’s the CRR and why does it matter?

RBI also cut the Cash Reserve Ratio (CRR) by 100 bps, giving banks more liquidity to lend. It supports the repo cut and enhances credit flow.